BOURGEON CAPITAL MARKET INSIGHTS

SEA CHANGE (Idiom) Substantial change in perspective on a particular issue. Similar to a paradigm shift…. (Wikipedia)

THERE WAS A SEA CHANGE IN THE CAPITAL MARKETS IN 2022. For over 40 years the US economy and capital markets had a monetary policy tailwind in the form of declining interest rates, monetary expansion and fiscal stimulus helping to fuel a massive equity bull market. On average, the S&P 500 gained 10.3% annually from August 1982 to the beginning of 2022. But then last year, after decades of “free” money, the Federal Reserve changed everything. In an unprecedented move, the Federal Reserve raised interest rates at the fastest pace in history to combat inflation. This Sea Change turned monetary policy from a tailwind into a headwind. Both stocks and bonds declined at the same time for the first time in 40 years. We have been an investor through several Sea Changes. From our perspective, we believe that we are at the beginning of a new era where inflation will be higher and stickier, interest rates may stay at elevated levels for longer than will feel comfortable, corporations will have to compete for capital, earnings growth may slow, and a restructuring of the new global economy will begin in earnest. Recognizing these changes, we adjusted stock and bond portfolios and held large cash balances over the past few quarters, helping to shield your portfolios from the worst losses. Our bond portfolios are now fully invested to take advantage of roughly 5% rates of return. However, acknowledging that paradigm shifts take time, and given the elevated risk of recession in 2023, we remain patient in deploying the cash in stock portfolios.

Sea Change: A Paradigm Shift

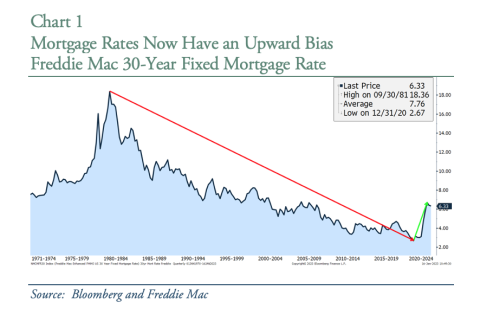

One simple way to view the massive shift currently underway is to look at a graph of mortgage rates. See Chart 1 below. According to Freddie Mac, 30-year mortgage rates peaked in September 1981 and subsequently declined for the next 40 years, ending with a low of 2.7% in late 2020. Over the past 2 years, mortgage rates have risen to over 6%, getting close to the 40 year average of 8%. Rising mortgage rates increase the cost of home ownership, slowing demand and price. This is a significant headwind for domestic economic growth in 2023. In fact, December 2022 housing starts were down 22% year-over-year, and building permits were down 30%.

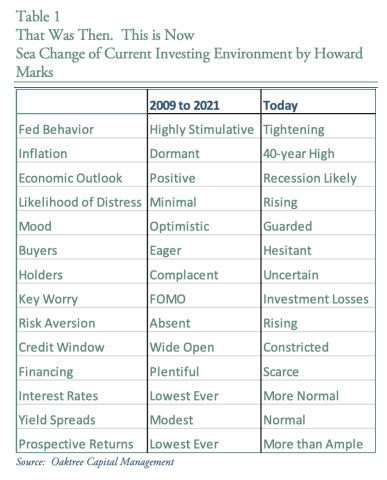

There are many other areas where major shifts are occurring. We are longtime fans of Howard Marks, the CEO of Oaktree Capital Management. In his most recent quarterly letter, Marks describes his version of the Sea Change that is currently underway in Table 1:

Inflation is Yesterday’s News

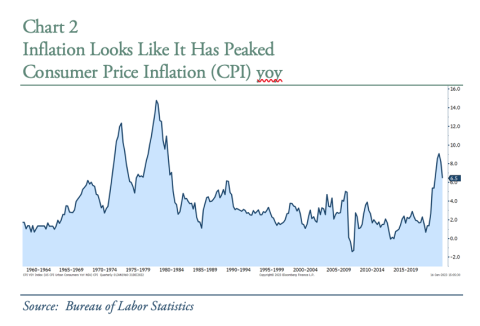

After a year of fighting inflation, it appears the Federal Reserve is finally having some success. Goods inflation looks like it has peaked. Services inflation is stickier, but we are now seeing price declines. Rent inflation is the newest major segment to exhibit weakness. Given the reduction in inflation in these areas, the Federal Reserve will likely pause hiking rates once the Fed Funds Rate reaches about 5% by mid-year.

However, wage inflation, the final and most important inflation indicator, has not yet provided enough of a sustained decline. Thus, the Federal Reserve continues to insist that it will keep interest rates higher for longer to ensure that wage inflation is pulling back to more acceptable levels. This will likely cause further pain in the labor market. The Federal Reserve remains more scared of inflation than it is of higher unemployment. They don’t want to repeat the same mistakes of the 1970s.

Currently the Federal Reserve has a target inflation level of 2%, vs. the current level of 6.5% (down from a peak of over 8% a few months ago). Given the current environment, we hope that the Federal Reserve considers raising their target to 2.5-3.0% to allow for more of a soft landing. Chart 2 shows the consumer price index over the past 60 years.

One major wildcard to the inflation outlook is the impact from China’s reopening post COVID. When the US and Europe reopened their economies after COVID shutdowns they experienced significant inflation. Will it be similar with China? Will demand jump? Will increased output help to offset the increase in demand? If inflation spikes in China will it be exported abroad? We are watching.

Earnings Will Be This Year’s News

The probability of recession in the upcoming year is well over 50%. Ed Hyman of EvercoreISI, says the upcoming recession is probably “the most anticipated of all time”. The debate is no longer will the economy fall into a recession, but rather – will it be mild or severe? And how will that translate into corporate earnings and stock market participation? We continue to be surprised by how little corporate earnings forecasts have declined in the face of very high recession risk. Either the underlying economic growth was so far ahead of our expectations to begin with, or the earnings cuts are still to come. Unfortunately, we believe the cuts are coming in the upcoming quarter or two. This could put downward pressure on the stock market. We have cash available to take advantage of opportunities that may present themselves.

New Investment Paradigm to Focus on Real Economic Growth Will Take Time

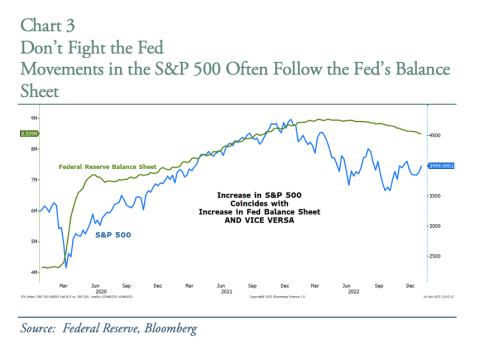

The “normalization” away from 0% interest rates, to where investment has a cost, has been dramatic, painful, and volatile. We have higher rates, slower monetary growth, less liquidity, and a declining Federal Reserve balance sheet. The capital markets are trying to adjust, stabilize, and get the proper footing. Chart 3 shows how changes in the Federal Reserve balance sheet have impacted the stock market.

While we believe that there may be more pain felt in the near-term, we also believe that ultimately this normalization will create a more stable economy focused on profit rather than just on revenue growth. This is a process, and it is new to many economic participants, but we have seen this before.

Geopolitical Risks Remain

In addition to high recession risk in the US, the capital markets are also grappling with higher-than-normal geopolitical risks. These include, but are not limited to, the Ukraine/Russian war, and heightened tensions between China and Taiwan. Here in the US, we are also contending with government dysfunction and concerns over the Debt Ceiling. While we hope that “Adults in the Room” might keep threats of government shutdown and default at bay, we think it is prudent to plan for the downside scenario, which would give us flexibility to react and take advantage of any market pullback.

Fourth Quarter Stock Portfolio Adjustments and Tax Loss Selling

The S&P 500 was up 7.5% in Q4, but down 18% for the year. Your stock portfolios nicely outperformed the S&P 500 due to several adjustments we made over the past year.

We made several changes to the portfolio in the fourth quarter of 2022, including tax loss harvesting. We do not like tax loss harvesting, because it means we lost money for our clients. However, it does provide a benefit of offsetting gains and reducing potential tax drag on client portfolios.

Taking Advantage of Price Arbitrage: In 2022 there was a divergence in valuation between public and private Real Estate Investment Trusts (REITs). Public REITs declined about 40%, while private REITs rose 10% or so. We decided to take advantage of this arbitrage by selling half of our private REIT holdings and using the funds to buy two publicly traded REITs.

Buying Great Companies on Sale: As the stock market declined in 2022, it was hard to avoid the carnage. We added to two core positions in Q4, for those clients underinvested relative to our targets. We also added to a smaller existing holding on price weakness.

Trimming Great Companies at Great Prices: Healthcare companies were relative winners in 2022. As such, several companies became outsized positions. As part of our risk management process, in the fourth quarter we trimmed on strength our holdings in certain healthcare stocks. Energy was the best performing sector in 2022. We took the opportunity to trim two core energy positions in Q4.

Adding a China Reopening Beneficiary: In late 2022, China reopened its economy and sent everyone back to work. We anticipated this potential and purchased a copper and gold mining company as a potential beneficiary of China reopening from COVID shutdowns.

Tax Loss Harvesting: In order to make the most of a difficult situation, we implemented tax loss harvesting strategies in several equity holdings in Q4. In addition, we did tax loss harvesting in some fixed income positions.

Mutual Fund Repositioning and Tax Loss Harvesting in Q4

Our mutual fund portfolios were up significantly in the 4th quarter, but they underperformed blended benchmark returns due to their overweight cash position in a predominantly up market. For taxable accounts, we actively harvested losses where available and avoided taking capital gains where practical. For all accounts, trading in the 4th quarter was fairly busy as we aligned some exposures with how we want to enter 2023. This included:

- Selling half our TIPS exposure and rotating into an actively managed Total Return bond fund

- Trimming some of our European exposure

- Exiting our Crypto position where it was held

- Initiating a position in the beaten down US Biotech and life sciences sector

- Putting all excess cash available into a money market fund with a respectable rate of return

We feel good about our mutual fund portfolios heading into 2023 and anticipate opportunities to get the excess cash invested throughout the year.

Making Roughly 5% on Bond Portfolios

For the first time in a very long time an investor can make 4%-5% on high quality fixed income invesments. We began 2022 with high cash levels in our bond portfolios, and thus had cash available to invest as interest rates rose. We are now fully invested in our 5-year ladder. The yield-to-maturity on our portfolios is close to 5% for taxable accounts and 2.5% for municipal portfolios. If one believes that the Federal Reserve will bring inflation down to the 2.5% - 3.0% level, then investing in fixed income now provides a positive real rate of return. It has been a long time since this has been the case.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.