BOURGEON CAPITAL MARKET INSIGHTS

"Once is happenstance. Twice is coincidence. Three times is enemy action." - Ian Fleming, Goldfinger

During the first quarter of 2024, the S&P 500 surged 10%, and the bond market (U.S. Aggregate Bond Index) declined 1%. The year started out strong from an economic perspective. S&P 500 company earnings estimates have moved higher. The underlying economic strength has pushed up inflation for three months in a row. According to Ian Fleming, “Once is happenstance. Twice is coincidence. Three times is enemy action”. Investors entered 2024 expecting slowing inflation, a weakening economy, and 6 interest rate cuts. However, based upon the three stronger than expected inflation readings, the bond market has readjusted, and now expects only 1-2 cuts this year. This had been our base case coming into 2024 – that rate cuts would have to be pared back. However, we had expected this to be followed by some stock market weakness. We were surprised by the Q1 strength of the market in the face of higher for longer interest rates and believe the initial pullback in Q2 was understandable. For our stock portfolios we continue to invest based upon themes with secular growth, while being mindful of valuation levels. For our bond portfolios, we are enjoying the opportunity to buy investment grade bonds yielding 5-6%. As usual, there are many crosscurrents in the market today. We remain alert and vigilant to them on your behalf.

The Economy Has Been Strengthening

Historically, one would expect a recession about two years after the beginning of a Federal Reserve rate hiking cycle. That would be today. However, although we have had a weakening economy and rolling recessions in several sectors of the economy, we have not yet experienced a full recession. In fact, after three years of relatively flat profits, earnings estimates (adjusted for special items) for the companies in the S&P 500 are now expected to be up 9% in 2024 and 14% in 2025.

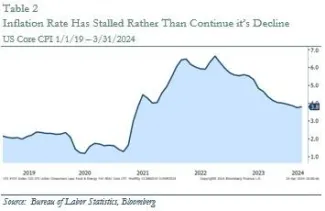

Core Inflation Rate Has Stalled Around 4% vs a 2% Target

Given concern over the rate of inflation post the COVID pandemic, the Federal Reserve raised rates to over 5% in 2022 and 2023 to slow economic growth.

The Federal Reserve initially had success, and core inflation (less food and energy) dropped from a rate of 6.5% to 3.8% as of the end of March 2024. But this is still well above the target of 2.0%. In addition, over the past three months, there has been a significant deceleration in the rate of decline in inflation. In fact, the latest month saw an uptick. While markets initially shrugged off inflation concerns, this last inflation reading for March 2024 created significant consternation. Has inflation yet again become a problem that may require action? “Once is happenstance. Twice is coincidence. Three times is enemy action”.

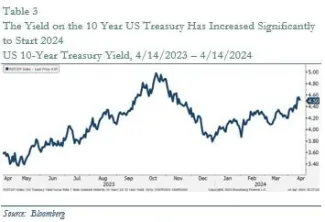

Strengthening Economy + Stalling Rate of Inflation = Higher Interest Rates for Longer?

The markets are always adjusting when reality doesn’t meet expectations. In this case, since the inflation rate isn’t continuing to decline, it makes sense that the Federal Reserve might reconsider whether it will cut rates at all. As a result, bond investors readjusted their thinking, and the yield on the 10-year US Treasury increased from a low of 3.8% in December 2023 to 4.2% at the end of March 2024 (and 4.5% as of 4/14/24).

While the market as a whole has been surprised by stubbornly high interest rates, this has been Bourgeon’s base case for the past year. We have used our opinions to your advantage while making tactical moves in your bond portfolios. However, we also believe that higher yields now will lead to lower yields later and thus it is advantageous to lock in bond returns now.

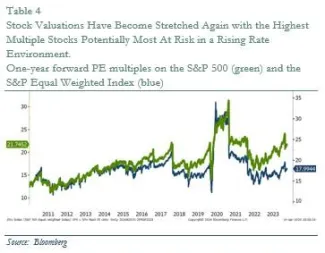

It's Up to Earnings to See How the Stock Market Will React

In 2018 and 2022 interest rates rose and multiples on stocks contracted (especially those with little earnings). However, this relationship didn’t repeat in the first quarter of 2024. Stocks rose along with interest rates. This was surprising to us, and we think partially explained by the strong underlying economic growth. If earnings stay strong, despite high interest rates, and continue to come in better than expected, it is likely that stock prices could find support. However, if earnings falter and don’t meet expectations (especially for high multiple tech stocks), valuations could contract significantly.

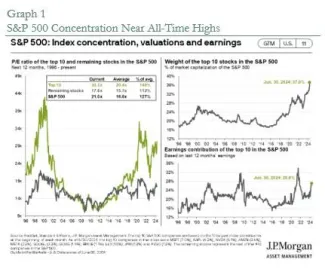

It is interesting for us to look at the valuation of the S&P 500 vs. the valuation of the equal weighted index. For many years, the valuations on the two indices were similar. Starting in 2015 there was a divergence, with the valuations of the top US companies increasing significantly relative to the rest. The one year forward price-to-earnings ratio of the S&P 500 has risen from 20x to 25x over the past year. This is primarily due to the high forward multiples of several high growth tech stocks (Microsoft, Apple, Nvidia, Amazon, Meta, and Alphabet). However, the one year forward price-to-earnings ratio of the equal weighted S&P 500 (blue line) has risen from 16x to 18x over the past year. We believe that there is more risk in the higher multiple stocks, and we have been reducing our exposure in that area over the past 6 months.

Our investment philosophy is primarily growth at a reasonable price. At this point, the average one-year forward price-to-earnings multiple of our core portfolio is 18x. We believe that the equal weighted index may well outperform the S&P 500 if we remain in a high interest rate environment.

One sector of the market that we believe is currently undervalued is healthcare. Over the past year we have added to our healthcare holdings, with a focus on biotech.

Geopolitical Environment Is Only Getting Messier and More Uncertain

In the US, the presidential race is a wild card. We expect a loud, boisterous, and nasty campaign with lots of noise and bad headlines. The US deficit will become more of a pronounced issue, as will the weaponized dollar. Outside of the US, there is significant uncertainty surrounding the wars in Russia/Ukraine and Israel/Hamas, as well heightened tensions with Iran and China.

First Quarter 2024 Stock Portfolio Changes

During the first quarter of 2024, we continued to rotate away from companies where we believed valuations to be stretched and into companies with strong secular growth at more reasonable valuations. Two of the secular growth themes we are currently focused on include Artificial Intelligence and Energy.

Artificial Intelligence (AI): We believe that Artificial Intelligence has the potential to significantly benefit economic growth and reduce corporate expenses. We see opportunities in all areas of the economy, particularly in medicine and education. But it’s still early, and it will take time to play out in a safe, constructive way. There are unknown ramifications, and the world will need rules as AI moves into prime time. There are many companies in our portfolio that benefit from AI and are trading at reasonable valuations.

Energy / Electrification: We continue to believe that the demand for clean and dirty energy will remain very strong. Demand will come from the US government’s three infrastructure policies, countries wanting to improve their energy independence, building data centers, and the improving global growth.

Model Portfolio Changes

All our model portfolios achieved positive absolute performance in the first quarter, largely tracking the performance of the major asset classes to which they are exposed. While equities had a very strong quarter, bonds were generally flat or down slightly as interest rates rose throughout that quarter. As such, our more aggressive, equity exposed models outpaced the more conservative, fixed income weighted ones, which were still up nicely for the period.

Changes made in the quarter include:

- Swapped out of an actively managed fund playing Asian Dividend names into a passive ETF exposed to the same strategy.

- For Conservative, Balanced and Moderately Aggressive portfolios, we trimmed some S&P 500 exposure and put the proceeds into Fixed Income. In both instances, this brought position weightings closer to model targets after having drifted over the last few quarters.

- For Aggressive portfolios, we trimmed some S&P 500 exposure and put the proceeds into Emerging Markets. In both instances, this brought position weightings closer to model targets after having drifted over the last few quarters.

The 2nd quarter is likely to be volatile for both equities and fixed income. Given the sharp rise in equities year-to-date, a pause or even pullback should be expected. Economic data has been firm, but there remains a wall of worries. Equity investors are still assuming a tailwind in the form of accommodative monetary policy and interest rate cuts throughout the year, but this is by no means assured. Should economic and inflation data cause rates to remain high and policy tight, both equity and fixed income investors will have to adjust to meet the new narrative. This uncertainty looms large given elevated stock prices and the potentially disruptive nature of “higher for longer.” Bright spots can be found, however, with employment levels supportive, money market assets at all-time highs and sentiment generally more cautious than euphoric. We remain alert and vigilant to all these factors on your behalf.

Enjoy Bond Investing

We continue to enjoy bond investing as real rates turned decidedly positive for the first time since 2007 and remain in the 3% range. This has led us to increase the duration on bond portfolios, taking our typical 5-year ladder out to 7 years.

In addition, we have also been tactical in our reinvestment strategy for maturing bonds, preferring to add to bond portfolios when being able to achieve a yield-to-maturity over 5%. We were right to believe that the bond market was being overly aggressive in its expectations of rate cuts as we began 2024. Our patience has been to your benefit.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.