BOURGEON CAPITAL MARKET INSIGHTS

Clients come to us because we talk with them honestly. They stay with us because of trust. - John A. Zaro

We have a process and style. Our investment process begins by identifying secular growth themes in markets that we believe offer unique opportunities for growth and/or preservation of assets. We invest with a style focused on growth-at-a-reasonable-price (GARP), while also considering economic, geopolitical, and concentration risks. We do not try to own the “shiniest penny”, but we would obviously be naïve to ignore when our performance doesn’t quite meet the level of some of our benchmarks. Over the years we have seen many market conditions – bull markets and bear markets, bubbles and crashes, recessions and expansions, and diverse political and tax-code environments. To each of these, we’ve responded nimbly to conditions while remaining true to our investment philosophy. Our process has allowed us to perform well through all types of economic cycles providing you with strong and above average risk-adjusted returns over the long term. Our success comes from being honest with ourselves and our clients and by being mindful of both reward and risk.

Year-to-date through June 30, 2024, the S&P 500 Index was up 15%, driven by significant price strength from the “Magnificent 7” technology stocks. While up nicely double digits, your stock portfolios didn’t quite match the S&P 500 rate of return, primarily because we chose to be underinvested in the Magnificent 7. Bond portfolios continued to modestly beat benchmarks. We were early investors in Artificial Intelligence (AI) and other tech growth areas, but our investment process led us to become more prudent and cautious during the most recent AI valuation mania. By the end of the second quarter of 2024, the valuation spread between the average S&P 500 stock and the top 10 stocks by market capitalization was near an all-time record. With growth expectations at extremes for a handful of stocks, we wondered what would happen if reality became slightly less than spectacular akin to what we experienced with Cisco in the late 1990s. Our investment process led us to change our view of the forward risk/reward environment, and over the past 9 months or so, we have sold or trimmed some of our highest-flying stocks, reinvesting in stocks that we believed had better future returns. Time will tell if this was the right decision.

Concentration Risk

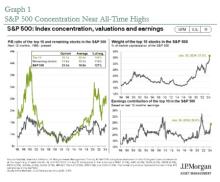

At Bourgeon, we consider downside risk alongside upside potential. One of the risks that has always concerned us is concentration risk - all your eggs in one basket. When we look at the S&P 500 today, an index that is supposed to be diversified amongst 500 companies, the top 10 companies represent about 37% of total market capitalization. Since 1996, the next highest level was close to 28%, at the time of the dot com bubble. Graph 1 from JPMorgan Asset Management provides a good visual of the current high concentration levels.

As the increased concentration occurred, it is not surprising that the rate of return of the top stocks has been significantly higher than the rest of the market. We see this most acutely in the performance of the Magnificent 7 stocks (Apple, Amazon, Google, Meta Platforms, Microsoft, Nvidia, and Tesla). Graph 2 shows the performance of the Magnificent 7 relative to the rest of the stocks in the S&P 500. YTD through June, the Magnificent 7 were up 33%, while the remaining 493 stocks were up 5%. The S&P 500, which owns both groups, was up 15%. Our stock portfolios were up double digits, but didn’t match the S&P 500 performance.

Diversification in AI to Offset the Concentration Risk

Throughout our history with the markets, we have seen how when everyone piles onto one side of the boat, at some point they rush to the other. We believe we are currently seeing this with the AI movement. Any company with AI “pixie dust” is being purchased with modest scrutiny given to fundamentals, valuation, and future competition. At some point, investors may decide to move to the other side of the boat.

The current AI mania surrounding Nvidia (NVDA) reminds us of Cisco (CSCO) in the 1990s. Similar to the internet boom, we believe that Artificial Intelligence will change our lives dramatically, and in ways we can’t imagine. It will also take time to unfold, and it is likely that competitors will come. Cisco didn’t initially have competitors, but they eventually came, and the stock came tumbling down. The problem is that one doesn’t know exactly when that might occur. History never repeats, but it often rhymes.

We think that time is on our side for now as we invest in AI. Very few companies know where they will truly make money, even though they are all investing heavily in the area. We suspect that at some point spending will at least pause as everyone tries to measure the outcomes to see where they are better or worse than expected. We are watching prudently.

Because the return on invested capital has yet to be proven, we felt it prudent to take our winnings in Nvidia and spread it across different AI companies and sectors. When our investment process led us to believe that the risk/reward dynamic had changed, we sold our position and moved on to other stocks where we believed the future risk/reward dynamic for AI could be better. Our confidence in the AI theme is reflected in many of our holdings including semiconductor, major diversified technology companies, electrification of the energy grid to support higher electricity needs, and technology consulting services.

In addition to investing in the AI theme with a basket of stocks, we are investing in several other secular growth themes: all energy (clean and dirty), biotechnology, life sciences, cancer drugs, e-commerce, infrastructure, and defense, to name a few. With the Federal Reserve anticipated to lower interest rates in the second half 2024, we think the opportunity exists for stock market returns to broaden out to some of the ‘forgotten sectors’ (i.e. the other 493).

So Many Other Risks

As we have often stated, it is our job to always prudently assess the risks, as well as the potential rewards, while investing on your behalf. Currently, there are several significant risks we are monitoring, and we believe this contrasts sharply with stock market valuation multiples being at historically high levels:

- Uncertainty surrounding the outcome of the presidential race in the US

- Ukraine/Russia war

- Israel/Hamas war

- US/China relationship

- China/Taiwan relationship

- US deficit

- Weaponization of the US dollar

Investing in US Treasuries and Cash is a Way to Lower the Geopolitical Risks

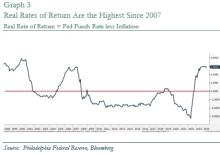

For the first time in almost 20 years there is a real rate of return on cash. The current effective Federal Funds interest rate is 5.3%. The forward expectation of inflation is 2.5%. When one takes the current earnings on cash less inflation expectations, we get a real rate of return on cash and US Treasuries of 2.9%. See graph 3 below.

If one is concerned about the current geopolitical environment, cash and US Treasuries do provide a positive real rate of return.

Diversification in AI to Offset the Concentration Risk

Throughout our history with the markets, we have seen how when everyone piles onto one side of the boat, at some point they rush to the other. We believe we are currently seeing this with the AI movement. Any company with AI “pixie dust” is being purchased with modest scrutiny given to fundamentals, valuation, and future competition. At some point, investors may decide to move to the other side of the boat.

Extending Duration to Combat Interest Rates Risk

We believe the Federal Reserve will lower the federal funds rate in the second half of 2024 with more than one rate cut. Because of this belief we continue to extend duration on bond portfolios by buying bonds out several years to do our best to lock in a 5% rate of return.

Second Quarter 2024 Portfolio Changes

During the second quarter of 2024 we made several stock portfolio changes:

We made changes to our AI portfolio: We added to an existing AI thematic holding on recent stock price weakness. We believe this company will benefit from helping others discover how best to implement and benefit from artificial intelligence in their businesses. We trimmed two semiconductor companies on strength.

We took advantage of great companies on sale: An existing tech blue chip holding had been relatively weak in 2024, and we had several clients who were not fully invested. We used the relative weakness in Q2 to bring them up to core holding levels.

Given our belief that yields might decline in later quarters of 2024 we added two sectors that could benefit from declining yields. The first sector was real estate investment trusts (REITs). When yields decline, it becomes “cheaper” to buy real estate with debt. We purchased a REIT that focuses on healthcare real estate for those who were underinvested. The second sector was railroads. When interest rates decline it is usually seen as pro-growth. Thus, we felt an investment in a particular railroad company would benefit. Valuations for this company are currently slightly below historical levels.

We saw an opportunity to trim. During Q2 we sold half of our holdings in a company we originally purchased in our portfolio in May 2020.

Model Portfolio Strategies

Our model portfolio strategies are each up significantly through the first half of the year, but not to the level of S&P 500 returns. As a reminder, there are four model strategies ranging from Aggressive to Conservative where equity exposure weightings scale from about 97% to closer to 40%, respectively. This is to say, these strategies express certain asset allocation wishes and are not meant to benchmark to the S&P 500 experience. We do choose an S&P 500 index fund as the single biggest equity position across all the strategies, but these portfolios are intentionally constructed to be more broadly diversified. As such, this large, core S&P 500 position sits alongside smaller exposure to International, Emerging, Small Cap, and Mid Cap allocations, as well as some other thematic plays.

We are pleased with the construction and performance of these portfolios so far year-to-date. We have chosen to rebalance programmatically where we have filled up the fixed income weightings when they have drifted lower, and we have trimmed some large cap exposure when performance has taken it too far above target. We are ok with letting winning positions run a bit above our model targets, but at certain points it makes sense to monetize these moves and bring them closer to their intended weightings. Our thematic investment in playing the build out and needs of our electric grid and infrastructure is such an example. After initiating the position in September of 2023, it has performed exceptionally well and grown well above our target weight, giving us the opportunity this past quarter to take half off the table but still maintain a meaningful position.

Locking In Duration

We continue to do our best to lock in 5% rates of return out several years. We are hopeful that the Federal Reserve can continue the “thread the needle”, providing the US economy with a soft landing, but there is no guarantee. The presidential race may change congressional spending, and this could impact the shape of the yield curve. We will remain vigilant and adjust our strategy when we believe appropriate.

Special thanks to our summer interns, Ethan Pakola and Dylan Smith, for their contribution to this Market Insights.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.