BOURGEON CAPITAL MARKET INSIGHTS

This time is NOT different. The Gray Rhino lives.

Fall 2025

Market headlines continue to be full of volatility and uncertainty. As we write this letter, President Trump is slapping an additional 100% tariff on Chinese goods and putting off his meeting with Chinese President Xi. In the rest of the world, the Trump tariffs continue to cause issues and consternation. Preliminary dea s are not yet concluded, making it difficult for corporations to plan. The US economy has slowed in the last several months, with unemployment increasing. The US government is now shut down as Congress fights over funding the annual budget, and the administration is beginning to fire workers. Spending on Artificial Intelligence (AI) continues strong, but rumblings that we are in an AI capital spending bubble are gaining intensity with no clear understanding yet of the potential return on the AI investment. We are hopeful that the Gaza war is over for now, and that a peaceful rebuilding can begin. Putin continues his rage in Ukraine. Europe is finally spending money to defend themselves, and this will be positive for their economies but will require financing, potentially putting pressure on social support.

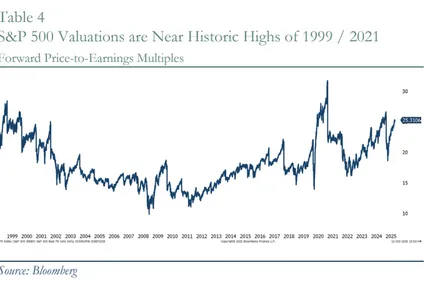

The S&P 500 continues to climb a wall of worry, gaining 8% for the quarter, and 15% year-to-date through September 30. Year to date, the overall bond market (US Aggregate Bond Index) was up 6%. Stock market valuations are at historical highs, and credit spreads are historically tight. The markets have been supported by the Fed’s reduction in interest rates. We are concerned that the current risks are not sufficiently priced into the market and are comfortable taking profits and holding a larger-than-normal cash position. We continue to look for opportunities to shift the stock portfolio – buying on weakness and trimming on strength – all mindful of our investment themes and our risk/reward outlook.

Artificial Intelligence Spending is a Main Support for Recent Economic Growth, Corporate Earnings, and Stock Prices

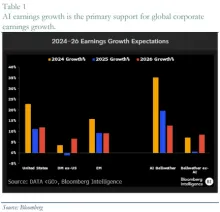

The broad economy continues to weaken, but spending on artificial intelligence is on fire. According to Gillian Wolff at Bloomberg Intelligence, global 2025 AI bellwether earnings growth is projected to increase to almost 20%, while non-AI earnings growth declined to just 0.7%. See Table 1. Gerard Macdonell at 22V Research estimated that growth at AI-related sectors explained just under 40% of the 1.6% real GDP growth in the first half of 2025.

According to an April 2025 study by McKinsey, capital spending to support AI-related data center demand could range from about $3 trillion to $8 trillion over the upcoming 5 years.

Companies that focus on AI and the AI buildout are seeing sizable stock price improvement. See Table 3. We continue to be big fans of investing in companies that benefit from AI. Our investments in this area include nuclear power, electrical industrial companies, copper, and technology. We are looking at potential investments in quantum and fusion.

An AI Bubble? This Time is NOT Different. The Gray Rhino Lives.

We recognize that it will take time to realize a return on all the AI spending. As it unfolds, there could be a mismatch of expectation and reality. Stock prices may be well ahead of the earnings realization. It is possible that we could be in an AI bubble.

Throughout history, we have seen bubbles in many different sectors. From our experience, the market can often overextend valuations, and these valuations can remain overextended for a long time until a catalyst arrives to pop the bubble.

We are reminded of the “gray rhino” at times like these. A “gray rhino” is a term coined by author Michele Wucker to describe a highly probable, highly impactful threat that is obvious – yet often ignored until it’s too late. It is the opposite of a “black swan”.

We are concerned that the current risks are not sufficiently priced into the market. We are comfortable taking profits and holding a larger-than-normal cash position.

Some Crack in the Private Credit Markets: Another Gray Rhino?

Since the Great Recession, the private credit markets have expanded tremendously. According to Goldman Sachs, the global private credit market has grown significantly to $1.5 - $2.0 trillion.

In the third quarter of 2025, there were two large defaults in the private credit sector: First Brands and Tricolor Holdings. This spooked some investors. The stock prices of several alternative companies have dropped about 20% to reflect the perceived increase in risk.

We are mindful of how interrelated the credit markets can be and are carefully watching how this unfolds.

Federal Reserve Lowers Interest Rates as Economy Slows: Valuations Expand

During the third quarter, the Federal Reserve lowered interest rates as employment weakened, and inflation remained stable. The expectation is that there are more rate cuts to come.

There is an adage that says, “Don’t Fight the Fed”. Unless the economy is on the cusp of a recession, generally, if the Federal Reserve is lowering interest rates, then valuations expand, and stocks rise. The converse is also true. During the third quarter, the Federal Reserve lowered interest rates as employment weakened, and inflation remained stable. The expectation is that there are more rate cuts to come.

The Q3 2025 S&P 500 increase of 8% and the expanding multiples are partly reflective of the reduction in interest rates.

Third Quarter 2025 Investment Management Changes

During the third quarter of 2025, we continued to take advantage of stock price dislocations to adjust the portfolio. Our stock portfolios are outperforming the S&P 500 year-to-date. Our top three sectors of year-to-date outperformance relative to the S&P 500 include Financials (bank overweight), Industrials (data center focus and a company buyout), and Utilities (nuclear). The three sectors where we have underperformed the S&P 500 include materials, energy, and technology (but Q3 was a positive turnaround for us). We continue to keep a large cash position as a hedge in the current very volatile economic and political environment.

TECH: This quarter, our tech portfolio has performed well, increasing by 13%, in line with the tech sub-sector of the S&P 500, reversing two quarters of underperformance. We took advantage of Q2 market dislocations to profitably invest in a select few existing and new holdings. The very strong performance of these stocks in Q3 led us to selectively trim and take profits as the quarter ended.

HEALTHCARE: When one part of the market looks expensive, we look to deploy cash to areas of the market where valuation is low and a catalyst exists. This sector could be healthcare. Given the current political environment, there is a lot of turmoil in healthcare. We are watching closely. While the all-clear has not been sounded, we are seeing some areas of improvement. During Q3, a producer of weight loss and Alzheimer drugs disappointed investors, and the stock dropped 20%. We took advantage of the drop to add to our position. Since that purchase, it is up 37%. Our buy here was timely and efficient. This is the best of all the drug companies. A generic pharma company we already owned has also been another standout this quarter, up over 40%. We expect more positive news out of this sector as time goes on.

Our third-quarter investment changes include:

We purchased an initial position in an investment company focusing primarily on real estate. We believe that the decline in interest rates should benefit this manager going forward.

Cybersecurity is a secular growth industry. In Q3 we took an initial position in cybersecurity company where we see value in their Agentic AI security portfolio.

An existing cybersecurity holding announced an acquisition to enhance their portfolio, but it initially dropped 20% on the news. We took the opportunity to add to our position. The stock has since recovered, regaining its previous 52-week high.

An existing investment in a metal and mining company was up 25% in 1H 2025. We sold half of our position. But then, in Q3, they announced a mine accident. The stock dropped 22% and we bought back what we sold. The company has almost retraced the drop.

We sold out of three companies that did not meet our expectations and realized losses.

Third Quarter Model Portfolios

Our model portfolios were all up strongly in the third quarter, with the more aggressive, equity-weighted strategies outperforming the more conservative ones, as would be expected in a quarter with such robust global stock gains. Year-to-date, all strategies are achieving significant returns, as global diversification has continued to work in 2025.

Fixed income returns year-to-date are solid, as are US markets following a great third quarter, but it is international markets that continue to lead gains in equities. We added a position in a Real Assets fund in early July to gain exposure to precious metals, natural resources, commodities, real estate and listed infrastructure. The fund has performed well, particularly benefiting lately from its exposure to gold, silver, and other precious metals.

Model portfolios are designed to provide broadly diversified global exposure, offering a choice of tiered weightings to mainly stocks and bonds, along with some real estate and real assets exposure. The portfolios mix passive and active strategies to maximize efficiency and leverage expertise where we feel it is warranted.

Alternatives Investments

As a reminder, we have been selectively allocating investments to private markets, where appropriate, and after thorough due diligence. We believe that private markets (equity, infrastructure, credit, real estate, secondaries) present a compelling opportunity to diversify your portfolio further.

Our private strategies are performing well across their various asset classes, all achieving nice absolute returns thus far this year. In addition, we are pleased that they are also fulfilling their intended roles within a portfolio: diversification from stock and bond exposure while also contributing meaningfully to performance and reducing overall portfolio volatility.

Private markets largely face the same wall of worries as public markets, so we are constantly monitoring the various factors and narratives that may affect alternative strategies. We are in touch with our managers on the specific tremors within private credit noted previously, and, while we are very pleased with their lack of exposure, we will continue to be vigilant in watching them on your behalf.

Our bond portfolios got a boost from lower rates and continue to provide a positive real return. Corporate bond portfolios are up about 6% year-to-date, while the municipal bond portfolios are up in the 4% range (6-7% on a tax-equivalent basis). With inflation in the 3% area, this is a good real rate of return. We continue to monitor the spreads of corporate bonds vs. US Treasuries, which continue to be at record-tight levels.

We look forward to speaking with you soon, and thank you for entrusting us with the management of your money. Please call if you would like us to walk you through our opinions in more detail.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.