Bourgeon Capital's Market Insights: Summer 2018

“It is Better to be Roughly Right than Precisely Wrong”

-Maynard Keynes, 1883-1946

In our last quarterly letter, we included a quote from Ray Dalio, CEO of Bridgewater, that implied the end to our current bull market was coming. During this quarter, Ben Bernanke, 14th Chairman of the Federal Reserve, said, “In 2020, Wile E. Coyote is going to go off the cliff and is going to look down.” The June 30, 2018 issue of Barron’s was titled “Why the Bull Market Could End in 2020.” It appears that 2020 is becoming the market consensus of a potential peak in US economic activity. If this assumption is correct, as the stock market is a discounting mechanism, then there is a possibility that we could see a peak in the stock market in the 2019 timeframe. While the future is inherently uncertain and we don’t know exactly when the second longest bull market will run out of steam, we do believe that we are in the later innings of this economic cycle. We have been modifying our ownership positions, seeing this as more of a gradual opportunity to reallocate rather than a needed, sudden event. “It is better to be roughly right than precisely wrong.” Our current intention is to continue trimming or selling stocks that are overweight or overvalued, rotating into defensive stocks, as well as holding more cash and Treasuries.

Main Street May be Better Than Wall Street

While we don’t want this letter to be a repeat of our last letter, we thought it would be instructive to remind everyone about our thesis. When the Federal Reserve is lowering interest rates, there are expectations that economic growth is going to accelerate, and thus stock valuation multiples rise. This has happened in the US markets over the past 10 years. Main Street is now so strong that we are in the phase when the Federal Reserve is raising interest rates with the intent of slowing economic growth. It would seem appropriate that the opposite would happen – valuation multiples should contract. For a while the valuation contraction should be more than offset by higher earnings – either through strong economic demand or through lower tax rates – but eventually there could be downward pressure on stock prices. We believe that we are in this late cycle phenomenon - where stock market returns could be below average. For more details please read “Main Street May Be Better Than Wall Street” dated Spring 2018.

Bad Things Happen When Balance Sheets Contract

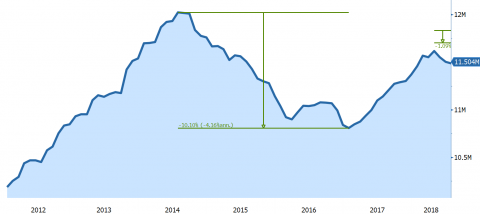

Global growth also has been strong, and, thus, we anticipate that Europe and Japan may also follow suit with removing financial stimuli over the next year or so. We call this “Too much of a good thing can be a bad thing." We believe that taking away stimulus by reducing global reserves is a big concern. Historically, bad things happen when balance sheets contract. In graph 1, one can see the 10% decline in balance sheets in 2014-2016, which corresponded to a 15% decline in the US stock market in the 2015-2016 timeframe. Balance sheets have started to contract again (very modestly so far!), and, if Europe and Japan begin to tighten, there is the potential to see global reserves contract further. If this happens, we believe it would be a negative for the stock market unless this is offset by further fiscal stimulus; this seems rather unlikely given large government debt levels globally.

Graph 1

In Recent History When Global Balance Sheets Contract Equity Returns are Under Pressure

International Reserve Assets, Excluding Gold

Source: Bloomberg

Can it Really Get Much Better Than This?

We don’t know the future, but we know the past. Unemployment is at historic lows and, consumer net worth is at historic highs. The S&P 500 has grown at an average real annualized rate of 18% since 2009 vs. a long-term historical average of closer to 10%. This is now the second longest economic expansion in history. Can it really get much better than this before something tips us in the wrong direction? What about geopolitical risks which appear to be rising? Could global trade wars continue to escalate and take away all the potential benefits from recent tax cuts?

If the Fed is Restocking its Monetary Toolbox, Shouldn’t We?

If the Fed thinks that it is time to restock its monetary toolbox to slow the economy and to prepare for the next recession by raising interest rates, shouldn’t we follow suit? Absolutely! Since we don’t know the exact trigger point for slowing economic growth, we see this more as a process than an event. We have been patiently, but proactively, modifying the portfolio over the past year or so to prepare for this late cycle market.

Shifting the Portfolio is a Process Not an Event

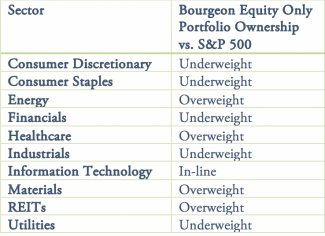

Table 1 below shows Bourgeon’s equity only ownership relative to the S&P 500. Please note that individual accounts may have different holdings and performance due to legacy positions, timing of investment, or use of modified strategies based on client requests.

Table 1

Bourgeon Equity Only Ownership vs. S&P 500 by Sector

Consumer Discretionary

We believe that, after the boost from recent tax cuts is over, the negative of higher interest rates will take over. We are starting to see increased delinquency rates on credit cards, despite higher wages and low unemployment. We are underweight this sector. Over the past year, we sold our homebuilder stocks (rising rates historically signal a peak in stock prices), and sold another stock that didn’t meet our expectations.

Consumer Staples

S&P 500 consumer staple stocks have underperformed the overall stock market over the past few years but we believe that this should be an area of increased investment for us going forward due to relatively low valuations and our view of where we are in this economic cycle. We sold two stocks over the past year in this segment as those stocks reached our price targets. We also swapped an underperforming consumer staple stock into a new investment where we anticipate better future returns.

Energy

We are overweight energy as we historically have felt that oil and oil services stocks typically are late-cycle investments. With global demand high, and inventories now low, oil prices have more than doubled from 2016 lows. But energy stocks have not completely followed suit. We own master limited partnerships for income, and oil and oil service stocks to leverage rising prices. We recently swapped an underperforming oil company into a new investment where we anticipate better future returns. This quarter we purchased an oil refining company. Given IMO 2020, regulations to reduce pollutants from tankers and cruise ships, we believe that the demand for refined oil products will greatly outstrip supply heading into 2020.

Financials

Financial stocks began 2018 exceptionally strong, but recently have weakened. Early in the year, given our view that rising rates would eventually lead to weaker stock markets we decided to sell some of our exposure in this sector. We currently are underweight with our financial ownership relative to the S&P 500.

REITS

Real Estate Investment Trusts have bond-like characteristics since they pay out a portion of their earnings. Thus, in a rising rate environment, the stock price of REITs tend to at least decline initially. This can lead to modest, if not negative, total return for this sector. So far we have insulated our portfolios by owning a timberland REIT and a logistic REIT.

Healthcare

Healthcare has been in a difficult investment sector this year due to political pressures to reduce drug pricing coupled with the threat of Amazon increasing its presence in drug retail. We continue to watch the drug distribution space and have attempted several investments only to sell shortly thereafter as we felt the perception of competing against Amazon was too risky despite the low valuations. For the rest of healthcare we have used diversification to our advantage, and thus own across several disciplines - pharmaceuticals, biotechnology, life sciences, and medical technology.

Industrials

We had expected industrials to perform better this year, and are disappointed in our performance. We sold three stocks in this sector over the past year – two outperformers and one underperformer. We subsequently invested in a company we believe to be a late cycle industrial. The low valuation, high dividend, strong cash flow, and great management has yet to translate into a profitable investment for us. We anticipate the second half of 2018 to show improvement and if not then we will reevaluate our position.

Technology

The Technology sector has rapidly grown to be the largest component of the S&P 500. It now represents about 26% of the S&P 500 up from its historical 16-18% range. Bourgeon has participated in this growth, and technology also represents about 26% of our actively managed portfolio. However, since the middle of 2017, we have been selling into strength in order to reduce the risk of high valuations and overweight positions. We added only one new stock to our technology holdings this year.

Materials

Materials are a good late cycle play when inflation begins to increase. We added an investment in materials in 2016 around the time that the Bloomberg Commodities Index registered an historical low level. We subsequently added a second investment in 2017. The stocks we own have strong management teams, balance sheets, and dividend yields. In addition they have near term catalysts, such as large share repurchase programs or unique capital deployment opportunities. With any materials investment one has to be cognizant of the economic cycle and willing to take profit when afforded the opportunity.

Utilities and Telecom

In the initial stages of a rising rate environment, both utilities and telecom sectors tend to underperform the general market. We sold the majority of our utilities and telecom over a year ago, and have been able to avoid losses in these sectors. As the cycle continues to mature, we may look to add to these sectors.

Cash

We Like Treasuries and Cash When Uncertain

We continue to be underweight equity targets across the board – selling more stock than we have been buying. We haven’t bought Treasuries for the portfolios since 2009, but now seems a great time with 3 month Treasuries yielding 2%.

We Shortened our Already Shortened Bond Ladder Even Further

The spread between short-term and long-term rates is at historical lows. Thus we do not believe that there is much reason to add duration risk to the portfolios, and have shortened our already shortened bond ladder even further. We currently are able to get a 2% return on very short-term Treasuries and over 3% on 2-3 year corporate bonds.

As always, we welcome the opportunity to discuss your portfolio and our current thinking with you at any time. While we have only spoken generically about asset allocation in this letter, we believe that it is a very individual decision. We do our best work for you when we are up-to-date on changes that may be occurring in your lives. We enjoy speaking with you and sharing ideas on a consistent basis; if your situation changes at any time between our regular discussions, please reach out to us and let us know.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

Sincerely,

|

John A. Zaro III CFA®, CIC |

Laura K. Drynan CFA®,CFP®,CIC |

Important Disclosure:

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market InsightsSpring 2018 Winter 2017 Fall 2017 Summer 2017 |

For more information, please contact us:

777 Post Road

Darien, CT 06820

203.280.1170 | info@bourgeoncapital.com