BOURGEON CAPITAL MARKET INSIGHTS

"There Will Be Blood." The title of a research report by Bruce Kasman, Chief Economist of JP Morgan, as he increased the risk of recession to 60% due to the impact of tariffs.

The title of our last quarterly letter was “Getting comfortable being uncomfortable: Welcome aboard the chaos train.” It was prophetic. Things changed very rapidly in the first quarter as Trump’s pledge to reduce government waste and remake the global financial system (using tariffs) created uncertainty and chaos in the markets. Many economists lowered their US growth prospects and increased their inflation outlooks, with some postulating recession or even stagflation. The stock market reacted negatively, with the S&P 500 down 4% in Q1 2025 (subsequently dropping an additional 11% through April 8 after the initial tariff announcements). In a surprising move, 10-year bond yields rose. While we continue to have an optimistic long-term view, we have been notably cautious over the last four months with valuations high and uncertainty increasing. Since the beginning of 2025, we have trimmed and sold stock holdings to raise cash, which currently represents about 20% of equity portfolios, higher than our historical average of 5%. Our intent is to protect recent equity gains with cash earning 4-5%. We love the flexibility of having lots of cash and short-term US Treasuries. Liquidity is key in the current turbulent market environment, allowing us to take advantage of dislocations to invest in companies we believe will benefit as markets normalize over time and companies find their way through the current chaos.

Spending Cuts + Tariff Income = Extension of Tax Cuts? or Not?

One of Trump’s goals has been extending the 2017 tax cuts without increasing our nation’s debt. To accomplish this, the administration is looking to find $4.5 trillion of cost savings and/or higher income. Musk’s DOGE team was tasked with reducing $1-2 trillion of government waste and fraud. As of April 17, according to the DOGE website, the team has identified only $155 billion in savings.

If the government is unable to find the cuts necessary in discretionary spending, Congress may have to look to other less desirable areas to reduce costs (such as Medicare/Medicaid/Social Security/Defense), or to gain more income (tariffs, raising the highest tax bracket or removing municipal bond tax exempt status). Or perhaps Trump will only be able to extend the tax cuts for a few years.

While we agree that fraud and reducing waste are helpful, we are concerned that the expansiveness of the government cuts could decrease our global competitiveness by reducing investment in growth industries such as technology, security, biotech/healthcare, quantum computers, electrical power transmission, and nuclear energy.

Tariff-ied

Trump believes in using tariffs to help achieve his economic and security goals. His tariff proposals, culminating in “Liberation Day” on April 2, were significantly higher than most economists had predicted, impacting all our trading partners, including close allies.

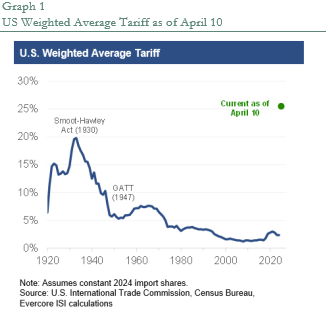

To put the tariff proposals in perspective, before this year, US tariffs on foreign states were 2%. Now it is effectively over 27% with China reaching 125% on April 9th. These are unprecedented numbers. Tariffs have not been this high since 1904 and are worse than the Smoot Hawley tariffs from a percentage perspective.

Economists expect that tariffs should, in the near term, lead to higher inflation and slower growth. There is concern that we could have damaged our long-standing relationship with our allies. Jamie Dimon recently said, “The most important thing to me is the Western World staying together economically, when we get through all this, and militarily, to keep the world safe and free for democracy. That is the most important thing.” Over the long term, the Trump administration believes that tariffs will improve our trade balance, bringing more manufacturing back to the United States.

Soon after the Liberation Day tariff announcement, Trump decided to push off the tariffs for 90 days for all countries except China. It is possible that the US will negotiate down the tariffs for many countries (and perhaps for companies) over the upcoming 90 days. However, we are watching the tariffs against China, which could take longer to resolve, as it appears an economic war is only building. As the US and China have similar GDP levels, an economic war could have serious global implications.

Slow Growing and Higher Inflation = Stagflation

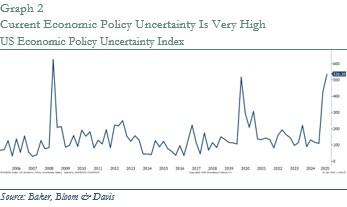

So far, the tariff announcements have reduced business and consumer confidence, making it significantly harder for companies to plan and invest. While the recent hard economic data has been good, the soft (anecdotal) data is concerning. Recent comments from major US banks (JPMorgan, Bank of America, Goldman Sachs, and Citibank) indicate that they are preparing for the possibility of a recession. Bruce Kasman, Chief Economist of JP Morgan, raised his recession probability to 60% due to tariffs, and titled his report “There Will Be Blood”. David Solomon, CEO of Goldman Sachs, recently said, “The prospect of a recession has increased. Our clients, including corporate CEOs and institutional investors, are concerned by the significant near-term and longer-term uncertainty that has constrained their ability to make important decisions.” Major companies, like United Airlines, are pulling earnings guidance based upon the uncertain economic environment. Graph 2 shows that economic policy uncertainty in the US is at historically extreme levels.

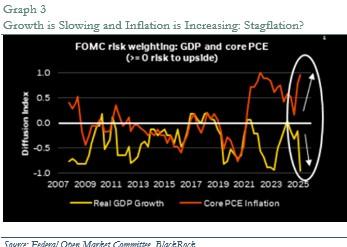

Recent data from the Federal Open Market Committee (Graph 3) shows that inflation expectations are increasing as growth declines. This could push the US economy into a stagflationary situation or a recession.

Stagflation poses a serious conundrum for the Federal Reserve. In an inflationary environment, the Federal Reserve would want to keep interest rates high to slow growth. In a slow growth / stagnant economy the Federal Reserve would want to lower interest rates to improve growth. In a stagflationary environment the Federal Reserve is caught in the middle of opposing policy paths.

Law of Unintended Consequences

Given so much dramatic change in US policies, it is important to recognize the law of unintended consequences. As a result of the initial tariff proposals, the bond markets began to freak out. Interest rates on the 10-year US Treasury rose rather than declined as the US economic growth outlook fell. Why? Nobody knows for certain. Some believe that foreign countries that own US Treasuries began selling some of their holdings. Some believe that our relatively low interest rate is the result of the US being the reserve currency. The reserve currency status is partially based on stability, trust, and a security umbrella of our government. The tariff announcements weakened those three pillars, and as a result, interest rates rose. Some believe that the current policies will only increase US debt going forward and as a result, interest rates rose to offset the associated increased risk in holding US debt.

The world is beginning to question US exceptionalism, the US dollar as the reserve currency, and why they should continue to hold US Treasuries.

We believe that the United States will be dealing with more unintended consequences over time.

De-Risking in an Uncertain Time

Faced with a very uncertain outlook, Bourgeon decided to raise cash levels from the normal 5% range to 15-20%. We like the flexibility provided by higher-than-normal cash levels. We have also been aggressively taking tax losses to protect your realized gains as much as possible.

As the tariff landscape is finalized over the coming 90 days and our economic outlook becomes clearer, we anticipate re-investing the cash (currently earning 4-5%). We believe it is better to hold most of that cash in the short term until we have a better understanding of where policy is headed. Sometimes, doing nothing is doing something.

While it may be the end of the world as we know it (for now), it’s probably not the end of the world. Companies are very ingenious, and we anticipate most will find a way through the current chaos. Many of our favorite investment themes are still viable in this changing environment: energy, electrification of the grid, artificial intelligence, defense, security, healthcare, and technology.

The most all-inclusive long-term theme is Artificial Intelligence. But all good secular themes have bumps in the road. During the quarter, AI investments were negatively impacted by the surprise announcement made by DeepSeek. This Chinese company was able to develop an AI model at a much lower cost that runs on significantly less energy. The announcement caused a massive sell-off across a broad swath of technology markets and related AI fields, including utilities, construction groups, and other data center-related companies. The implosion was swift and wide, with many names down 30-40% even before the tariff week of April 2. The selloff provided us with an opportunity to add to some of our favorite AI-related stocks.

As we watch AI move from “training” to “inferencing”, it will require more power, chips, and infrastructure. Capex, as a separate subject, should continue to be quite strong, unless we have a dramatic downturn. As we listen to earnings calls over the next few weeks, we will learn more. A good point to remember is that everyone wants lower-cost AI, and all players are striving for that.

We will now enter the period of deciding who can make money with products from all this AI capex. Ultimately, we see lower costs for AI as positive. Lower costs drive more AI usage and allow AI to flow into many areas of our economy to improve global productivity. This is often referred to as the Jevons Paradox, which states that “technological advancements that increase efficiency in resource use can paradoxically lead to an increase in overall resource consumption, rather than a decrease.” DeepSeek and Chat GPT, etc. will allow students and workers to learn and develop their economies and lives faster and more equally than ever before. That growth leads to more worldwide net worth.

We continue to focus very heavily on all related areas of Artificial Intelligence and believe very strongly in the growth expectations. We believe the most important area is the growth of electricity, power, and all manners of energy. Our expectation is that by 2026 people will fully realize how hard we need to push and that we are behind. A position, as it relates to China, that we don’t want to be in.

The economy and the consumer could suffer in the next few quarters as we work through new economic policies. The market will likely remain volatile in the near term, but with recent market weakness, stock prices are certainly closer to fair value. We are long-term investors, and we expect that over time, the investment landscape will provide decent returns. As always, we are vigilantly conservative and trying to be good stewards of your capital. We will all live to fight another day.

Alternatives in Bourgeon Portfolios

As we continue to explore investment opportunities, we have begun selectively allocating to private markets, where appropriate, and after thorough due diligence.

Over the last five years, significant changes in the alternatives landscape have made it more accessible to individual investors, lowering traditional barriers and opening new growth potential. We believe that private markets (equity, infrastructure, credit, real estate, secondaries) present a compelling opportunity to diversify your portfolio further.

As always, we remain committed to guiding you through these opportunities. If you’d like to discuss how alternatives could fit into your investment strategy, please don’t hesitate to contact us.

Mutual Fund Portfolio Changes

Our model portfolios benefited in the quarter from their exposure to international markets. Both developed and developing international markets were able to post strong results in the first quarter, which, for these portfolios, directly helped to partially offset the weakness seen in most US equities. In addition, the allocation to fixed income in most of our models also produced positive returns, again helping to offset the weakness seen in US equities. Lastly, our commitment to maintaining exposure to the real estate sector within equities was helpful, as that sector was able to post respectable gains in the quarter.

The above-mentioned conditions resulted in two of our more conservative strategies posting positive absolute returns for the quarter. The two more aggressive, equity heavy, strategies were only down modestly, a relative win given the environment.

In the quarter, we swapped a European value fund for a more growth-oriented European fund we have used previously. We also used the strength in Chinese markets to exit our thematic exposure in that market, which we bought in May of 2024.

Bond Markets Put Pressure on Tariff Policy

The bond markets are also dealing with uncertainty and volatility. The yield on the 10-year US Treasury has swung wildly and unpredictably over the past quarter. After the tariff announcements in early April, bond yields unexpectedly rose, creating dislocations that ultimately pushed Trump to call for a 90-day tariff delay. Our strategy has been to continue to keep our bond portfolios fully invested. We like 4-5%-ish annual returns on our investment-grade bond ladder. We have been increasing quality in our recent bond purchases, staying with defensive sectors and increasing international holdings. The yield curve has been surprisingly volatile, and we have been nimble in our management of your holdings.

We look forward to speaking with you soon, and thank you for entrusting us with the management of your money. Please call if you like us to walk you through our opinions in more detail.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.