BOURGEON CAPITAL MARKET INSIGHTS

"It's OK Until It's Not" - Ed Hyman, Economist for Evercore ISI

Broadly speaking and across most developed markets, economies and equities continued to outperform expectations in the second quarter. The US was propelled by a narrow leadership group of large cap tech stocks, as well as a general wave of enthusiasm for Artificial Intelligence investments. The Fed found enough cover with improving inflation conditions to enact their first “pause” in June, though bond yields continued to rise throughout the quarter and the Fed continues to push a hawkish narrative for the second half of the year. The most anticipated recession in a long time continues to prove elusive. In fact, much has been written on how the most consensus thoughts and trades of 2023 have all, thus far, proven to be wrong: lower rates, stronger US dollar, emerging market outperformance, and a US economic recession.

The outlook for the second half of 2023 continues to be very unclear and risks remain elevated to both economic growth and financial markets. Wall Street is never without a laundry list of concerns with which to grapple, but the set up for this second half seems uniquely fraught. Having ignored most concerns year-to-date, equity markets have achieved impressive returns and find themselves at arguably lofty valuations. While the wealth effect of a higher stock market is real, things can turn on a dime when we are still grappling with sticky inflation, significantly higher borrowing costs, persistent hawkish monetary policy determined to slow the economy and loosen the labor markets, not to mention the war in Ukraine. There are, however, bullish secular growth narratives that include robust spending on the clean energy transition supported by fiscal policy, and a wave of spending on Artificial Intelligence initiatives – all of which will take time to have an impact on companies and the economy. As stewards of your money, and with a focus on capital preservation, we are particularly mindful of the warning signals from an inverted yield curve. Our stock portfolios continue to have a high cash position (15%) invested in US Treasuries or money market accounts earning 5%. Our bond portfolios are fully invested, taking advantage of high real rates. This conservative approach led to outperformance relative to our benchmarks in 2022, but underperformance so far in 2023. We understand that monetary policy works with a lag and as Ed Hyman, economist for Evercore ISI, is fond of saying “It’s OK Until It’s Not.”

Inflation is Falling, and the Economy Continues to Weaken,

but a Recession Remains Elusive So Far

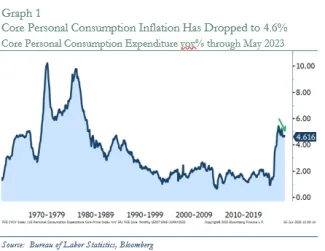

The Federal Reserve has been fighting inflation for the past 18 months, taking the federal funds rate from 0.00% to 5.25%. Their work is beginning to have an impact. Inflation has been cooling for about a year, with the CPI dropping from 9% in June 2022 to 3% as of June 2023. Even core inflation measures, like the core US Personal Consumption Expenditure (favorite of the Federal Reserve), are slowing. See Graph 1. Perhaps more importantly, the year-over-year growth in average hourly earnings is cooling, declining from an almost 6% rate in 2022 to about 4% as of June 2023. The Fed’s target for inflation is 2%, so inflation rate has to come down even further to reach their target, and this last push could arguably be more challenging to achieve than the initial decline.

Economic growth has begun to cool as well, and the Federal Reserve decided to “pause” their rapid tightening cycle in June. US GDP growth rates have fallen from over 10% in the middle of 2021 down to 1% in the fourth quarter of 2022 before flattening out YTD. Historically, tightening cycles have eventually pushed economies into recession, so the decision to pause was met with appreciation by many economists (and us). However, we do continue to believe that the Federal Reserve will keep interest rates higher for longer. Mary Daly, the San Francisco Fed President recently said, “Right now all my attention is on if we need to hike more and how much more will we need to hike [to get inflation down to 2%].”

Surprisingly, GDP growth and employment have stabilized in 2023 rather than continuing to fall, and the recession that many assumed was imminent has remained elusive. However, given the lags with which monetary policy affects economic activity and inflation, the tightening of financing standards post the bank crisis in Q1, and the significant decline in the money supply, we continue to believe an economic slowdown is coming in the next 6 months or so.

Hard Landing, Soft Landing, No Landing, Rolling Recessions, or Gray Rhinos?

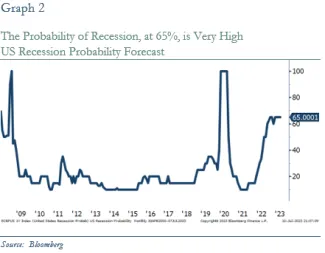

For the past year, a recession has been around the corner. At certain points consensus has rallied around hard landing, soft landing, rolling recessions, and most recently no landing. Part of our job as risk managers for our clients is to assess the economic landscape in front of us and decide how to adjust portfolios. On the one hand, according to a group of 100 or so economists, the probability of recession is 65%, and has been so for several months. See Graph 2. On the other hand, since recession hasn’t happened yet, and some sectors of the economy remain stronger than expected, Goldman Sachs and others suggest there might not even be a recession. The idea of “rolling recessions” where certain sectors of the economy enter and then emerge from recession at different times has also been gaining acceptance.

With so many viewpoints, what are we to do? We are reminded about “Gray Rhinos”. According to Michele Wucker, author of the book Gray Rhino, “A “gray rhino” is a highly probable, high impact yet all too often neglected threat: kin to both the elephant in the room and the improbable and unforeseeable black swan. Gray rhinos are not random surprises but occur after a series of warnings and visible evidence.” Admittedly economic growth has been stronger than our expectations so far this year, and our internal debate about the outlook has increased. But the US economy is currently experiencing the strongest indicator of economic recession, an inverted yield curve. This indicator “has predicted every recession since 1969 with no false positives,” and is a strong driver in our worries of recession (Darian Woods). Ultimately, as stewards of your assets, our default is to give the downside scenarios more weight and maintain more conservative positioning until we have increased confidence in the future outlook.

Amidst the Economic Uncertainty There Are Powerful Economic Themes Building

In the face of economic uncertainty, there are a few areas of secular growth that deserve some recognition, such as artificial intelligence and clean energy/infrastructure spending. Our optimism around these growth areas over the long term remains high, but we recognize that the benefit may take time to achieve. Prosperity takes time.

Artificial Intelligence

Major technology companies have been talking about the potential to benefit from artificial intelligence (AI) for many years. In the winter of 2022, generative AI was introduced through ChatGPT. In the spring of 2023, investor excitement exploded. Ever since, the news has been dominated by stories on how AI has the potential to transform the world we live in. A McKinsey report says that “Generative AI’s impact on productivity could add trillions of dollars in value to the global economy.” The Brookings Institute believes that AI will increase overall productivity 2-3x what was produced in the 1990s from the founding of the internet. Several companies in your portfolio benefit from an initial rollout on AI.

Over time we believe that generative AI should provide a benefit to companies in every sector of the economy. For example, Morgan Stanley estimates that over the next decade, the use of AI in early-stage drug development could translate into an additional 50 novel therapies worth more than $50 billion in sales. But there are also risks to consider. Sam Altman, CEO of OpenAI, has said “We are a little bit scared” about AI and its potential negative consequences. Disinformation, bias, privacy, intellectual property, and environmental impact are challenges that must be addressed so that the risks of AI can be mitigated. Regulation remains a potential setback and will be important to monitor.

Inflation Reduction Act, Infrastructure Investment and Jobs Act, and CHIPS and Science Act

In the face of an economic slowdown, it is often helpful to focus on areas of the economy that benefit from government support that will happen irrespective of underlying economic growth. At the moment there are three such programs: the Inflation Reduction Act, Infrastructure Investment and Jobs Act, and CHIPS and Science Act. Together, these three programs will provide significant funding in areas of clean energy, electric vehicles, roads, bridges, water infrastructure, chip manufacturing, and increasing domestic high-tech manufacturing. There are several companies in your portfolios that benefit from these programs.

The Inflation Reduction Act, implemented in 2022, commits $369 billion to investing in energy and climate reform (solar panels, wind, electric vehicle tax incentives) to help reach a goal of lowering greenhouse gas emissions by up to 40% from 2005 levels by 2030. The Infrastructure Investment and Jobs Act of 2021 also invests in electric vehicles and clean energy, including charging stations, nuclear, and green hydrogen. The CHIPS and Science Act has helped create 642,000 manufacturing jobs since 2021. CHIPS has the goal to strengthen American manufacturing, supply chains, and national security and invest in research and development, science and technology and the workforce of the future to keep the US the leader in the industries of tomorrow, including nanotechnology, clean energy, quantum computing, and artificial intelligence.

Second Quarter AI Frenzy and Narrow Breadth

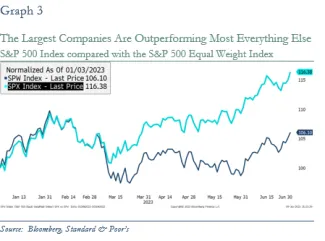

During the second quarter of 2023, the S&P 500 was up almost 9% on a total return basis, bringing the YTD return to 17%. The strong returns were dominated by a frenzy of buying in AI focused names, such as Nvidia, Microsoft, Meta, Alphabet, Apple, and Amazon. The concentration among these 6 names created a historical narrowness to the overall stock market, which, in our opinion, is fragile at best.

Here are some comments from Toni Sacconaghi, technology strategist for AB Bernstein, that make us pause: “The most defining characteristic of this year’s tech rally has been its narrowness. The six largest tech companies (AAPL, MSFT, GOOG, AMZN, NVDA and META) have accounted for 100% of tech’s relative return. Tech is now trading at a 54% premium to the market, its highest level in 45 years other than the dot com bubble, and well above its historical average premium of 26%.”

As part of our portfolio management process, we take concentration risk seriously. Once a stock reaches 4% of the Bourgeon portfolio, we are even more acutely monitoring for downside risk – as this could have an outsized impact on our portfolios. We almost always trim stock holdings once they are 5% of the portfolio. Thus, we find it concerning that Apple and Microsoft combined represent 15% of the S&P 500.

One way to see the impact of concentration on the S&P 500 is to look at the “equal weight” index. This index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated a fixed weight – or 0.2% of the index total. The total return of the S&P 500 Equal Weight Index (SPW) was only 6% for the year, a significant difference vs. the S&P 500 index (SPX) at 17%.

We have always been fans of “reversion to the mean.” Thus, when the breadth of the market is super narrow, either it broadens out, or the top beneficiaries revert back down. We continue to believe that a recession within the next 6 months is likely. Combining it all together with a recent increase in interest rates, and our view that rates are likely to stay higher for longer, we are cautious on the stock market in the near-term and are happy to have 15% of your stock market allocation in money market funds or US Treasuries earning about 5%.

Our actions in the stock portfolio this quarter included:

Given our view that a recession remains likely, we sold half or our holdings in two industrial stocks.

The support for clean energy investments will be heavily reliant upon several materials, including copper. We decided to add to an existing position exposed to this trend.

With AI stocks up significantly, we opted to again trim a core position that had appreciated meaningfully throughout the quarter. Sell High.

Buy Low. We took an initial position in relatively inexpensive healthcare name where we see opportunity for price-to-earnings multiple expansion as they reduce debt.

We did some tax loss selling at on two positions. We will be looking to buy back the shares at some point.

Model Portfolio Strategies

Our model portfolio strategies all achieved significant positive performance for the second quarter. All strategies have slightly overweight exposure to the S&P 500, and as such participated fully in the outsized gains experienced in the large cap tech stocks within the index. As broadly diversified portfolios, the strategies maintain exposure to many of the equity indices that worked so well throughout the quarter: mid cap stocks, small cap stocks, developed international equities including Japan, and even Emerging Market posted a modest gain for the quarter. We sold our thematic exposure to Cybersecurity in the quarter, taking advantage of a significant move higher. Our thematic Biotech position outperformed even the high-flying S&P 500 for the quarter. We added exposure to the Oil Service sector in June. It was a challenging environment for fixed income investments as yields rose throughout the quarter. Many of our fixed income funds were modestly down for the period but in line with their benchmarks. We maintain high levels of yield generating cash due to the uncertain environment, and we feel good about the current positioning and outlook for the strategies looking forward.

There is Finally Income in Fixed Income

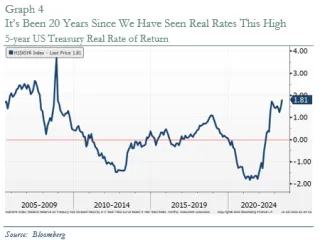

It has been a long time since one has made a real return on cash and fixed income. It feels good. One can earn 5% on short term and intermediate term investment grade bond holdings. Inflation, as measured by the CPI, is running at 3% (and the Fed has a target of 2%). That’s a real return of about 180 basis points (1.8%) for a 5-year bond. In fact, federal funds rates and real rates are now at levels last seen prior to the Great Financial Crisis.

Given our concern of a recession in the upcoming 6 months or so, we continue to fully invest bond portfolios, extending duration to lock in the higher rates, and moving up in quality to protect against the potential for a hard landing.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money. Please call if you would like us to walk you through our opinions in more detail.

Special thanks to our summer interns, Liam Pakola and Dean Kaduboski, for their contribution to this Market Insights.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.