BOURGEON CAPITAL MARKET INSIGHTS

People are Shakily Optimistic. -Howard Marks, Co-Founder & Co-Chairman, Oaktree Capital Management

Bourgeon had an amazing 2025! The title, last year, of our Winter letter was “Getting Comfortable Being Uncomfortable: Welcome Aboard the Chaos Train.” Thus, we began 2025 in a cautious mode with a larger than normal amount of cash as we were concerned about uncertainties surrounding the Trump Administration agenda. But then we “got comfortable” and had one of our most successful years in our 26-year history. Our assets under management grew to over $1 billion from a combination of very strong investment performance, coupled with account additions from client referrals. We added new investment offerings and expanded our financial planning and family office services. We look to continue our momentum in 2026!

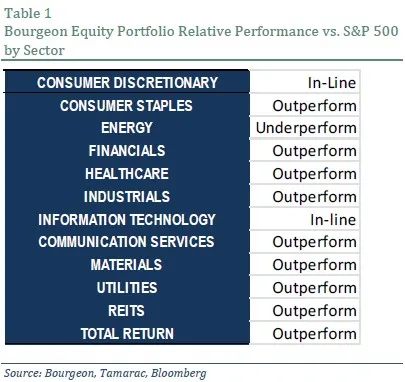

In 2025 the S&P 500 was up 18%, and the broader bond market was up 7%. Bourgeon’s stock and bond strategies posted returns better than our benchmarks, model portfolios kept pace with global markets, and our private alternative funds were among the top quartile in their strategies. The star outperformance was in our stock portfolio. As we begin 2026, we are “Shakily Optimistic” and are starting with a defensive posture. We have rebuilt cash balances so that we can remain patient and nimble to take advantage of thematic stock opportunities that may arise in this uncertain environment. We are playing the long game.

Investors are Shakily Optimistic: Economic Pros/Cons in 2026

The economy ended the year in a good position. There are some storm clouds, but we don’t see a major disruptor on the horizon. Real GDP growth for Q2 / Q3 was 4% on average, with Q4 estimates just under 3%. As we enter 2026, it is likely that growth will remain strong – at least in 1H.

One Big Beautiful Bill Act (OBBBA): Implementation of the OBBBA is expected to boost GDP growth by 0.5% plus in 2026.

Inflation: So far, broad inflation measures have remained tame relative to expectations. However, inflation for the lower-end consumer (affordability) is a big issue.

Interest Rates: Current expectations are for interest rates to decline in 2026 as the labor market weakens and inflation stays tame. This should boost economic growth. There will be a new Fed Chair in 2026, and every indication is that this person will support Trump’s ideas of reducing interest rates.

Artificial Intelligence: The dramatic growth in the use of AI has the potential to improve profitability across many sectors of the US economy.

Unemployment: The unemployment rate continues to slowly rise and wage growth is slowing.

Debt levels: There is no political incentive or will in the US to reduce our debt levels. Both parties have flip-flopped on this subject over the last few decades. COVID stopped us from making any real headway here. Going forward, this negatively impacts the government’s ability to respond to a real fiscal emergency. We are tracking this closely.

Tariffs: Trump implemented tariffs by claiming powers under IEEPA (International Emergency Economic Powers Act). This is being challenged. After two lower courts found that IEEPA tariffs were unlawful, the case is now in the Supreme Court. We may hear a decision by the end of January 2026. If the tariffs are declared unlawful, then importers may be able to seek billions in refunds. The Trump administration could also find other ways of implementing tariffs.

Geopolitics: Trump is attempting to reshape the political landscape, which creates uncertainty. The situation in Venezuela is still in motion. The idea that this could “fix” the oil industry by keeping worldwide prices low could be a positive, but it is a long way off and could cost more than $100 billion to achieve. Oil companies may be hesitant to pay for this until political stability is reached in Venezuela. Time will tell. Venezuela only adds to global jitters surrounding China, Taiwan, Ukraine, Russia, Greenland, Cuba, Colombia, Iran, and Israel. Policy-wise, this “Donroe Doctrine” or “Neo-royalism” seems to validate what China and Russia are doing – each taking their own hemisphere. This shifts the world order and causes discomfort, which is usually not good for world markets.

The Right Mix of Themes & Companies in our Stock Portfolio for 2025

Often an investor can pick the right theme, but not the right companies. And vice versa. During 2025 Bourgeon got them both right – outperforming across almost all sectors in the individual stock portfolio.

Our primary investment themes:

Artificial Intelligence (AI): The significant growth of AI provides a rich environment for stock picking. Investor interest has broadened beyond Nvidia to several other companies and sectors.

For Bourgeon, semiconductors were the standout in Q4. Our best performer was completely out of favor when we bought it the first half of 2025, but the stock subsequently more than doubled before the end of the year and the companies products remain sold out through 2026. It is a cyclical stock, and we hit the cycle at the right time.

AI-focused software companies also enjoyed a strong rally in 2H 2025. In early 2025, investors shunned some of the best software companies. Because we had cash available, we were able to invest in these great companies at great prices and got a great return – a triple win.

Data Centers and Electrification: The amount of power generation necessary to support the increased usage of AI is staggering. As a country, we are far behind. And there are many political, regulatory and logistical issues to overcome. It’s complex, will take time to fully resolve, and the risks are large. Much capital has been spent, with more to come, and if the industry fails to get a proper return on that investment, there could be disappointment. Power is a broad category that includes: transmission, generation, nuclear, natural gas, fusion, batteries, storage, alternative energy, etc.

We like the “tools and parts” of the data center buildout. Our investments here show up primarily in the Industrials sector of the Bourgeon portfolio.

From a utilities sector standpoint, our area of focus has been nuclear energy, and it turned out to be a home run for the Bourgeon portfolio in 2025.

The buildout of data centers will require basic materials, including copper. We represent this theme in our long standing holding in a major mining operator.

Finance: A stronger economy, steeper yield curve, and deregulation have allowed financial companies to soar. Our overweight in bank stocks was the primary source of our outperformance in the sector.

Healthcare: The Trump administration's healthcare scare in 2025 gave us an opportunity to buy companies under pressure.

We purchased a pharmaceutical company in the summer of 2025, down about 25% from recent highs. Subsequently, positive data was released on its weight loss/diabetes drug, which has fueled upside, along with better overall government pricing. We expect good performance from here. In addition to weight loss drugs, the company has a full drug pipeline in cancer and Alzheimers.

In the diagnostic and tools segment of healthcare, we began to see recovery in two names we have owned for a while. One company was a real turnaround story in 2025. A series of self-inflicted wounds by the old management team had pushed the stock down over 80% in 5 years. It was then blindsided by the Trump/China trade war when one of its primary products was blacklisted in China. We used this volatility to our advantage. The new management team is doing a great job of refocusing the company and getting it back on track. The product was removed from China’s blacklist this quarter.

Our best healthcare performer this year was a company that had no investor support when we purchased it two years ago. It was selling at only 8x earnings, well below the valuation levels of the S&P 500, the healthcare sector, and its own history. But we recognized the potential and have been well rewarded as the stock is up 250% since our initial investment in 2023.

Defense: The world is increasingly uncertain. Geopolitical risks are high. Artificial Intelligence increases cybersecurity risks and cybersecurity regulation is ever-increasing. In our portfolios we own defense and cybersecurity companies.

Some themes we are focusing on for 2026: Manufacturing, reindustrialization, robotics, and quantum energy.

Fourth Quarter Stock Moves and Initial 2026 Positioning

After many years of very good, if not excellent, returns, we expect the stock market is overdue for a “pullback”. It happens. Drawdowns and increased volatility may return in 2026. Right now, people don’t seem to be very concerned, and they certainly don’t seem to be cautious. And for that reason, we remain cautious. We wouldn’t call it being contrarian, but rather, we are playing the long game. Maybe it’s time for a rest.

For 2026, we will continue the strategy from 2025: Focus on secular growth themes, spend cash judiciously, be mindful of overvalued stocks, and be tax-aware. We will be patient and watch for opportunities while trying to avoid large losses.

In Q4 we made several changes to the portfolio, with the result that our cash position declined. In early January 2026 we trimmed several stocks that we believed were overvalued and increased our cash position to above 10%.

Model Portfolios: A Strong Year for Diversification

Our model portfolio strategies range from Aggressive to Conservative by holding mutual funds and ETFs to achieve varying degrees of exposure to global equities and fixed income. The models are generally biased toward passive, low-cost index exposure but also hold small actively managed fund positions in select asset classes.

Model portfolio accounts were up significantly in 2025, participating alongside strong global equity performance. The models have exposure to emerging and developed international markets, both of which were standout performers last year. In some instances, active funds had strong absolute returns, but they could not match their lofty benchmarks. The fixed-income holdings in the models also enjoyed a solid year, mostly surpassing their benchmarks but, obviously, well shy of equity performance.

The model portfolio strategies are purposely built to be different from the actively managed Bourgeon stock and fixed income holdings. The holdings are globally and broadly diversified, rebalanced periodically and meant to generally perform in line with their underlying indices.

Alternatives in Bourgeon Portfolios

As various investment options continue to evolve, we have been selectively allocating to private markets where suitable for clients and after thorough due diligence.

In recent years, significant changes in the alternatives landscape have made these strategies more accessible to individual investors, lowering traditional barriers and opening new growth potential while still acknowledging their reduced liquidity. We believe that private markets (equity, infrastructure, credit, real estate, secondaries) present a compelling opportunity to further diversify your portfolio.

Yield Curve Steepening in the Bond

Our bond portfolios benefited from lower federal funds interest rates and continue to deliver a positive real rate of return. The broader bond market index (Bloomberg US Agg) was up 7% in 2025. With inflation in the 3% area, this is a good real rate of return. We continue to monitor the spreads of corporate bonds vs. US Treasuries, which continue to be at record-tight levels.

In 2026, we plan to keep the bond portfolios fully invested and maintain our 5–7-year bond ladder. We will be mindful of potential volatility around the announcement of a new Federal Reserve Chairman.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.