Bourgeon Capital's Market Insights: Winter 2019

Published January 20, 2020

“Only Strong Swimmers Should Enter These Waters"

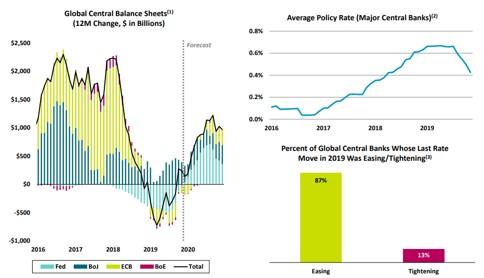

With the S&P 500 up 31% in 2019, it was a phenomenal year for the stock market. Not only was investment performance outstanding, but the ability of the markets to tolerate difficult news with very little volatility (after a brutal ending to 2018), was astonishing. The markets were helped when the Federal Reserve reversed course, moving from tightening policy to loosening policy. In addition, 87% of central banks around the world joined the US in easing monetary policy. Thus, despite weakening global economic growth with recession concerns throughout 2019, investors are now hopeful that with monetary stimulus up and trade tensions declining, that 2020 should see a pickup in demand and growth. Given our mandate to both protect and grow assets, we had a conservative investment stance heading into Q3 2019, with relatively large cash balances. However, during Q4 as the concerns were being addressed, we began adding to risk assets and reducing cash. After a strong Q4 equity performance, with the S&P up 9%, the US equity market does seem to be ahead of itself again. At the moment, we think that only strong swimmers should enter these waters. We would not be surprised to see a consolidation over the next few months, which would allow us to put the rest of our cash holdings back to work.

Don’t Fight the Fed

Global central banks came to the rescue of the economy and markets once again in 2019. As global economic activity weakened as trade tensions rose, CFOs became overly cautious about business and capital spending, leading to a weak manufacturing outlook. The US Federal Reserve reacted by doing an about-face – moving from tightening to loosening monetary policy. In the US, not only did we lower rates, but we added to the Federal Reserve Balance sheet to make sure that the Repo market worked smoothly into year-end. On a global basis, central bank balance sheets rose, and rates declined as well. About 87% of global central banks have recently eased. See Table 1. The markets cheer such moves because historically stock valuations rise, and economic activity improves, after monetary stimulus.

The question now becomes – will central banks remain accommodative? Given that inflation continues to remain tame, Central Banks are likely to keep monetary policy loose, and this would continue to be supportive of the stock market. However, if inflation begins to rise, then there would be some risk that central banks would consider raising rates again, and equity valuations could come under pressure.

Table 1

Over the Past Year Central Banks Provided Significant Monetary Stimulus

Source: Blackstone

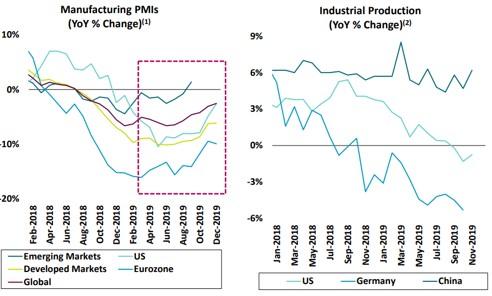

Global Growth Improves

Economic growth typically picks up about 6 months after central banks loosen monetary policy. Thus, it should not be a surprise that we are seeing economic green shoots around the world. One can see this in the manufacturing PMIs (purchasing manager’s index) globally. See Table 2. While the indices are still declining, the rate of decline appear to be improving, indicating that better days may be ahead for global growth.

Table 2

Global Economic Growth Appears Ready to Improve

Source: Blackstone

Trade Tensions Ease

As 2020 begins, we have trade positives with the signing of a Phase 1 trade deal between China and the US., and expectations of signing the new trade deal between Mexico and Canada (USMCA) in January 2020. With China, we believe that the Phase 1 deal is a step in the right direction, but there are many questions and concerns left unanswered for a Phase 2. Phase 2 could be far more difficult and could be used as a political weapon for the election. We would anticipate that a Phase 2 deal is pushed off by Trump until after the election.

But the Global Political Environment Has Become More Stressed

But not all is calm in international politics. President Trump’s attack on Soleimani and the ensuing reaction by Iran further complicates issues in the Middle East. Even though the current situation has calmed, we would not be surprised to see a re-escalation in the future.

Elections

2020 is a Presidential election year. On the Democratic side, the race is wide open with Biden neck and neck with populist Bernie Sanders. Elizabeth Warren and Pete Buttigieg are struggling to remain relevant leaders. As we get closer to the election, if Sanders or Warren become top contenders, markets may become more volatile. It is good to keep in mind that historically if the stock market is up 7-8% at the time of the election, the incumbent has won. It is in Trump’s interest for a strong economy and stock market for 2020.

2020 Stock Market Outlook

Our thoughts on 2020 are for the Fed to remain accommodative, which leads to a pickup in the economy. Industrial and Manufacturing businesses should see at least a small pickup in activity after the Phase 1 deal is signed with China, and severely depleted inventories are rebuilt in some sectors. Energy and energy-related businesses could continue to struggle as investors focus on sustainability, capital markets find the right equilibrium, and the companies become more efficient cash flow businesses. Technology and Healthcare should continue to do well as companies innovate and plan for the future. When we look to the future many of our long-term investment ideas center around healthcare and technology.

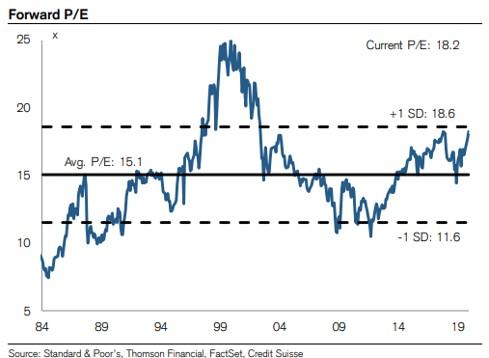

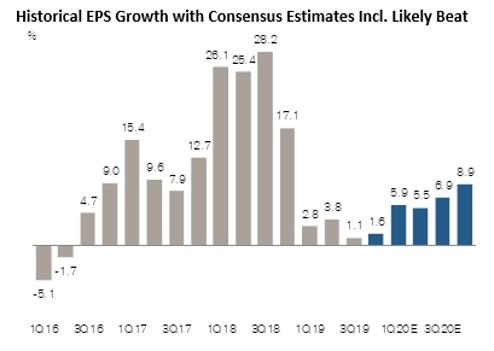

Can we repeat 2019, with the markets up 30%? Many technical strategists point to history to say that it is quite common that a strong 20-30% performance year is followed by a year up in the mid-single digits. Our current expectations are for a rally in the first part of the year followed by more volatility as we lead up to the election. 2019 was a year of multiple expansion (i.e. increased valuation) as stock prices rose without a commensurate increase in earnings. See Table 3. We think the markets in 2020 will be more interested in earnings growth. See Table 4. We continue to focus on companies with long term growth potential, strong balance sheets, good capital allocation strategies, and reasonable valuations.

Table 3

Valuations Increased in 2019 as Price-To-Earnings (P/E) Multiples Expanded

Source: Credit Suisse

Table 4

Earnings Growth Should Reaccelerate into 2020

Source: Credit Suisse

During the quarter we took an initial position in a semiconductor company, a consumer products company, and an exchange traded fund that tracks the European stock market.

We continue to feel confident about our gold position. We view this not only a hedge against volatility and a weak dollar, but also a safe haven against global political uncertainties, and the potential resurgence of inflation as world central banks vow to do whatever it takes to bring inflation back. Additionally, the issues with Iran after the attack on Soleimani will remain and we are convinced that further retaliation will come. Iran does not give up and will not stand down.

Mutual Fund Portfolios

Our mutual fund portfolios participated in the strong market performance of 2019. Similar to the past several years, the US markets outperformed international markets. The S&P 500 was up 31% in 2019, while the MSCI all world ex. US index was up 23%. Fixed income funds benefited from the reduction in interest rates, with the Barclays Aggregate Bond index up 8.7%, the best performance since 2011. During the fourth quarter of 2019, we made no changes to our mutual fund portfolios.

The Yield Curve is no Longer Inverted

During the past quarter, the bond markets have returned closer to normal. First, with the reduction in fed funds rates and additional liquidity to support the Repo market, the US yield curve has normalized. It is no longer inverted. While this is a welcome development, it doesn’t completely remove recession concerns. Second, the amount of negative yielding debt, which peaked at 30% of global debt, is now back down to 20%, a level similar to the past 3 years. We are finding opportunities in corporate bonds and municipal bonds, where spreads over Treasuries have returned to normal levels.

As always, we welcome the opportunity to discuss your portfolio and our current thinking with you at any time. While we have only spoken generically about asset allocation in this letter, we believe that it is a very individual decision. We do our best work for you when we are up-to-date on changes that may be occurring in your lives. We enjoy speaking with you and sharing ideas on a consistent basis; if your situation changes at any time between our regular discussions, please reach out to us and let us know.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

Sincerely,

|

John A. Zaro III CFA®, CIC

|

Laura K. Drynan CFA®,CFP®,CIC

|

Important Disclosure:

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market InsightsFall 2019 Summer 2019 Spring 2019 Winter 2018 |

For more information, please contact us:

777 Post Road

Darien, CT 06820

203.280.1170 | info@bourgeoncapital.com