BOURGEON CAPITAL MARKET INSIGHTS

PIVOT (v.) The act of changing course when you realize that the strategy you were pursuing is not going to get you to your goal.

During the Fourth Quarter of 2021, the Fed completed their pivot by saying that inflation is no longer transitory. The Fed is now considering three interest rate hikes in 2022 (compared with none until 2024 only 18 months ago). What an incredible change! While COVID concerns are not over, we now have more solutions with vaccines, better treatments, and potential herd immunity. The consumer is healthy and consumer net worth has exploded with housing and stock prices. Corporations are mostly in great shape as earnings are now well above pre-pandemic levels. It is time for extraordinary stimulus by the Federal Reserve to taper off and eventually end. COVID induced fiscal stimulus is also coming to an end, with the final installment, or the Build Back Better plan, having been scaled back significantly. From an investment standpoint, the easy part is over. While we have been impressed with how the Fed has telegraphed the pivot, we also recognize that the potential for a Fed policy “mistake” increases as they move through the tightening phase. We have been preparing for this pivot by changing the composition of our underlying investments and taking stock allocations down to target.

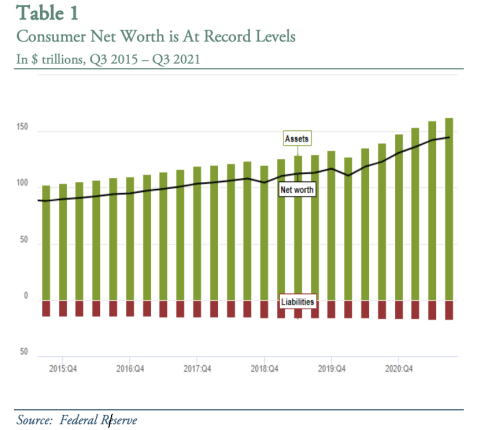

Consumer Net Worth is Above Pre-Pandemic Levels by 24%

The extraordinary stimulus from the government in 2020 did more than just bridge us to the vaccine, it has led to a significant increase in consumer net worth. The pre-pandemic peak of consumer net worth was $117 trillion. As of Q3 2021, consumer net worth had grown to $145 trillion, an increase of 24%. Add to this an unemployment rate of under 4% and wage inflation of 10% and the consumer, in general, looks to be very healthy

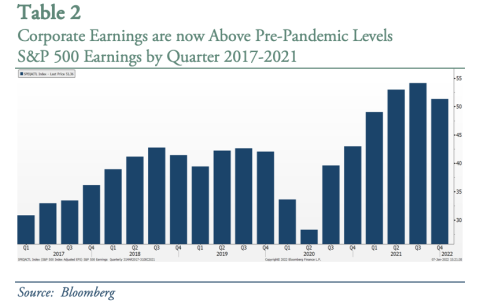

Corporate Earnings are Above Pre-Pandemic Levels by 40%

Strong demand, low supply, and price inflation have allowed corporate earnings to expand significantly. Annual earnings per share (EPS) for the S&P 500 are up by 40% over pre-pandemic levels. Low interest rates and COVID-related government support allowed corporations to keep their doors open and refinance their debt keeping interest expense low for many years. High cash flow has helped several companies pay down debt, plan capital expansion, buy back stock, and/or raise dividends.

The infrastructure package that was passed in 2021 should provide further demand support for many corporations for several years into the future. The Build Back Better plan would provide an additional increase in demand, but there is some doubt that an already-scaled back version will pass Congress in 2022.

Inflation is No Longer Transitory

Despite the very strong economic growth in 2021 and building inflationary pressures, there was still uncertainty surrounding COVID impacts on the economy. Thus, it took until the fourth quarter of 2021 for the Federal Reserve to finally acknowledged that the US economy no longer needed extraordinary stimulus, and that inflation was no longer transitory. In December 2021 the Fed said, “In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of net asset purchases.” With the tapering process in place, the Federal Reserve could begin raising rates by March 2022, with the average outlook now at three rate hikes for the year.

The recent inflation figures are staggering, especially when compared with the past decade. For example, after several years of no increases, Social Security recognized the cost-of-living impact of inflation, and raised payments by 6% this year. Most importantly, wages are increasing, with the recent figures showing a 10% year-over-year rise. This “wage-price” spiral is one of the most concerning for the Federal Reserve because it could impact inflation expectations and make it more difficult for the Federal Reserve to combat inflation.

As we have said all year, despite a strong economy, a rising interest rate environment poses risks to the stock market. We are reminded of this from recent events in 2013 and 2018 when the stock market declined as interest rates rose faster than expectations. All economic expansions have ultimately ended when the Federal Reserve makes one too many rate hikes. The stock market is aware of this potential for a “policy mistake”.

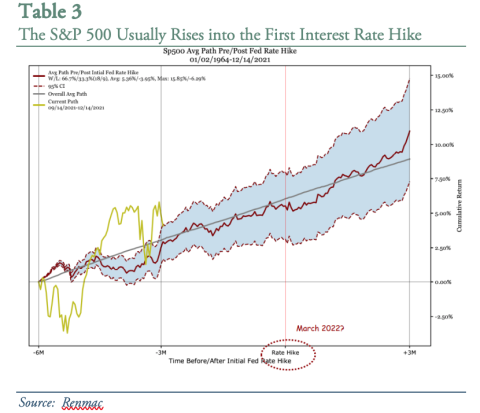

The good news for the near-term is that historically the S&P 500 rises into the first rate hike. Table 3 shows the historical range of performance of the S&P 500 three months before and three months after the first rate hike, according to the technical analysis of Jeff DeGraaf of Renmac. Performance this cycle is in green. If we assume that the first rate hike happens in March, then according to history, the S&P could be up 5-10% from here through June 2022.

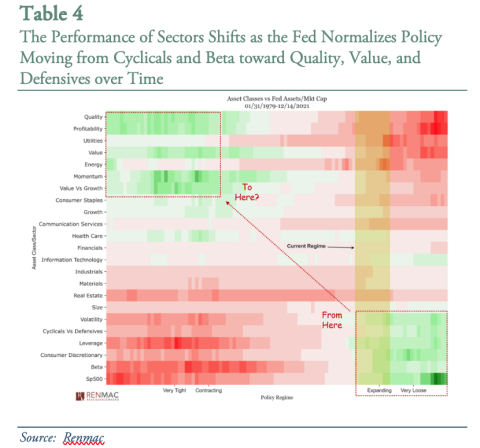

Even though initial rate hikes typically do not pose a risk to the “overall” stock market indices, there is often a shift in performance of the underlying sectors. When rates are declining and stimulus is strong, we usually have an “everything rally”, and almost all asset prices inflate.

When the Fed tightens, the market typically becomes more volatile, and the performance of stock sectors begins to differentiate. Often, interest rates rise and valuation multiples contract. Initially this most negatively impacts long duration stocks (i.e. those with no earnings and crazy high valuations, such as speculative companies). But we believe the easy part is over, and active investing could provide a better return going forward.

Subsequently, a rotation can often occur over time away from cyclical and high beta stocks and into value (“old economy”), quality, and defensive stocks. The transition from the cyclical upswing to the next phase of lower, but more sustained growth is likely to take some time and will probably be bumpy. We will monitor the markets for interesting investment opportunities.

In Table 4, RenMac shows the shift among investment styles that has historically occurred when the Federal Reserve begins to shrink its balance sheet (taper).

Raising Cash Into Year-End 2021

Even though corporate earnings are at strong levels, it is the future rate of earnings growth relative to expectations that matters most for stock prices. It is here where we have some concern for the future. We started 2021 overweight stocks (holding more stocks compared with individual targets) and with a focus on cyclical stocks. As we ended 2021, our stock allocations declined, and were in-line with targets. We were underweight technology and still overweight value and cyclical stocks (although less than before). We would expect to continue a rotation of the underlying investments into 2022 and may even consider moving to an underweight position in stocks as we move through the year

Fourth Quarter Portfolio Changes

During Q4 2021, we did more selling than buying. Most balanced accounts (those that own both stocks and bonds) are now back in-line with their target stock allocations.

We trimmed our ownership positions in several companies that had done extraordinarily well for us and added to some stocks on weakness.

While we never like tax losses, we did have an opportunity to take tax losses on 2 holdings at the end of 2021.

Full Rebalance of Mutual Fund Portfolios as We End the Year

2021 was a great year for the Domestic Equity funds in our portfolio. Our Large Cap and Real Estate funds performed especially well, while our gold and clean energy investments negatively impacted our performance. Sticking to the mantra of “buy low, sell high”, we rebalanced our mutual fund portfolios in December to capture the equity gains and better position ourselves for the market conditions ahead. We increased our allocation to International Developed Markets and made some changes to our Thematic Investing holdings. For those with the appropriate risk tolerances, we added a cybersecurity ETF and a digital asset currency ETF. We also made a few changes to our short-term fixed income allocation. We sold out of our investment in a short-term bond index and used the funds to purchase a low duration preferred bond fund and strategic income fund. We believe adding bond mutual funds with active management style will be prudent as the Fed begins to raise rates in 2022.

Time to Start Rebuilding the Short End of the Bond Portfolios After Fed Pivot

Investing in our bond portfolio has been difficult with yields so low. For most of the year, we have generally let maturing bonds sit in cash, sporadically adding to bond investments after a spike in yields. In the equity side of client holdings, we have increased the dividend yield of the portfolios. The current dividend yield on the equity portfolios is about 1.5%, which is slightly higher than the S&P 500 at 1.3%. For those with the appropriate risk allocations, we added alternative investments that provide income. In general, throughout most of 2021, about 15% of the “fixed income” allocation was cash, and 15% was equities.

With the Fed pivot now in place and the bond market targeting at least 3 rate hikes in 2022, we believe that we can begin to rebuild our bond portfolio as market expectations and Fed policy are more closely aligned. We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.