BOURGEON CAPITAL MARKET INSIGHTS

“SING like no one’s listening, LOVE like you’ve never been hurt, DANCE like nobody’s watching, and LIVE like it’s heaven on earth.”

Welcome to reopening!

With the COVID-19 vaccination rate in the United States at over 50%, mask mandates relaxed, and companies calling for employees to head back to the office, people are starting to live their lives again. Road traffic is up significantly. Airports are full of people reconnecting with their families or enjoying an opportunity to get away. Unemployment is dropping. Retail spending has spiked to above pre-COVID-19 levels. And yet, bank accounts are still full of cash, as only a portion of stimulus money has been spent. Corporate earnings should be very strong. Overall, our economy is trying to return to normal, with animal spirits on the one hand, and continued COVID-19 uncertainty (i.e., Delta variant) on the other. Here at Bourgeon, we are focusing on what comes next and believe that it is possible that the global markets may see a peak in economic growth rates over the upcoming 6-12 months, to be followed by a slower, but more self-sustaining expansion. In the near-term, peak growth rates combined with Fed tightening could lead to volatility and buyable market pullbacks. To prepare for this volatility, we sold some of our stock holdings during the strong markets in the second quarter and are spending the summer patiently doing research and preparing to deploy capital.

Welcome to Reopening!

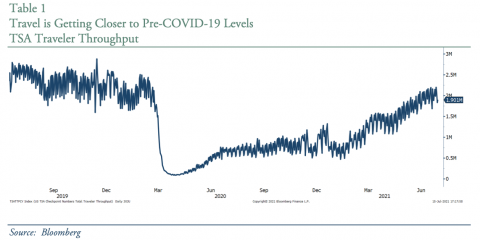

Pent-up demand for goods is now transitioning to a pent-up demand for services as the world reopens. Table 1 shows airline traffic is almost back to normal levels.

Corporate Earnings are Likely to be Explosive in 2021 Before Growth Rates Decelerate into 2022

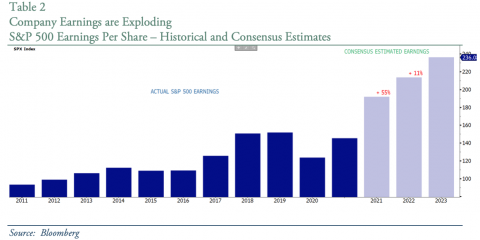

We believe that Q2 earnings season could surprise strongly to the upside. Demand for goods has exceeded expectations, while supply chains have been stressed. This has led to pricing power for many corporations that should overcome labor shortages in the near-term. According to Bloomberg, the consensus EPS estimates for the S&P 500 could be up 55% (or more!!) in 2021, followed by an 11% increase in 2022.

But it is Future Expectations That Will Be Most Important

While past earnings growth rates will be amazing, we will be looking more closely to future outlooks. What is going to happen to sales and profit going forward? How much will earnings growth rates decelerate into 2022 and 2023, and how will this compare to expectations?

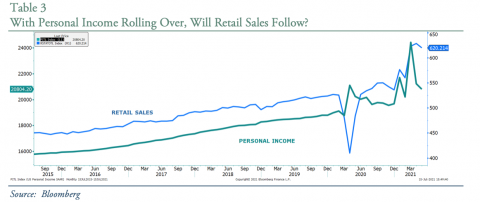

Sales could drop back down to trend line into 2022 as the sugar high from fiscal stimulus fades. One way to look at this is through retail sales and income. When personal income goes up then people spend more. Personal income got a big boost in 2020 and 2021 from fiscal and monetary stimulus. The childcare tax credit checks for 2021 are soon to hit bank accounts to provide another increase. But after that, we believe that stimulus checks stop. It would make sense that as stimulus drops off, retail sales should drop back down to trend line over time. While this could still provide a 5% annual growth rate, it would be a deceleration from 2021 levels.

But even with a slowdown in retail sales, rebuilding of inventories (which are at extremely low levels) will provide a few more quarters of strong demand for goods. Corporate profit margins will be interesting to watch. Pricing power has increased for many companies, but so have costs. How the two balance over time will vary depending upon industry.

The government is currently discussing several big infrastructure initiatives in the $1-6 trillion range. Whatever comes from the discussions should provide more long-lasting demand, but over an 8–10-year timeframe.

The Next Phase: Fundamentals and Free Cash Flow

As the historical growth rates of liquidity and fiscal spending begin to drop from their peaks, fundamentals should be more important to drive market valuations and economic growth. We anticipate slower economic growth, but a more self-sustaining environment that is less reliant on government spending and more reliant on consumer and business spending. We also anticipate that interest rates will increase to reflect risk and not ultra-dovish monetary policy.

In such an environment, we believe that a focus on fundamentals and free cash flow will be key. It will likely favor active management over passive management as investors will have to be more discerning about their investment choices. Interest rates should rise, leading to a higher cost of capital. Inflation should increase, leading to a steepening of the yield curve. This could negatively impact valuations of long dated assets (long bonds and tech companies with little or no free cash flow). Secular themes should be important in the investment process.

Some of the themes we are researching for investment include artificial intelligence, hydrogen and other alternative energies, electric vehicles, MedTech, and biotech.

We believe that the alternative energy space offers a variety of very interesting investment opportunities, such as electric vehicles, wind and solar, carbon capture, and hydrogen as fuel for transportation. Each of these opportunities has many sub-investable categories. However, at the moment, many investments in the alternative energy space are priced expensively, as most (but not all) alternative energy companies don’t make money and have very little free cash flow.

While we continue to research new opportunities in the alternative energy space, we already hold multiple companies in our portfolio that benefit from the increased use of alternative energy.

One of our portfolio companies is a leading provider of technology and equipment for the use of hydrogen as a clean energy source. We also have positions in a renewable energy company that generates power through wind, solar, natural gas, and nuclear. This investment addresses two of our investment themes: green energy, and a shift to more late-cycle and defensive holdings. Finally, we added a clean energy fund to our holdings this quarter. With mandates and funding for the development of renewable energy and alternative fuel sources from the Biden administration, this fund represents another way to participate in the upcoming green transition.

The Transition Will Take Time

The transition from the cyclical upswing to the next phase of lower, but more sustained growth is likely to take some time and will probably be bumpy. As we monitor the markets, we may use strength in Q2 to continue to shift our cyclical holdings. While the Fed has started tapering is easy monetary policy, it will likely do more. Peak growth rates + tapering have historically led to periods of increased volatility, but we will monitor these markets for opportunities to buy into some of the secular themes we discussed above.

During the Second Quarter We Continued to Trim Tech and Select Cyclicals on Strength

In the second quarter we did more selling than buying and leaving us with a strong cash position. The transition in our portfolio involved:

- Trimming select cyclical stocks

- Continuing to trim some of our big tech holdings on strength

- Rotating our Clean Energy holdings

- Shifting some of our defensive holdings

- Taking advantage of the transition from pent-up demand for goods into to pent-up demand for services

- Trimming our real estate investment holdings on strength

Stay the Course for our Mutual Fund Portfolios

We have made no changes to our mutual fund holdings year-to-date, however, we continue to benefit from the changes we made at the end of 2020. Our increased allocation to our real estate fund and inflation-protected bonds added to relative performance. Meanwhile our addition to our gold holding, and the addition of a dividend growth fund, detracted from relative performance.

With Yields So Low, Bond Investing is More Difficult

Investing in our bond portfolio has been difficult with yields so low. During Q1 yields on the long end spiked, and we invested. During Q2 yields on the 2-year spiked, and we invested. But overall, we continue to have a barbell approach to our duration as the yield curve steepens – holding higher than normal cash balances on one side and buying 5–7-year investment grade bonds on the other. In the equity side of client holdings, we are working on increasing the dividend yield of the portfolios. For those with the appropriate risk allocations, we are looking at alternative investments that provide income.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.