BOURGEON CAPITAL MARKET INSIGHTS

“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.” ~ Jimmy Dean

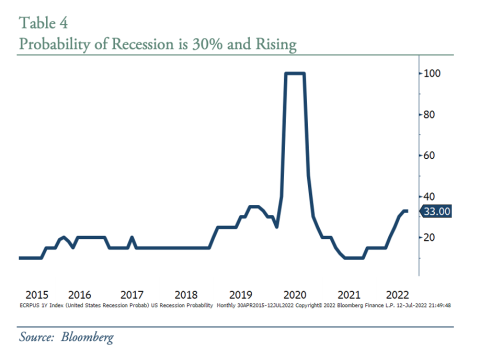

Hurricane. JPMorgan CEO Jamie Dimon went on record in June to warn that an economic hurricane may be coming. Indeed, storm clouds have been gathering throughout the first half of 2022, generating historic headlines of a negative nature. It was the worst first half for the stock market since 1970 and the worst year for US Treasuries since the early 1970s. We prepared for the rough waters and partially protected your accounts by holding large amounts of cash. Our stock and bond holdings outperformed their respective indices, but we could not avoid the storm completely and portfolios are down year-to-date. As we look forward, we ask ourselves: Has the hurricane passed, is it still barreling towards us, or might we be in the eye of the storm? Are the skies clear enough to confidently deploy capital? The probability of a recession now stands at 30% and continues to rise. However, recognizing that wall street often recovers before main street, is it time to start putting that cash to work? On the bond portfolios we believe the answer is yes, and in Q2 we deployed the extra cash and are close to being fully invested. For the stock portfolios, we continued to modify our underlying investments, but cash holdings remain high. We believe this earnings season may provide important insights on how to proceed with excess cash. The current investing environment is tumultuous, and we encourage you to call us to share concerns, thoughts, and ideas.

Inflation Hits 8.6% in May, The Fastest Rate Since 1981

After decades of inflation at or below the Federal Reserve target of 2%, the inflation rate rose rapidly in 2022 to 8.6% as of May 2022 (recently released June data ran hotter). This was this fastest rate of inflation since 1981. See Table 1. Inflation was exacerbated by supply shortages during COVID, significant fiscal and monetary stimulus, and impact from the Ukraine War. While inflation was broad based, increased prices for food and energy are the most destabilizing factor. To combat the significant rise in prices, the Federal Reserve announced large increases in benchmark interest rates.

Interest Rates go Up and Valuations Go Down

Interest rates going up and valuations going down has been our mantra for the past year as we were expecting the Fed to raise rates. But we didn’t anticipate that rates would go up as quickly as they did.

Since the beginning of 2022, interest rates on the 10-year US Treasury have risen about 150 basis points, and interest rates on the 1-year US Treasury have risen 260 basis points. Compared with the start of the year, these moves were well above market expectations in speed and size.

As interest rates rise, the value of bond portfolios goes down. The performance of the Bloomberg US Aggregate Bond Index was down 10% in the first half of 2022 and municipal bond portfolios performed similarly. These are among the worst performances in history.

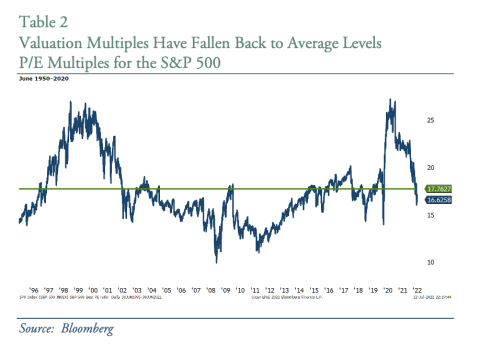

For stock portfolios, an increase in interest rates leads to reduction in valuations. A common valuation tool is “price-to-earnings multiple” or P/E multiple. Table 2 shows the significant reduction in valuation multiples for the S&P 500 over the past year. Stocks have quickly mean reverted from expensive (above the green average line) to slightly below average.

Because earnings for most companies have remained relatively strong (so far), a reduction in the multiple, while keeping earnings, or “E”, constant, led to a significant decline in price. The S&P 500 was down 20% during the first half of 2022, and the Nasdaq was down 30%.

Bonds Did Not Protect Portfolios

One typically expects a bond portfolio to help protect asset values, especially when stocks go down. One of the most frustrating parts of the first half 2022 performance is that both stocks and bonds went down together at the same time. This is only the second time in 40 years they declined in tandem.

Do We Really Have to Fight Inflation?

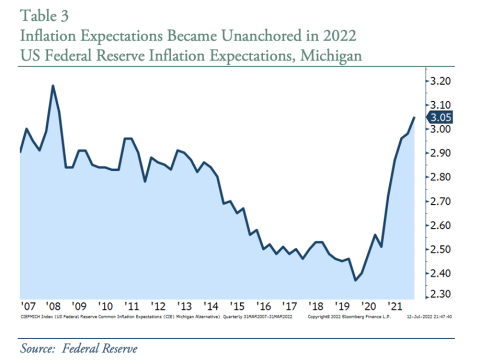

Why is it so important for the Federal Reserve to fight inflation if there is the potential to hurt the markets? History has shown that periods of high inflation create significant economic instability. Thus, it is important for investors to have confidence in the ability of the Federal Reserve to keep inflation within an acceptable range. While the Fed will accept periods of high inflation, what is unacceptable is when inflation expectations become unanchored, which is what happened in the first half of 2022. Future expectations of inflation started to rise, and the Fed, realizing they were meaningful behind the curve, pivoted to a more forceful stance against inflation by raising rates further than many had originally anticipated.

Are We Going to Have a Recession?

One thing we know is that when the Federal Reserve raises rates, the chance of recession rises. Tighter monetary policy intends to curtail economic growth and slow the demand for goods, which should ease pressure on prices. The current scenario fits this mold, with the Fed raising rates to combat high inflation. While the Federal Reserve would love to be able to engineer a “soft landing”, it is very difficult to achieve. The probability that the US is going to have a recession has increased to 30% (and rising) over the past 6 months. See Table 4.

Economic growth, or GDP, for Q1 was negative and according to GDPNow by the Atlanta Federal Reserve, growth may be negative again in Q2. There is a ‘rule of thumb’ that states when there are two consecutive quarters of negative GDP, we are in a recession. For this cycle, however, there are several nuances surrounding supply chains and inventories that cause us to wonder if that is the right metric to use. With unemployment at 3.6% and strong corporate and consumer balance sheets, we continue to believe that a typical financial recession may be avoided. This would be akin to the non-financial recessions of 1990 and 2001.

Peak Inflation Already?

As economic growth slows, inflation should cool. May and June consumer price inflation may be running at levels last seen in the 1970s, but there may be reason to believe we are nearing “peak inflation”. While inflation could stay above normal for some time, the rate of inflation likely moves closer to the 2-3% goal over the upcoming few years from the current ~9% levels.

There are some areas of the economy where we have recently seen prices weakening as growth fears are rising. Gasoline futures are down almost 20%, copper prices are down over 20%, house prices are weakening as mortgage rates hit 6%, rental prices are starting to cool, and transportation and shipping fees are falling.

Does this mean that the Fed can take its foot off the brakes and be less hawkish? At some point perhaps, but we don’t think this will happen quite yet. We believe it is still necessary for the Federal Reserve to remain tough and focused on fighting inflation, but at some point, perhaps in Q4, it is possible that the Fed becomes less hawkish. That could easily lead to a rally in the markets.

Be Greedy When Others Are Fearful?

If inflation is peaking, is the hurricane over? Is it time to “be greedy when others are fearful” as Warren Buffet has taught us?

We believe the answer for the bond market is definitely “Yes.” Prior to Fed Chair Powell vowing to “unconditionally” fight inflation, the bond market had already read the tea leaves, swiftly bringing rates much higher. We worked hard in Q2 to invest the excess cash in bond portfolios, to take advantage of the higher interest rates. At 4-5% for short term investment grade bonds, these are levels we haven’t seen in years.

For stock portfolios, the answer to us is less clear. We know that stock prices have dropped, leading to a sharp reduction in PE multiples. But we wonder about the “E” or earnings part of the PE ratio. If the Federal Reserve wants to combat inflation by lowering economic growth, then it would make sense that corporate earnings growth expectations should decline. If corporate earnings expectations decline, and PE ratios stay the same, then stock prices have further to fall.

Thus, we believe it is best to be relatively cautious and flexible as we move through the July/August 2022 earnings season. We have much to hear and learn from company conference calls.

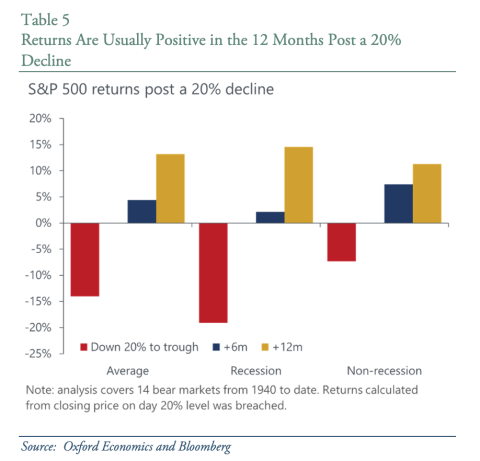

We recognize that timing the exact bottom of any investment cycle is difficult. It is instructive for us to remember that buying after a significant 6-month drawdown has often been profitable in the year ahead. For example, according to Oxford Economics, after a 20% decline in the S&P 500, the market may have further to fall in the near-term, but the stock market is usually positive 6-12 months out. There were only two periods where equities saw meaningful negative returns over the following 12 months – the global financial crisis in 2008-09 and the early 1970s. See Table 5.

Second Quarter Focus Was on Rebuilding the Bond Portfolio and Researching Secular Growth Ideas

Throughout the second quarter, a primary focus was investing excess cash to capture higher interest rates for those with bond portfolios. The equity portfolios still have a high cash position, but we continue to modify the underlying portfolios with a barbell strategy of defense and offense. We are astonished with the speed of this pandemic economic cycle and believe it is important to stay nimble and flexible in this environment.

We continue to research secular growth areas for investment, so that we can act quickly when we believe the risk/reward of an investment opportunity becomes favorable. As we look at the changes over the past 18 months, from Covid to China to Ukraine, we are even more confident of several long-term investment themes. We have previously discussed several of these with you in prior letters, such as alternative energy and climate change. But other themes are coming to the forefront because of recent worldwide economic, political, and competitive changes. Some examples include:

• Food security and availability concerns are rising given logistics issues and droughts.

• Nations are increasing their focus on defense, including both national security and cyber security.

• Deglobalization is accelerating leading to reform of supply chains.

• Commodity shortages may continue, including metals for various alternative energy sources (i.e. batteries, wind mills, and solar).

• The seismic opportunities surrounding energy transition should continue. Significant capital will likely be spent on both clean and carbon-based energy (to aid in the clean energy transition). Supporting energy infrastructure has reemerged as a national security focus and clearly shows that the last 5-7 years of severe underinvestment in carbon-based energy will be quite costly. This should help support many carbon-based sectors, including liquified natural gas, pipelines, and oil service companies.

Second Quarter Stock Portfolio Changes

Defense: We look at defensive holdings with a two-pronged approach – defensive sectors that perform relatively well during an economic slowdown (healthcare, utilities, and consumer staples) and defense companies that will help support our national security and protect us from bad actors. It is important to note that healthcare is now our second largest investment sector, and your portfolios are overweight healthcare relative to the S&P.

Offense: With several stocks down significantly in the first half, we saw opportunity for long term holders to begin increasing our investment in beaten down companies. We recognize that it is very difficult to pick the bottom.

Tax Loss Harvesting: We never like losses. But when they occur we do review to see if it makes sense to reduce your tax burden. We have a few tax loss harvesting strategies underway at the moment.

Opportunities to Take Profit: Even in a bear market environment there are stocks that go up. A few positions benefited from momentary surges in Q2 that allowed us to make advantageous sales. Finally, gold had held up well this year, but with our peak inflation mentality diminishing some of its beneficial characteristics, we felt that we should sell gold and use the proceeds to purchase other investments with a more favorable risk/reward outlook.

Don’t let that Cash Go to Waste: Rather than let our excess cash sit idle, we have invested a portion in US Treasuries yielding 1-2%.

Mutual Fund Portfolios

Like the equity portfolios, our mutual fund strategies have generally held an above average cash position from which they benefitted in the 2nd quarter. In a nod to the narrative of peak inflation and having trimmed our position in TIPS earlier in the year, we continued to sell gold down and exited the quarter with no exposure. Some proceeds were redeployed to true up our Emerging Markets exposure to reflect a potentially favorable risk/reward setup in the beaten down Chinese markets. We remain on the lookout for opportunities to further deploy the excess cash holdings.

Bond Portfolios Rebuilt

While we were concerned that market participants were being too complacent about inflation last year, we never expected interest rates to rise as quickly as they did. We certainly didn’t expect to see a 10% selloff in the broader bond market in such a short time.

Investing in bond portfolios has been incredibly difficult the past few years. Throughout 2021, with the real return on bonds negative, we did not reinvest many of the bonds that matured, opting instead to keep much of those funds in cash. Where appropriate, we added some alternative investments with a focus on income. Finally, we have kept the duration on our bond portfolios very short. Thus, while your bond portfolios did decline YTD, our high cash and alternative investments helped lessen the impact compared with the broader bond market index.

During Q2 we moved quickly to invest excess cash in your bond portfolios, taking advantage of yield-to-maturity levels for short term investment grade bonds in the 3-5% range. This is 3-4x higher than the rates last year. In addition, for those with a long-term gain in their alternative REIT investments we liquidated half, using the cash to invest in traditional corporate or municipal bonds.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.