Bourgeon Capital's Market Insights: Fall 2018

“The Fable of the Boiling Frog”

-Author Unknown

The cautionary fable of the boiling frog has been told for centuries. The story goes like this: If you put a frog into a pot of boiling water it will quickly jump out. However, if you put a frog into a pot of cold water and then turn the heat on low, it will happily stay there until it is boiled to death. This cautionary tale reminds us that it is important to be aware of the hidden dangers that can sometimes come of gradual change. Domestic growth is now the highest since 2006, unemployment the lowest since 1969, and inflation still quite tame. While a reason for current celebration, this goldilocks scenario has never persisted for long. We believe that the Federal Reserve will continue to raise interest rates until policy “normalizes”, which some Fed participants indicate would be in the 3.25% range vs. 2.25% today. In addition, the Federal Reserve is shrinking its balance sheet for the first time in 10 years through quantitative tightening. The intent of both these actions is to contain inflation by slowing economic growth. The tax cuts have provided a welcome offset to monetary tightening in 2018, but in 2019 they become a historical event, and the potential for domestic economic growth rates to decelerate increases. This would be a headwind for the stock market. We continue to meet gradual change with progressive modifications in your underlying portfolios with the intent to reduce risk and acknowledge that the water is getting warmer.

Watch what they do, not what they say. The water is getting warmer...

Jerome H. Powell, Chairman of the Federal Reserve, spoke at the 60th Annual Meeting of the National Association for Business Economics on October 2, 2018. He began his remarks focusing on the “remarkably positive outlook” for the U.S. economy, but a further read left us more cautious. “Since 1950, the U.S. economy has experienced periods of low, stable inflation and periods of very low unemployment, but never both for such an extended time as is seen in these (Federal Reserve) forecasts….Common sense suggests we should beware when forecasts predict events seldom before observed in the economy…Our path of gradually removing accommodation, while closely monitoring the economy, is designed to balance these risks.” In the past year the Federal Reserve increased the Federal Funds Rate from 1.25% to 2.25% and is forecasting a rate in the range of 3.25% a year from now.

What happens when the Fed raises rates?

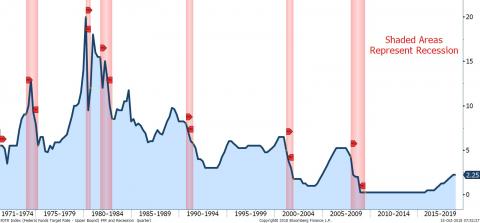

The intent of increasing rates is to slow economic growth and keep inflation at bay while maintaining a low level of unemployment. However, history shows that at some point in a tightening cycle the Federal Reserve eventually takes a step too far and pushes the economy into recession. How long this takes depends on many different variables and has historically been between 4 and 7 years. We are already three years into this hiking cycle and the pace of increases has started to accelerate.

Chart 1

Historically It Has Taken 4-7 Years for a Recession to Occur Once Rate Hikes Begin

Rate is the federal funds rate until Sept. 27, 1982, the federal funds target rate until Dec. 15, 2008, and thereafter it is the upper limit of the federal funds target rate range.

Source: Federal Reserve, Bloomberg

What happens when the Fed reduces its balance sheet?

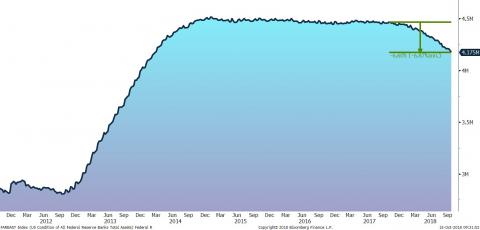

Truthfully, nobody really knows what happens when the Federal Reserve reduces its balance sheet since they have never done it before. Theoretically it should act as an additional fiscal tightening measure. But we are mindful that historically there often are unintended negative consequences when balance sheets contract. It has been a year since the Federal Reserve began shrinking its balance sheet, and it is down close to 7%.

Chart 2

The Federal Reserve Balance Sheet is Down 7% In the Past Year

$ in trillions, September 2011 – September 2018

Source: Federal Reserve, Bloomberg

Running harder to stand still.

As financial tightening continues in response to the strong domestic economy, this will exert downward pressure on stock market valuations. Think of it this way: if I know that interest rate increases at some point lead to decelerating growth, I am going to pay less for those future earnings. Thus, we typically see a decline in price-to-earnings ratios when interest rates rise. Initially, corporate earnings growth will more than offset the contraction in P/E ratios. But at some point, earnings growth rates will likely slow and stock markets likely contract. In 2018 U.S. corporations benefited from lower tax rates but in 2019 corporations won’t have that extra earnings boost. Thus, companies must run harder to stand still in 2019.

Table 3

Stock Market Valuations Have Declined from 2017 Peaks

S&P 500 Forward Price-to-Earnings Multiple. Line is Average Value

Source: Bloomberg

Higher interest rates are impacting consumers.

We remind our readers that it is not just corporations that are feeling the impact from higher interest rates. Consumers who utilize debt are being hurt. 30-year fixed rate mortgages are now almost 5%. Home equity lines of credit are close 6%. Student loan interest rates are rising as well.

U.S Treasuries may be a better risk/reward vs. corporate bonds and as a hedge for stock portfolios.

With the risk/reward dynamic shifting, we are finding value in U.S. Treasuries. They are very low risk. For the first time in 10 years the interest rate on the 3-month Treasury (2.25%) is now better than the dividend yield on the S&P 500 (1.8%). We don’t believe that one has recently been getting paid enough for the extra risk of owning corporate bonds or high yield bonds. The spread between the rate on U.S. Treasuries and investment grade corporate bonds is at historically low levels. Given this dynamic, we have been increasing the ownership of Treasuries in all our portfolios, including stock portfolios.

Can we remain an island unto ourselves?

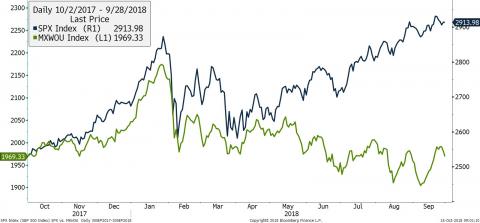

One additional observation we believe worth noting is the divergence of stock market performance globally. We know that the U.S. stock market has done well, but it is one of the very few major global indices that is up year-to-date (YTD). In the chart below, we compare the S&P 500 Index (up 10% YTD) vs. the MSCI Global ex-U.S. Index (down 1% YTD). To break it down further, the MSCI Europe Index is up 1% and the MSCI Emerging Markets Index is down 8%. Why the divergence? We believe that there are several pieces to this puzzle. The stronger dollar (a result of relatively higher interest rates in the U.S.) favors investing in the U.S. relative to the rest of the world. U.S. tax cuts are helping with a U.S. corporate earnings boost relative to the rest of the world. Finally, the impact of tariffs outside the U.S. is perceived as a larger negative.

The biggest question is what happens from here? Can we remain an island unto ourselves? Will the performance of the markets in the rest of the world increase to meet ours? Or the other way around? We are watching and assessing but are very concerned about our relationship with China (the world’s second largest economy). Don Straszheim a long-time China market watcher from EvercoreISI recently said he felt the U.S.-China relations were the worst in 40 years.

Table 4

U.S. Stock Market Is Performing Better Than the Rest of the World

S&P 500 Index vs. the MSCI World Index ex. U.S.

Source: Bloomberg

We will continue to balance the risks by gradually lowering risk in the portfolio.

We do not know when the water will boil, and rising interest rates will tip the U.S. into a recession, but we do believe it is prudent to continue our progressive modification of portfolios to address this growing risk. We continue to gradually sell or trim companies where we believe the risk/reward may be moving against us, or where we have become overweight. During the quarter we trimmed 7 holdings, but only added to 2 existing holdings. With the cash raised we have purchased short-term U.S. Treasuries. We added no new equity positions to the portfolio in the past quarter.

We trimmed 7 companies on strength, reducing each position from over 4% of the portfolio down to 2-3%. The list includes companies in the technology, finance, defense, and pharmaceutical industries. In addition, we trimmed our ownership of a mining company because of our concerns over U.S.-China relations. Finally, we sold half of our position in a biotech company after its significant runup into new data regarding the potential benefits of their drugs.

We added to 2 of our positions. With our belief that the markets are becoming more late cycle, we added to a multi-national food company that pays a high dividend. Finally, we added to an oil refining company. There is a proposal to reduce emissions from maritime ships (cruise/cargo) in 2020. One of the primary solutions would be to use refined fuel oil, and it appears that the world is short in its refining capacity to meet the potential demand. Thus, with a potential supply/demand imbalance we believe that this company should prosper.

We are keeping bond portfolios short and buying more Treasuries, but watching the yield spread with interest.

The spread between short-term and long-term rates is near historical lows. This had caused us to go very short in our bond portfolio and add some floating rate debt. Fortunately, spreads have begun to widen in the early part of October, and we will monitor with interest. We can currently garner a 2.25% return on very short-term Treasuries and 3-4% on 2-3-year corporate bonds. Short-term bond yields are now above the dividend yield on the S&P 500 for the first time in a decade.

NEW SECTION: Mutual Fund Portfolio Review

During the past few years, we have had several clients request portfolios that primarily utilize index funds as well as a few actively managed funds where appropriate. These accounts are typically initial client portfolios, or for clients who desire a “passive” addition to their existing “active” investment style, or clients who have asked for our assistance in providing non-discretionary advice for their corporate retirement accounts. We feel that it is important to begin addressing our management of these assets with its own section of our quarterly letter.

We have positioned our mutual fund portfolios to reflect our current macro thinking. We raised our cash positions at the end of last year and continue to hold those higher-than-normal levels as we maintain a slightly cautious outlook. We are actively managing these higher cash levels to generate a better return compared with solely holding the default sweep bank cash. We rebalanced the portfolios mid-September to return allocations back to their targets.

Over the past several years we have increased the financial planning capabilities at Bourgeon. We currently utilize goal-based financial planning discussions and software as well as personal financial websites to assist our clients in navigating their unique financial journey. If you haven’t already taken us up on the offer of these services, please do so. We find them to be incredibly helpful, insightful, and fun. “Those who plan often fare better than those who don’t.”

As always, we welcome the opportunity to discuss your portfolio and our current thinking with you at any time. While we have only spoken generically about asset allocation in this letter, we believe that it is a very individual decision. We do our best work for you when we are up-to-date on changes that may be occurring in your lives. We enjoy speaking with you and sharing ideas on a consistent basis; if your situation changes at any time between our regular discussions, please reach out to us and let us know.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

Sincerely,

|

John A. Zaro III CFA®, CIC |

Laura K. Drynan CFA®,CFP®,CIC |

Important Disclosure:

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market InsightsSummer 2018 Spring 2018 Winter 2017 Fall 2017 |

For more information, please contact us:

777 Post Road

Darien, CT 06820

203.280.1170 | info@bourgeoncapital.com