BOURGEON CAPITAL MARKET INSIGHTS

“Time is the Wisest Counselor of All” - Pericles: 495 0 429 BC

Over the past year we have often said to our clients “The Federal Reserve will raise rates until something breaks.” After raising rates to almost 5%, something broke. Signature Bank and Silicon Valley Bank were shut down by federal regulators as people took their deposits and ran. A similar situation unfolded in Europe, and Credit Suisse was quickly sold to UBS to contain the crisis. Fortunately, regulators provided a swift response to help restore liquidity and confidence, and concern over a further run on the banks has subsided for now. However, we have no way to confidently quantify the fallout from the past few weeks, nor to hazard a guess as to the duration. We believe that lending standards will tighten much further at banks, and that the risk of an economic hard landing by year-end has increased. Only time will tell how this will unfold. The stock market appears to be shrugging off the possibility of negative consequences from the crisis, as the S&P 500 ended the quarter up 7.5%, near the highs of the year. In contrast, the bond market believes the chance of recession has gone up, as the yield curve inverted even further. Given the even more uncertain path ahead due to the recent banking crisis, we at Bourgeon are more inclined to sell into stock market rallies in the Short Run and invest the proceeds into bonds earning over 4%, keeping our powder dry to deploy for Long Run opportunities as the dust settles.

Risks Have Only Increased

We know that there was a bank crisis. We know that it was scary enough that bank regulators had to shut down banks, broker sales of banks, and provide emergency liquidity. We know that bank lending standards have only tightened, which will slow economic growth. We know that the Federal Reserve and other Central Banks around the world continued to raise interest rates in the face of this banking crisis. We know that it is too early to know exactly what happens from here. But there is almost universal agreement that risks have increased. Time will tell.

We believe we should be respectful of the increased potential for negative downside effects. For example, small and medium sized banks could tighten lending standards the most, shutting off access to loans for many small and medium sized businesses. Similarly, there is growing concern about how a decline in commercial real estate and leveraged loan markets will impact economic growth. In our opinion, a hard landing of the economy could occur within the upcoming 2-3 quarters. As such, we have started to reduce our allocation to stocks, and could use strong equity markets to continue to do so. We will monitor the knock-on effects of the banking crisis and adjust as necessary. While we wait for the dust to settle, we will hold short term Treasuries or money market funds yielding 4%-plus.

So Many Opinions: It's Confusing

There are always buyers and sellers in any market. We listen to so many opinions, paying the most attention to those with the opposite opinion of our own. But at the end of the day, as your advisors, we are the ones who are making the decision of when and where to take risk with your interest top of mind. We have already told you that we would rather be cautious with your portfolio in this environment. But we are one voice of many, and we thought it would be instructive to share with you some of the ideas of our colleagues.

The Federal Reserve is unsure of the impact on the economy from the recent bank failures. At Chair Powell’s press conference in March, he said that the additional tightening from the bank crisis could be similar to a 25 bps increase in the Federal Funds Rate. However, the minutes from that meeting showed that several of the staff felt the impact would be closer to 100-150bps of tightening.

Robert Kaplan, former head of the Dallas Federal Reserve, believes that we are in the 2nd or 3rd inning of the financial crisis. “The patient is stable with a slow bleed.”

The IMF warns that it’s too soon to sound the all-clear. “The resilience of the global financial system has been severely tested. It remains to be seen whether the measures so far have been sufficient to fully restore confidence in markets and institutions.”

Jan Hatzius, Chief Economist at Goldman Sachs, has a relatively rosy opinion: The bank crises leads banks to tighten lending standards. This reduced credit availability will be a headwind that helps the Fed keep growth below potential despite the support from rising real income and better global growth. We stay out of a recession. (But they also raise their probability of a recession from 25% to 35%.)

A more concerning scenario, as suggested by Mike Wilson, Chief Investment Officer of Morgan Stanley, goes something like this: After the recent banking crisis, Mike believes it is becoming more obvious that earnings estimates are unrealistic. He believes that both corporate earnings and stock valuations have yet to fall enough. Money Supply (M2) growth is still decelerating and is now the lowest in at least 60 years. If this doesn’t reverse, broader growth should soon follow in a way that isn’t priced into many equities. The final leg of this bear market is ahead of us.

JP Morgan’s Marco Kolanovic, Head of Quantitative Research, believes that “the risk-reward for equities does not look attractive into 2H in light of risk-free hurdle rate at 5%.” He goes on to say that to be positive on equities from here, one has to be bullish on growth/rates/China/politics and then compare this to the alternative of earning 5% risk free. He would fade technology and buy defensive stocks.

Rich Ross, the technical analyst at Evercore ISI is bullish on technology and 2-year US Treasuries “as peak Dollar, Yield, Crude, Credit Spread, Inflation and Policy all continue to drive the averages higher.”

Short Run vs. Long Run

It is important for us to distinguish between Short Run positioning and long run opportunities. In the Short Run we are increasing cash holdings to help shield your assets from increased recession risk. In the Long Run we see significant opportunity for us to deploy the cash into secular growth investments.

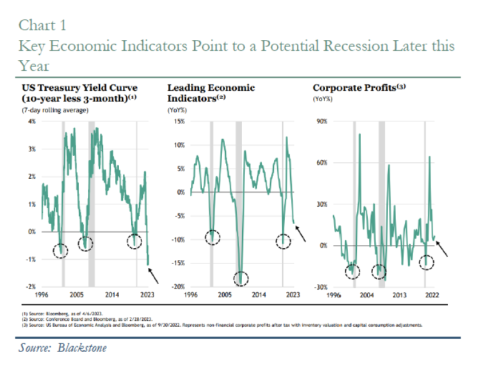

We recently listened to Joe Zidle, Chief Investment Strategist at Blackstone give his current outlook. He is focusing on three primary indicators that point to a potential recession later this year: The inversion of the yield curve, the decline in leading economic indicators, and the drop in corporate profits. See Chart 1. And Mr. Zidle’s macro scorecard has been getting progressively more negative. See Chart 2.

In this letter we have focused primarily on what is happening in the United States. However, Mr. Zidle’s scorecard reminds us that we should be aware of what is happening outside the US, especially the heightened geopolitical risks (Ukraine, Russia, China, etc.)

Our long-term investment themes have not shifted much over the past year. We like energy investments (both green and dirty), artificial intelligence, defense, commodities, cybersecurity, reindustrialization, healthcare for boomers, and logistics, to name a few. The government’s Infrastructure Investment and Jobs Act of 2021, CHIPS and Science Act of 2022, and the Inflation Reduction Act of 2022 support many of these long-term themes.

The biggest shift to our long-term theme over the past year is how we view interest rates and inflation. We believe that interest rates have normalized, and it is possible that the last 20+ years of extremely easy money is over. As we have said over the past year, this lack of free money changes the investing landscape. Investors will be more likely to seek out companies with current positive earnings and strong free cash flow.

First Quarter 2023 Stock Portfolio Changes

During the first quarter 2023 the S&P 500 was up 7.5% and bond markets rallied (yields declined). We started 2023 by slowly increasing stock allocations, as we were becoming more comfortable with a soft-landing viewpoint for the economy. However, after the bank failures we reversed this position, increasing the probability of a hard landing, and have been more of a seller of stocks. Today our equity portfolios have an allocation to cash of about 15%. We have been investing this cash in money market funds and/or US Treasuries yielding 4-5%.

At the beginning of Q1 we were beginning to get comfortable with the idea of a soft landing. This led us to take initial positions in three new names.

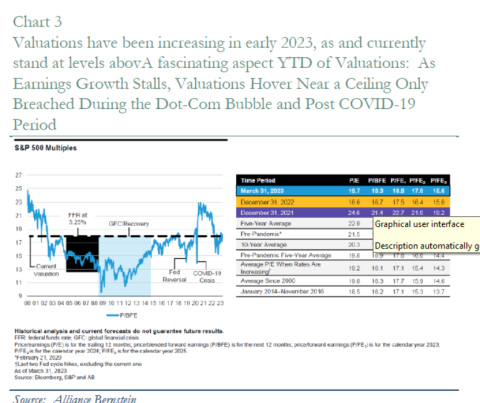

It has been frustrating for us to watch earnings estimates decline, the probability of recession increase, and then also have valuations increase. See Chart 3. The stock market is “climbing the wall of worry” with technology stocks significantly outperforming. This lack of breadth makes us wonder about the durability of this recent rally.

High valuations combined with our belief in the increased probability of recession led us to trim our exposures in five positions.

Unfortunately, not all of our stocks were up this year. Ever watchful for improving client’s tax positions, we did tax loss trades on three positions in the first quarter.

Mutual Fund Portfolio Changes

Our mutual fund portfolios all achieved absolute positive performance in the first quarter. The equity focused strategies benefitted from their overweight in large cap holdings over small and mid-size funds which generally underperformed. A select underweight in Real Estate helped in the quarter, as did our thematic exposure to Cybersecurity. The more balanced or conservative portfolios also performed well on the back of the significant fall in interest rates, particularly in March. All portfolios maintain a high level of yield earning cash to reflect our continued uncertainty and desire to be patient for a more resounding “all clear” signal. We trimmed some European exposure on strength during the quarter and added to a thematic position in Biotech. We also got all excess cash invested in money market funds with significant yield. We continue to monitor several ideas to shift exposures for when the time and opportunity seem beneficial.

Bond Portfolios Remain Fully Invested

After the Fed raised rates 500 basis points, in the fastest hiking cycle in 40 years, our goal for 2023 has been to remain fully invested in your bond portfolios while increasing duration. It is nice to finally earn 4-5% on bond portfolios. We are listening to the Federal Reserve for clues about future rate hikes. They could raise rates one more time, but then we think that they stop for a while to see the impact. The Fed has been adamant that they will keep the Federal Funds Rates higher for longer, even in the face of recession. If that is the case, then long rates could drop further, leading to our thought of adding duration. A more optimistic view would have the Federal Reserve pausing now and lowering rates before recession gets too uncomfortable. This would argue for a barbell strategy – buying bonds both on the short end and on the long end.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.