Bourgeon Capital Market Insights: Summer 2020

“Life is like riding a bicycle. To keep your balance, you must keep moving”

- Albert Einstein

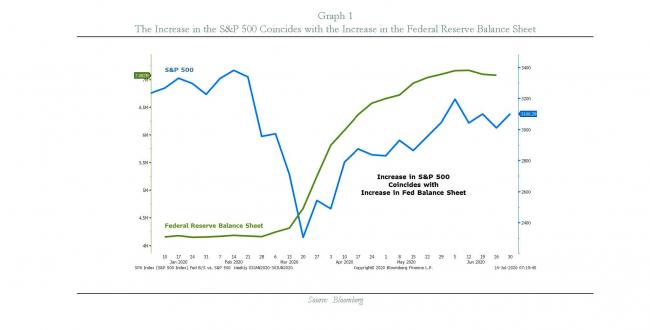

After falling 20% in the first quarter of 2020, the stock market rose 20% in the second quarter. The steepest and deepest recession brought on by the COVID pandemic was offset by unprecedented fiscal and monetary stimulus. Imagine the economy to be a bicycle, and fiscal and monetary stimulus to be training wheels. Our economy, currently unsteady on its own, is moving forward with the assistance of the large training wheels. Thus, even though economic growth is still extraordinarily weak and unemployment very high, the stock market is almost back to even for the year. One of our biggest concerns around future stock market levels is the size and subsequent removal of those training wheels. If removed too early, or underinflated, then we could stumble. If removed too late, we could see rampant inflation. We would like to see stimulus support continue at least until we develop a vaccine. In late July 2020, the government will decide on the next stimulus package. Although it is certainly needed, questions abound. Will it be $1 trillion or $2 trillion? Will extra unemployment payments continue, and will states get enough support? Will we be able to add enough air into our training wheels? We are hopeful that the government will continue its “do whatever it takes” approach to supporting the economy until it is stable enough to move forward on its own. After a strong “V” bounce upon initial reopening, the economy is stalling a bit with new COVID cases rising. We are optimistic that society’s ability to adapt to a “new normal” combined with human ingenuity on pharmaceutical treatments and vaccines will eventually lead to a resolution of this crisis. We believe it is prudent to hold high cash balances in case of unforeseen consequences from the pandemic.

Unprecedented Fiscal and Monetary Stimulus Filled the Initial Void Caused by the Pandemic Lockdown

Unprecedented Low Interest Rates Globally

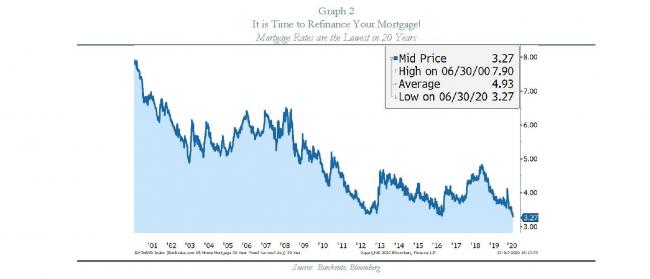

Global short rates continue to make historical record lows at 0.7% as of July 2, 2020. This is 50% of the previous 2010 low of around 1.6%. These low rates should provide one to two years of economic stimulus for the US and the world, and thus support capital spending. In the US, we are already seeing the benefits of low mortgage rates reflected in the strength of our housing market. Given that mortgage rates in the US are at historic lows, you might want to consider refinancing your mortgage.

Refinance Your Mortgage

Reopening Looks Like a ‘V’ So Far, but Moderation May be Coming

While monetary policy is helpful, it is fiscal policy that is required to move our economy forward. The Fed treats the symptoms, but Congress has the cure. So far, the government has implemented 3 policy responses, culminating with the CARES Act. This provided $2.2 trillion of stimulus, with much of it not yet spent. We expect we will need more fiscal stimulus.

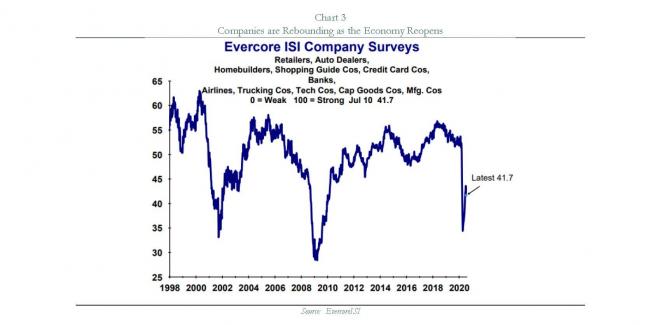

This economic stimulus has helped the economy bridge the gap from lockdown to reopen. Reopening has brought a rebound in economic growth. PMIs are rising and unemployment claims are falling. Evercore ISI surveys companies every week on their current state of business and has historically been very accurate in predicting economic growth. Chart 3 illustrates the recent decline, and subsequent rebound of those surveys. With COVID cases on the rise in the last few weeks, we are seeing a slight pullback.

So far, the recovery looks like a ‘V’, but we do not expect it will stay this way. We continue to believe that after this initial bounce, growth rates may moderate going forward. Thus, the recovery may ultimately look more like a “Swoosh”. JPMorgan describes their outlook as “boom now, malaise later”. That makes sense to us.

Will Our Training Wheels Need More Air?

We are not out of the woods yet and may need more air in our training wheels:

- A second wave of COVID cases may slow economic growth further as we enforce social distancing measures once again. On the plus side, we do believe that we are better equipped to handle COVID infections today, compared with 6 months ago, due to better testing and treatments. We look forward to a vaccine by early 2021.

- Unemployment is still high at 11%. Many retail workers have started to go back to work. However, with the initial dust settled, we are now seeing more permanent layoffs from state and local governments and corporations.

- The extra unemployment insurance expires at the end of July, and negotiations in Congress will determine if it needs to be extended. It was estimated that 60-70% of those receiving unemployment were getting paid more than when they were working pre-COVID. Obviously, this was a big support to the economy, and with unemployment still high, complete removal of the extra unemployment insurance may not be advisable at this time.

- Bankruptcies are on the rise. Defaults and bankruptcies typically peak a year after a recession ends.

Will Fiscal Package Four be Large Enough?

Fiscal Package Four will be negotiated in late July. Unemployment benefits run out July 25/26, and these have provided a meaningful macro benefit of about $18bn per week. Congress will debate unemployment checks or stimulus checks or perhaps both? There is also a question of how much state and local fiscal relief should there be. States have $250-$500 billion budget gaps and must balance their budgets. Moody’s has estimated that without any aid states could be on track to lose 4 million jobs. Finally, what about business tax relief and small business aid? Current estimates are that the Cares 4 fiscal stimulus package may be worth $1.0 to $2.0 trillion. If it falls short of what the market believes is necessary, the stock market could weaken until Congress ‘gets it right’.

In addition to our economic concerns geopolitical and racial tensions continue to rise. And we must not forget, elections are coming…

… and at some point, the world will have to face tremendous debts. How will we pay for all of this stimulus? Will taxes rise, or will we keep pushing the can down the road?

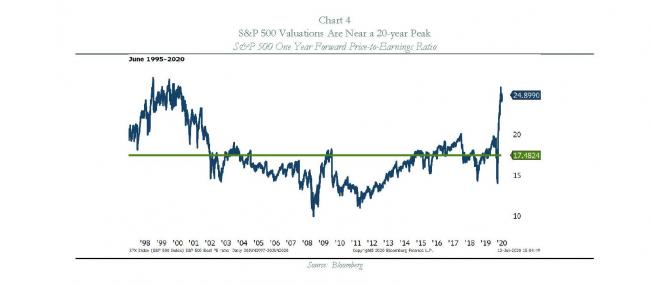

TINA: There is No Alternative

History has shown that when interest rates decline (or quantitative easing begins), stock market multiples increase. The theory goes like this: As bond yields go to zero, investors are less compelled to own bonds. They are instead encouraged to take more risk and buy stocks. This decision is made independently of what company earnings are doing. Thus, a stock can rise while earnings are flat or even declining.

This time is no different. Massive stimulus was met with massive valuation increase. One year forward looking Price-to-Earnings (P/E) ratios on the S&P 500 are now at 25x. This is well above the 25-year average of 17x and is near the valuations in the 1998-1999 timeframe (the peak of the tech bubble). Chart 4 shows S&P P/E Ratios for the past 20 years.

Nobody Likes it When the Punchbowl is Taken Away

Going forward, one must be careful. What goes up often comes down, and reversion to the mean is a powerful concept. Thus, once the economy is on stronger footing and/or soon after we have a vaccine, it is likely that the impact of the substantial stimulus we have had will begin to fade. The punchbowl will be taken away. Yields (and perhaps taxes too!) will rise, and multiples will fall. If underlying earnings are not strong enough to offset the multiple contraction, stock prices could come under pressure. The timing of this is all uncertain. If we get a vaccine in early 2021, there could be a synchronized global recovery leading to powerful upside initially. However, after the initial party, this strength may ultimately lead to the reduction of stimulus.

Cash is King, Represents 15-20% of Equity Portfolios

With both pandemic concerns and valuations high, we believe it is prudent to keep cash balances higher than normal as we continue to put more focus on capital preservation over capital appreciation. At the end of this quarter, cash, cash equivalents, and US Treasuries represented about 15-20% of your equity allocation.

During the quarter, we sold several cyclical stocks to take advantage of tax losses and replaced them with other cyclical stocks that we felt would benefit from reopening after COVID.

Once again, the largest tech stocks are benefiting the most from the high valuations. These companies have been able to maintain high cash flows even in the face of the pandemic. Several tech companies in your portfolios experienced significant price appreciation in 2020. With valuations well above historical levels, we took the opportunity to sell or trim.

Gold Represents 6% of Equity Portfolios

Given the massive amounts of monetary stimulus, the rapid growth of central bank balance sheets, and large numbers of developed country interest rates below zero, we think gold is currently a great investment. We started purchasing gold in the portfolios in 2019. Gold currently represents about 6% of the equity portfolio.

No Change to Mutual Fund Portfolios This Quarter

For our mutual fund portfolios, we made no changes during the quarter. Gold was the best performing investment in these portfolios, up 17%.

Yield is a Scarce Commodity

Last month we talked about the opportunities in fixed income. Today, that is not the case, with yield being a scare commodity. About 90% of government bonds in advanced economies yield less than 1%. In the US, the 10-year Treasury yield is currently 0.6%, an historic low. These ultra-low interest rates are depressing returns on the already meager savings that retirees have put aside. At the beginning of the quarter, we were able to buy some corporate and municipal bonds with good spreads vs. US Treasuries. However, as the quarter progressed and with the US Treasury now backstopping the bond market by buying bond ETFs and individual bonds, those spreads have narrowed considerably. Given our view that the stock portfolio is where our clients take risk, we keep the bond portfolio conservative with a short duration. Yield to maturity for a 5-year investment grade corporate or municipal bond is currently about 1.0% on a taxable equivalent yield basis.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

|

Sincerely, |

|

|

|

|

|

John A. Zaro III, CFA®, CIC |

Laura K. Drynan, CFA®,CFP®,CIC |

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market InsightsSpring 2020 Winter 2019 Fall 2019 Summer 2019 |