BOURGEON CAPITAL MARKET INSIGHTS

It's Early, But is it Getting Late?

Over the past 9 months the world has been awash in cash. Our view that economic growth would be stronger than expected, inflation would increase, and cyclical/industrial/material/reopening stocks would outperform has come to fruition. However, with inoculations and reopening spreading rapidly, and emergency stimulus coming to an end, we are considering when it might be time for a new strategy. Some investors are saying it’s early in the economic recovery, but it may be getting late in the stock market’s cycle. Conversely, other market watchers are calling for several more years of strong economic and stock market growth. We are evaluating both possibilities. We are cognizant that the sugar high from COVID fiscal stimulus and some of the proposed infrastructure stimulus might already be embedded into stock market expectations, and that eventually the Federal Reserve’s easy money policies should come to an end. There is growing expectation that this may happen this year, which could put some downward pressure on stock market valuations. Thus, while we still believe that cyclical stocks should continue to be strong in the near term, we will be watching for late cycle signs, and may adjust stock holdings once again as we move through the year. Separately, many of our balanced accounts are overweight equities after two years of strong stock market gains. As interest rates rise, we may continue rebalancing accounts back to benchmark.

Hotter Shorter?

We have a much hotter economy than most would have expected a year ago. We had a steep recession, followed by rapid recovery, supported by massive monetary and fiscal stimulus. In fact, one year after the nadir in the economy brought about by COVID, economic growth is close to getting back to trend line. Historically this would have taken several years. GDP growth could be in the 7% range this year – a level not seen since 1984.

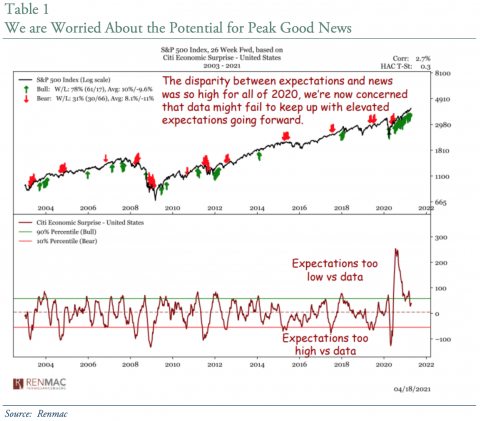

As a result, we wonder, could the stock market rebound be shorter than a typical recovery? Some things we are considering: The stock market likes acceleration over deceleration. The emergency COVID monetary and fiscal stimulus push is over. Have we reached peak good news? We will watch to see if elevated expectations become too high for the underlying data. See Table 1. As we go through 2021, the year-over-year growth rates will begin to decelerate (but likely remain nicely positive). For example, expected US GDP growth rates could be 7% in 2021, 4% in 2022, and 2% thereafter. If future corporate earnings growth rate expectations come under pressure, valuation multiples could contract, and companies may have to run harder to stand still.

Or "Go Big"?

On the other hand...

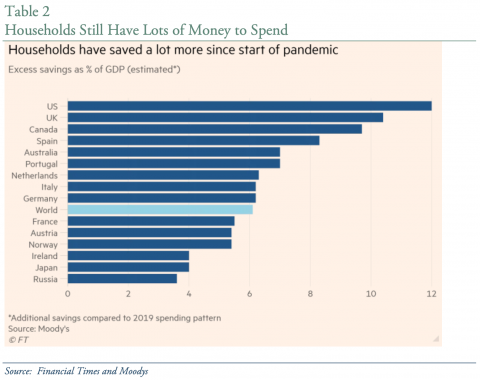

The economy remains awash in cash, and this should support strong economic growth for a few years to come. Consumer Net Worth is up 17% from the bottom in Q2 2020, and up 10% from the end of 2019. Household savings is still way above normal levels, and inventories are tight. According to Moody’s, if consumers spend about 1/3 of their excess savings, they would boost global output by just over 2 percentage points both this year and next.

And what happens if we add an infrastructure package onto an already strong economy? There is little doubt that the US needs to improve its infrastructure. In fact, several administrations have promised infrastructure packages, but have failed to get it done. Perhaps we will this time? After the sugar highs of COVID fiscal stimulus, infrastructure spending may provide a more long-lasting economic benefit to the economy.

Janet Yellen, our new Secretary of the Treasury, has said that she wants to “Go Big” with Biden's infrastructure package. Jerome Powell, head of the Federal Reserve, has continued to say that he will keep interest rates low to support the economy as it emerges from COVID lockdowns. This is a very powerful economic growth combination.

This is where the “It’s early but it’s getting late” thesis may be wrong, allowing for a continued strong support for cyclical stocks. This would support taking our time as we move out of a mid-cycle portfolio stance into a more late-cycle or defensive position.

Everything is Better in Threes

As we move through this recovery, where are we headed? We like the simple way that Ed Hyman of EvercoreISI describes it: 3% inflation, 3% unemployment, 3% interest rates. This implies a strong economy leading to an inflation overshoot and higher interest rates from where we are today.

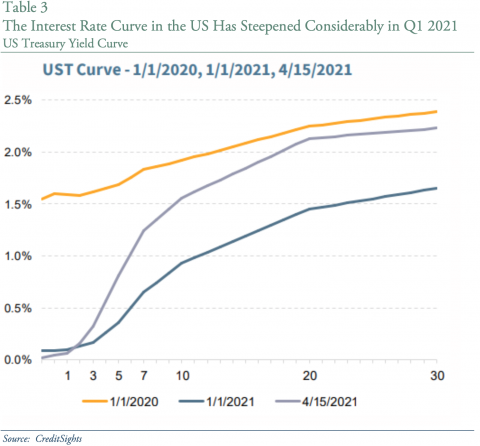

We are ever watchful of interest rates, not only where they stand today but where they may be going, and how quickly they get there. During the first quarter the yield curve steepened significantly. See Table 3. This caused a temporary pullback in the markets during late February 2021. While absolute interest rate levels are not terribly concerning now, if rates keep rising, then they could undermine some investments. The rate at which the market adjusts to higher rates is important as well. A rapid increase will likely cause more concern compared with a steady increase. The CEO of JPMorgan recently commented in his annual letter to shareholders that, “The increase in inflation may not be temporary and may not be slow, forcing the Fed to raise rates sooner and faster than people expect.”

Worries: Shifting Geopolitical Tensions And The Deficit

We are always watching the geopolitical environment for areas of concern. In Asia we are concerned about China and its actions toward Hong Kong and Taiwan. If China/Taiwan tensions rise, it could have a calamitous effect on worldwide growth and markets. China is clearly flexing its muscle and will continue to put pressure on players via islands off Indonesia/Philippines as well as various seaways.

We are not ignoring the Middle East, but we think that the focus of the Biden Administration has moved to Asia and Russia.

Lastly, we are mindful of the extreme debt burden in the aftermath of a war against COVID. We are spending our way out of our problems, and this creates an enormous burden on future generations. At some future time, we will have to pay down our debts.

During the First Quarter We Continued to Buy Reopening and Cyclicals with a Nod Toward Defensives

While we spent most of first quarter 2021 buying stocks that benefit from the cyclical/reopening trade, we did begin to add to defensives as the quarter progressed. Throughout the quarter, inflation expectations increased, and we believe there may be more to go. Thus, we have maintained our allocation to gold.

We added three new stocks to the portfolio in Q1 that should benefit from a strong reopening economy. We believe that there is pent up demand for travel and purchased a stock that should benefit from reduced travel restrictions. With low inventories, strong demand, and recent favorable tariff movements, we also felt it was the right time to benefit from price increases in a materials stock. Lastly, after a 20% price decline, we decided to take the opportunity to buy a chip manufacturer to benefit from the current chip shortage.

Biden’s infrastructure plan should benefit renewable energy companies. We have owned a company that benefits from carbon capture, liquified natural gas, and green hydrogen technologies for 6 months, which is up since our purchase in late last year. We have also traded a solar energy stock to your benefit over the past year. Finally in March 2021, after a large selloff, we purchased a utility that focuses on renewable energy and checks off two investment buckets for us – renewable energy and a late cycle defensive stock.

We continued to trim technology stocks to pay for our cyclical additions. Our weighting to technology is currently about 20%. This compares with the S&P 500 weighting of about 27%. As interest rates increase this negatively impacts the valuation of long dated assets, including high growth/speculative technology companies.

In addition, we sold out of 3 positions. We have owned a healthcare stock for a decade, and we felt that there was better opportunity in other healthcare names. We purchased a defense company when Trump was elected into office. The stock outperformed, but after Biden was elected, we felt that the defense budget may come under pressure, and thus we sold the position. Finally, we sold our last holding in an industrial company, as we felt the risk/reward was no longer in our favor.

Stay the Course for our Mutual Fund Portfolios

Last quarter, Q4 2020, we made some significant shifts in the mutual fund portfolio holdings. Our increased allocation to our real estate fund and inflation protected bonds added to performance. Meanwhile our addition to our gold holding detracted from performance. We made no changes to our mutual fund holdings in Q1 2021.

Finally Putting Cash to Work in Bonds

Yield is getting a bit easier to find as the curve steepens. After two quarters of allowing cash to build in bond portfolios, we finally put some of that money to work late in Q1 2021 once we were able to achieve a 2%-ish yield to maturity on 5-year bonds. We have a barbell approach to our duration as the yield curve steepens – holding higher than normal cash balances on one side and buying 5–7-year investment grade bonds on the other. In the equity side of client holdings, we are working on increasing the dividend yield of the portfolios. The current dividend yield on the equity portfolios is about 1.8%, which is higher than the S&P 500 at 1.5%. For those with the appropriate risk allocation, we are looking at alternative investments that provide income.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.