BOURGEON CAPITAL MARKET INSIGHTS

The Key Is Not To Predict The Future, But Prepare For It. Pericles 500BC

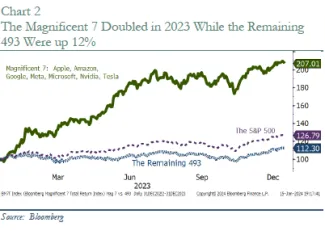

the fourth quarter of 2023 the S&P 500 surged 12%, and the bond markets rallied 7% as the Federal Reserve said that their rate hiking cycle can pause and a cutting cycle was coming. For the year, the total return on the S&P 500 was up 26% and the U.S. Aggregate Bond Index was up 6%. Thankfully, 2023 turned out much better than we had initially expected. For most of 2023, we were concerned with a potential US recession after two years of rate hikes, the fallout of a banking crisis, and heightened geopolitical risks. So far, those concerns have either not come to pass or have had minimal impact on the stock market, which was primarily focused on the “Magnificent 7” tech stocks. Our default position has always been to focus on protecting wealth, as well as growing it. Thus, given our concerns, we maintained a more cautious position than normal last year. Your portfolios were up double digits in 2023, and bond portfolios outperformed. Stock portfolios, however, underperformed relative to benchmarks for the first time in a few years, and from this perspective, it was a humbling year. As we look forward to 2024, while we can’t predict the future, we are preparing for it by remaining focused on several multi-year secular growth investment themes: infrastructure super cycle, defense (traditional and cybersecurity), de-globalization, clean energy transition, healthcare, data and artificial intelligence to name a few. We are cautiously optimistic and looking for a reversion to the mean, with the remaining 493 stocks of the S&P 500 potentially offering more profit potential than the “Magnificent 7”

The Economy Was Stronger Than Most Expected in 2023

While many investors (including us) assumed that the US would enter a recession in 2023, the economy surprised on the upside.

Consumers felt gloomy throughout the year but ended up spending freely, helping to boost economic growth. There were some smaller “rolling recessions” through various sectors of the economy, but none was strong enough to cause massive layoffs or broad contagion. Interestingly, even with this relative and unexpected strength, the mood was sour at both the corporate and individual level. Most corporate executives spent the year worrying about an impending recession, while individually stating that their company was OK. Similarly, consumers who were employed and spending freely felt that they were worse off than before, and 30% felt we were in a recession.

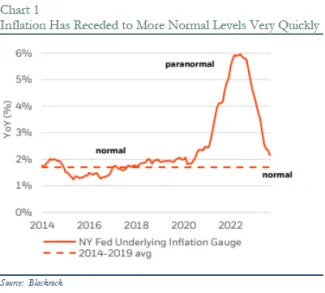

Inflation continued to decline, and by the end of 2023, inflation rates were very close to "normal" levels. This normalization occurred much faster than most inventors had expected.

The Foot May Be Off the Brake for the US Economy

After two years of trying to slow economic growth to bring down inflation, the Federal Reserve paused rate hikes in Q4 2023. They felt that they had made sufficient headway in slowing inflation, and that it was time for a pause. In fact, by December the Fed was hinting at three rate cuts for 2024. The stock and bond markets rallied on this news.

The stock market happily focused on a goldilocks scenario in which the Federal Reserve can negotiate a soft landing of the economy. A reduction in interest rates should increase economic growth relative to previous expectations.

The bond markets were also giddy and thought three cuts were too few. Perhaps the economy is heading for a hard landing? The bond market subsequently priced in six rate cuts for 2024, with the first one starting as early as March 2024.

We believe that directionally the market has it right. The pace of inflation isn’t as concerning as it was a year ago, and it makes sense for the Fed to take its foot off the brake. However, we believe that pricing in six rate cuts may be too aggressive. We wouldn’t be surprised if in Q1 2024 market expectations of rate cuts were lowered.

Will 2024 Be the Year of the Magnificent 493?

The S&P 500 was up 26% in 2023. But there was a tale of two cities underneath that performance. See Chart 2.

One city consisted of the “Magnificent 7”. These are 7 stocks that were seen as primary beneficiaries of the use of Generative Artificial Intelligence. The seven stocks are: Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla. A portfolio made up of the Magnificent 7 doubled during 2023.

The second city consisted of the remaining 493 stocks. These were down for most of the year, but ended up rallying in Q4 after the Federal Reserve announced that they were taking their foot off the brake and were considering rate cuts for 2024.

Your portfolios contained most of the Magnificent 7 stocks (all except for Tesla) for some/all of the year, but the size of your positions was smaller than the index. This was the primary reason for our stock portfolio underperformance relative to the S&P 500.

We continue to believe that generative AI has the potential to be a game changer for economic growth and productivity improvement. However, we also acknowledge that the transition to using AI is still new, transitions take time, and there will likely be growing pains. Valuations for several technology stocks are at levels last seen at the beginning of the Tech Bubble in the late 1990s.

So, we are wondering if 2024 could bring a “reversion to the mean”, where the remaining 493 stocks see better performance than the Magnificent 7? We are watching.

Geopolitical Risks Are Only Increasing

We continue to monitor the geopolitical landscape with concern as conflict seems to be increasing rather than abating. Russia invaded Ukraine in February 2022. Hamas attacked Israel in October 2023. The Houthis in Yemen are attacking ships in the Red Sea. There is a risk of expanding conflict throughout the Middle East. Taiwan voters recently rebuffed China, as the ruling party was re-elected to a third presidential term. The range of outcomes from here is wide.

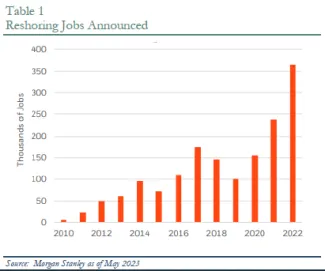

To date, the conflicts appear to have had only a modest impact on the US markets. Under the surface, however, some noteworthy effects of the conflicts have emerged such as the increased onshoring/reshoring of manufacturing (See Table 1), creating additional supply chains, rebuilding of inventories for defense companies, and increased demand for cybersecurity, just to name a few.

Fourth Quarter Stock Portfolio Adjustments and Tax Loss Selling

We made several changes to the portfolio in the fourth quarter, including implementing tax loss harvesting strategies. We do not like tax loss harvesting because it means a position lost money for our clients. However, it does provide the benefit of offsetting gains and reducing tax drag on client portfolios.

New Additions to the Portfolios: A large part of the infrastructure programs approved by Congress over the past three years includes components to improve the utility grid. We added two companies to the equity portfolio that will benefit from this spending. In addition, as Q4 was ending, consumer spending was strong and product inventories were very low. We think that at some point in 2024, product inventories will have to be rebuilt. As a result, we took an initial position in an international freight transportation company.

Adding to Healthcare: When adding to our healthcare holdings, we had two top-down themes in mind. First, historically during the time between the Fed pause and the first rate cut, healthcare stocks outperform. Second, healthcare valuations were at historical low levels, and we are conscious of the possibility of reversion to the mean in 2024. In Q3 we initiated positions in a large cap biotech company and a generic pharmaceutical maker. In the fourth quarter we added to the biotech position. We are now overweight in healthcare (17%) relative to the S&P 500 Index (13%).

Trimming Great Companies at Great Prices: Cybersecurity has been a great investment theme. During 2023 we benefited from our holdings in two cybersecurity names. One of our holdings was bought out at a nice premium. We sold for clients in Q4. For the second, we decided to trim and take some profit off the table for qualified accounts.

Selling Stocks that Didn’t Work: During our research on the energy transition, we became interested in the potential for green hydrogen. We then purchased a small position in a company as a potential beneficiary of green hydrogen investments. Unfortunately, the stock didn’t benefit as we had expected. We sold at a loss.

Tax Loss Harvesting: In order to make the most of a difficult situation, we implemented tax loss harvesting strategies in several existing portfolio holdings.

Model Portfolio Repositioning and Tax Loss Harvesting in Q4

Like the overall stock and bond markets in the fourth quarter, our model portfolios had significant positive performance in the final months of the year. All strategies, in fact, finished 2023 at or very near their highs for the year. Admittedly, many asset classes generally ended the year near their highs, however, there were a few small adjustments that helped our models achieve their returns. Like our overall posture given the backdrop in 2023, our models were positioned defensively throughout the year, retaining higher levels of yield earning cash than we ordinarily would allow. Throughout the quarter, however, we made a few tactical adjustments that helped the portfolios hold their own versus benchmarks.

- We increased our real estate exposure prior to the rebound it experienced in Q4.

- We sold all of our remaining TIPS positions and some shorter duration Preferred exposure.

- Using these shorter duration proceeds, we increased and, in some cases, initiated medium duration fixed income exposure prior to the large move down in rates.

- We increased our overall exposure to the Biotechnology sector. Simultaneously, we harvested a loss for taxable accounts by moving from one Biotech holding into the larger weighted new position.

- We completed a tax loss harvest trade in our Clean Energy position where we established a lower cost basis in September.

Our model portfolios continue to hold an above average allocation to cash earning money market rates. We are hopeful that 2024 will present an opportunity to become fully invested across the strategies, but being paid to be patient is an acceptable alternative until then.

Please note: Over the last few years we have incorporated the use of ETF’s in conjunction with mutual funds within our Model Portfolios for reason that include (but are not limited to) tax efficiency, cost benefits and increased liquidity. As such, where we have traditionally referred to them as Mutual Fund Portfolios, we have transitioned to calling them Model Portfolios meant to broadly characterize them as diversified, multi asset class strategies. We are happy to speak with you individually on this decision should you have any questions.

Enjoying Bond Investing

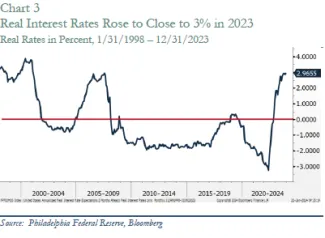

We enjoyed bond investing during 2023, as real rates turned decidedly positive for the first time since 2007. See Chart 3

During the beginning part of Q4 the yield on the 10-year US Treasury rose to over 5%. We took the opportunity provided by this move to extend the duration of your bond portfolios to achieve long-term equity-like returns. Unfortunately, the window of opportunity was short lived. During November and December, yields declined as the Federal Reserve started hinting at the potential for three rate cuts in 2024. The bond market decided that the Federal Reserve was being too modest and eventually priced in 6 rate cuts. As interest rates declined, bond prices rallied, with most of our corporate bond portfolios up 6-7% in 2023.

We believe that the bond market is being overly aggressive in its expectations of rate cuts, and thus, it is possible that interest rates go up a bit into the first few months of 2024. Most of your bond portfolios were purchased with a yield-to-maturity of 5% plus.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.