BOURGEON CAPITAL MARKET INSIGHTS

New Year New Strategy

The devastating human toll of the COVID-19 pandemic will forever stain our memories of 2020. While many criticisms of the last year are valid, we seek to identify some positives. We are awed by the ingenuity of the pharmaceutical industry and by the monetary and fiscal response to the COVID crisis. After an initial sharp decline, the stock market discounted future expectations of life after COVID, and the S&P 500 rebounded, ending the year up 18%. As we look forward to 2021, we see a new year, new vaccines, and a new administration, all of which calls for a new strategy. We started repositioning your portfolios a few months ago to take advantage of our new outlook. We envision the repositioning continuing into 2021, which could lead to higher-than-normal trading in your accounts. As always, we continue to evaluate downside risks, including a COVID strain resistant to our vaccines. Currently our biggest concern is higher than expected inflation. With demand above expectations, the savings rate super high, and inventories super low, we expect prices will rise. If inflation increases strongly, the federal reserve may decide to pull back on stimulus sooner than expected. Outcomes vs expectations determine market performance, not outcomes themselves. Thus, as expectations of waning Fed stimulus get pulled forward, this could put pressure on already high valuations. During Q4 we put most of your cash to work. Those clients with balanced accounts are now overweight stocks, and we may rebalance those accounts as we head into 2021.

In the Midst of a Global Pandemic, the S&P 500 Was up 18% in 2020

The numbers behind the COVID pandemic are staggering. As of January 10, 2021, there were 22 million confirmed cases of COVID in the U.S., with 372,552 deaths. Equally as staggering is the increase in the S&P 500 during this crisis. After an initial 30% drop, the S&P 500 rose over 70% and was up 18% for the year.

NEW COVID-19 Vaccines + NEW Stimulus =

When Was the Last Time the U.S. Had 5-10% GDP Growth?

This will be the year of the vaccine. Pfizer and Moderna were the first companies to gain FDA approval for their vaccines, and they did so in record time. However, other vaccines (Johnson & Johnson and Astra Zeneca) are in development as well. While the initial rollout is a bit bumpy, we anticipate a quick learning curve. The economic growth that will result from a vaccinated global population should be astounding.

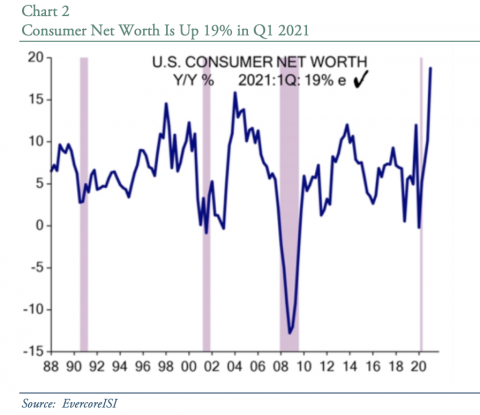

During 2020, there was unprecedented monetary and fiscal stimulus to help bridge our economy to the vaccines. In 2021, there will be new fiscal stimulus - $900 million initially, and another recently proposed $1.9 trillion. This should help support unprecedented economic growth and asset price appreciation. One channel monetary stimulus works through is higher stock prices and higher house prices, i.e., consumer net worth, which is up a record 19% year over year. See Chart 2.

According to Ed Hyman of EvercoreISI, Q1 GDP could be up 10%. Of the $900bn stimulus, he estimates about $500bn is likely to flow into Q1 GDP. He concludes that this would lead to a 10% increase in GDP (reported as a 45% annual rate). Several other economists are more conservative, forecasting “only” 5% GDP growth. When was the last time you remember the U.S. having 5-10% GDP growth?

We agree with Mr. Hyman and expect to see the economy in the United States and Worldwide continue to recover over the rest of the year. The news will not be all good, as it is likely that in the near-term, we will continue to hear about distress in the weakest areas of the economy: lodging, retail, restaurants, and education. Fortunately, the rest of the U.S. economy has continued to show strength, especially manufacturing, housing, industrials, autos, semiconductors, and copper. In addition, there is still a lot of money in savings, as bank deposits for consumers are up 20%. That gives us confidence that the recovery continues, as immunizations continue to roll out and we make it through these brutal winter months. We believe it will take 2-3 years to get us back to the employment level of 2019.

With earnings season upon us, we believe that companies should post strong results overall. Inventories are low worldwide across many industries and in the U.S. specifically. U.S. corporations have run a tight ship, cutting costs, planning diligently, pricing where they can, and generally being conservative in their planning. We expect that this will lead to strong earnings, cash flow, free cash flow, and employment.

Outcomes vs. Expectations Are the Market, Not Outcomes Themselves

The stock market is already anticipating much of this earnings goodness, so we are unsure how much strong earnings growth will move stock prices. This is like the idea of “under promise and over deliver.” We currently believe that the increased pricing for many cyclical companies is still underestimated. But the market is a quick learner, and we are unsure how long this scenario will last.

New Administration + New Infrastructure Package = New Investment Strategy

While the specifics of Biden’s infrastructure package, “Build Back Better”, have yet to be unveiled, he did say that his proposals would “make historic investments in infrastructure, along with manufacturing, research and development and clean energy.” Infrastructure spending has long been a desire of many administrations, however, the ability to get it done was nonexistent. We are hopeful that this will be different under the Biden administration.

If we add an infrastructure package to the stimulus of the past year and to the dovish combination of Yellen as head of the U.S. Treasury and Powell as head of the Federal Reserve, there is the potential for powerful economic growth to continue for a while. We are bullish on the economy, and especially so in more cyclical areas, which is different than in the past.

We have shifted our investment strategy to take into consideration the new investment climate for 2021. We have been moving away from “COVID winners” to “reopening winners”. From high valuations to low valuations. From momentum to beta. From an overall asset allocation strategy, we are now underweight technology, and we are overweight inflation winners like basic materials, industrials, and energy (both traditional energy and clean energy).

Our clean energy investments have performed well. The companies we purchased are potential beneficiaries of Biden’s Build Back Better plan. Clean energy currently represents about 5% of your equity portfolio.

Traditional energy should also benefit from 2021 reopening. Valuations on energy stocks were at historic low levels in 2020. In fact, energy as a percentage of the S&P 500 had dropped from 14% to 3% over the past 5 years. Given our positive view on reopening, Bourgeon added to energy, taking it to 8% of our portfolios, more than double the S&P 500 allocation. In addition to reopening benefits and low valuations, we like the income from our energy investments, with dividend yields in the 6-8% range (very compelling relative to investment grade bonds).

Tax efficiency is important to Bourgeon. Thus, we took the opportunity in the fourth quarter to first add to one of our biotech holdings and then trim for our taxable accounts to take the loss. We subsequently repurchased the position 31 days later. We believe that the biotech company’s recent acquisitions are likely to be more profitable than many expect, and we like getting paid a 4% dividend to wait.

We added to our position in another healthcare company, as we believe that upcoming corporate actions should provide a catalyst for renewed interest by investors.

With interest rates low, savings rates high, and inventories low, we expect that inflation should be stronger than people expect. As a result, we decided to increase our investment in gold back up to 5%, after it hit its 200-day moving average support level.

Always opportunistic, we took an initial position in a data analytics security software firm that we have admired for some time. The company benefits from the strong secular themes of artificial intelligence, data analytics, and internal security platforms for large corporations. When the company reported earnings that were weaker than expected and the stock declined 20%, we took advantage of the opportunity to buy a 1.25% position. We expect to increase our holdings here on any market weakness.

To make room for the new purchases, we did make some sales from existing holdings during the quarter.

Even with the strong stock market in 2020, we believe that there is more room to run in 2021 as earnings should come in better than expected. However, we would temper expectations for market strength similar in level to the last several years. Over the past 5 years, stocks have averaged a 15% annual rate of return. This compares with long-term historical average of 6-8%. What will be the catalyst for mean reversion? We do not know the answer, but some thoughts would be concerns of inflation, higher taxes, higher debt levels, or socio-economic divide.

Is It Possible to Have Too Much of a Good Thing?

…

Expansions Don’t Die of Old Age, They Are Murdered by the Fed

We believe that both easy fiscal and monetary policy must continue for now as a bridge to the vaccines. The good news is that should lead to very strong economic growth. The bad news may be that inflation could be stronger than most people expect and could lead to the Fed pulling back on stimulus sooner than investors expect, leading to a pull back in the markets. For example, when interest rates decline, the valuation of stocks rise. We can see that today, with the valuation multiples far greater than historical averages. The opposite is also true. If quantitative easing is reduced or interest rates rise due to higher inflation, then it is likely valuation multiples contract. If a company can’t keep up with very strong growth expectations (running harder to stand still), then the stock could come under pressure. During the end of 2018, we witnessed a similar phenomenon which led to a short-term decline in stocks of 20%.

There Will be Plenty of Time to Worry About the Consequences of Stimulus Later

We are always looking at downside risks. In addition to inflation, we are watching:

- Negative real interest rates globally have led to ‘bubble like’ speculation over the last 12-18 months. Examples include Bitcoin, Tesla, and the newfangled SPACs (Special Purpose Acquisition Companies). It is our view that “eras” like these always end badly, and this one will be particularly unique.

- The socio-economic divide in the U.S. has grown wider and deeper with COVID-19. Our country will need to address this problem. It will help that Biden is a consensus builder.

- Old school economists assume that we will eventually have to pay for all the fiscal and monetary stimulus to reduce our debt. Thus, at some point we should expect higher taxes.

- However, new school economists are talking about Modern Monetary Theory. They like debt, especially when a country has a reserve currency, and is in no hurry to pay it back.

- The geopolitical winds continue to shift. The cybersecurity breach of SolarWinds is massive and extremely problematic in its depth, complexity, and blatant appearance of an inadequate U.S. response. Additionally, China continues to be the elephant in the room. We need to realize as a country (and as investors) that China wants to be number one and wants the renminbi to be “the” currency and “the” electronic currency. That is a real and present danger. Lastly, geopolitical strains continue with Russia and the Middle East.

New Strategy for Our Mutual Fund Portfolios: Gold, Clean Energy, Dividends, Real Estate, and TIPs

We have implemented new strategies in our mutual fund portfolios as well. We added a 5% allocation to clean energy, and we increased the allocation to gold to 5% of the equity holdings. With interest rates low, we do feel that investors overall will be looking for more yield. As a result, we added a dividend growth fund to all equity mutual fund portfolios. We added to our real estate mutual fund to benefit from reopening. Finally, to address our concern about inflation, we added TIPs (Treasury Inflation Protected Bonds) to your bond holdings.

Yield Is a Scarce Commodity

Yield is so very hard to find. Over the past quarter, we decided to hold back on reinvesting bonds that matured, keeping cash levels higher than normal. The good news is that the yield curve has begun to steepen as fiscal stimulus is announced. If the curve continues to increase, you should expect us to begin putting that cash to work in the upcoming quarter. We are keeping our duration short and credit quality at investment grade. However, in the equity side of client allocations, we are working on increasing the dividend yield of the portfolios. The dividend yield on the equity portfolios is about 1.8%, higher than the S&P 500 at 1.5%. For those with the appropriate risk allocation, we are looking at alternative investments that provide income.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.