Bourgeon Capital's Market Insights: Spring 2019

“An Object in Motion Stays in Motion Unless Acted Upon by an Outside Force.”

- Newton’s First Law of Motion

During the first quarter 2019, the S&P 500 posted its best quarter in nearly 10 years. This was a complete reversal from the fourth quarter 2018, which was the worst fourth quarter since the Great Depression. What turned things around? The Federal Reserve turned dovish, allowing valuation multiples to expand. During 2018 the Fed was doing a tightening trifecta – raising rates, talking about raising rates even more, and reducing its balance sheet. But after weak economic news in the fourth quarter, the Fed paused on tightening and said it would stop reducing its balance sheet around September 2019. The stock market has rallied significantly on this news as investors anticipate that the Fed’s move could reaccelerate growth. But where do we go from here as there is a tug of war between slowing growth and central bank liquidity? Recently the yield curve inverted (for a brief time), with the 3-month Treasury yielding higher than the 10-year Treasury. Historically the inversion often precedes a recession (1-3 years out) and rarely has sent false signals. Several economists are telling us to ignore this inversion saying “This Time is Different”. In our opinion, we believe it is prudent to head the warning, especially with the myriad of “Gray Rhinos” such as rising global debt levels and increasing geopolitical pressures. We continue to take rallies to pivot the portfolio more defensively.

Economic Growth Rates Have Been Weakening For a Year.

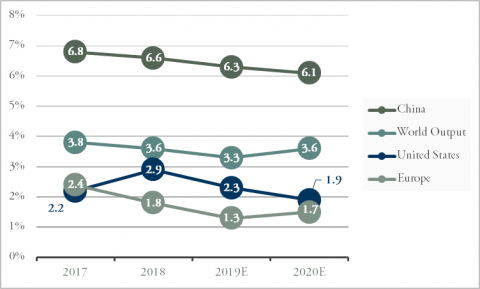

The IMF has once again reduced global growth forecasts. In April 2019 the IMF forecasted a 2019 global GDP of 3.3%, down from close to 4% in 2017. A year ago, it was clear that China’s economic growth rates were weakening, by midyear the weakness spread to Europe, and most recently to the US. For 2019 three major economies – China, Europe, and the US are anticipated to have slowing growth rates. See Table 1. In addition, the Index of Leading Economic Indicators and the Citi Economic Surprise Index are both negative.

Stimulus Can Turn Things Around – But Has it Been Enough So Far?

“An object in motion stays in motion unless acted upon by an outside force.” In order to improve growth rates from here, global economies need stimulus. Starting in 2018 China began to provide significant stimulus to their economy. Europe followed with small stimulus. The US came last by announcing a pause in tightening. Time will tell if this was enough, or if more stimulus will be needed. China still has the ability to provide monetary and fiscal stimulus, but for Europe and the US, options are more limited given current high debt levels and low starting interest rates.

Table 1

IMF Economic Growth Forecasts

% Change, unless noted otherwise

Source: IMF

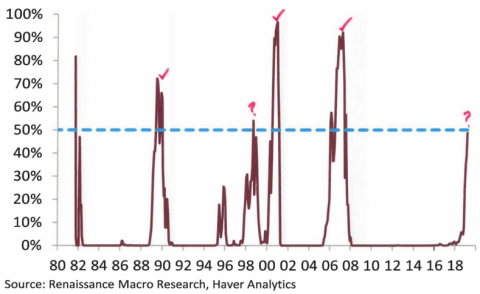

The Yield Curve Inverts and the 12-Month Probability of a Recession Spikes to 50%

Acknowledging weak growth rates, the US Federal Reserve decided to pause it’s hiking cycle and announced that it would slow and eventually stop its balance sheet reduction. The bond market reaction to these announcements was a rapid and significant decline in the long end of the yield curve. This resulted in the 3-month Treasury yielding more than the 10-year Treasury for a brief moment. According to Renmac, the inversion of the 3M-10Y yield curve implies that the probability of recession in the year ahead spikes to 50%. See Table 2. While an inversion is not immediately an outright sell signal, it does increase the probability that something could go wrong.

Table 2

Yield Curve Signals Recession in the year ahead

12-month Implied Recession Probability: 10Y less 3M

This Time is Different vs. History Rhymes

There are several economists who are looking at the historical probabilities but who are claiming that this time is different, and a recession isn’t coming. This is usually followed by discussion of ‘term premiums’ and comparisons with negative global yields. However, if recent history is to repeat itself, this global economic weakness will lead the Federal Reserve to cut rates, perhaps significantly. The stock market will rally (after the last 3 inversions the rally averaged 39%). This rally will lead the Federal Reserve to resume rate hikes, and a recession then ensues. If one looks at the previous 16 times that the yield curve has inverted, Renmac says that 54% of the time after an inversion the stock market was lower 6 months out. While we don’t know which scenario will be correct, we think that the best course of action is to be respectful of the potential downside risk, especially with the myriad of “Gray Rhinos”.

Gray Rhinos Revisited: Get Used to Volatility

A “gray rhino” is a highly probable, high impact, yet neglected threat: kin to both the elephant in the room and the improbable and unforeseeable black swan. Gray rhinos are not random surprises but occur after a series of warnings and visible evidence. We believe that Brexit, rising geopolitical tensions, China trade negotiations, and increasing global debt levels are a few of our current Gray Rhinos. We are cognizant that the stock market has an optimistic bias toward their outcomes, and thus carry downside risks should we be negatively surprised. While the US has raised rates and begun quantitative tightening, we are unsure if they have sufficiently primed the pump. Thus, to quote Krishna Guha from Evercore ISI “Limited policy ammunition means downside surprises/shocks generate larger declines in asset prices that in turn threaten to amplify the initial downside shock.” In other words, investors should get used to volatility.

What is the Stock Market Telling us?

The stock market has been moving more defensive for months. According to Renmac, the sectors with the strongest internal leadership over the past several quarters have been utilities, REITs, consumer discretionary, healthcare, and certain areas of tech. This would imply that the market is anticipating a weakening economy.

We have been Transitioning to a More Defensive Position Since the Middle of 2018.

We remain underweight risk assets. At the end of the first quarter 2019 we are holding 15%-20% cash in our all equity accounts. Our target 60% equity portfolios are holding 10% cash. We have invested our cash in Treasuries yielding 2.5%, or high yielding money market funds.

Over the past year we have also become more defensive in our holdings, taking opportunities to trim or sell high multiple companies to rotate into companies with more reasonable valuation.

During the first quarter we sold our remaining positions in a consumer discretionary and mining stock. We trimmed two positions on strength this quarter and used these funds to add to stocks where we saw value. We also added one new defensive growth stock to our holdings. Finally we sold two stocks for losses (one consumer staples and one biotechnology).

Mutual Fund Portfolios: Increased Emerging Markets Exposure on Strong China Stimulus. Added Disruption to Aggressive Portfolios.

We made a few changes to our allocations in our mutual fund portfolios during the quarter by deciding to trim our exposure to US large-cap and to reallocate the proceeds to other areas we see potential. With China continuing to stimulate its economy we believe the emerging markets will benefit. We added to one fund that provides exposure to developing regions, while also maintaining a tilt towards quality which helps it outperform its peers during downturns. We also added a new fund to our more aggressive portfolios. This fund focuses on companies that develop new products or services that they deem as “disruptive” and have the potential to change the way the world works. While it primarily invests in the technology sector, it also provides exposure to other industries that are showing innovation such as healthcare and fintech.

The 10-Year Yield Dropped 80bps in Four Months. Wow that Was Fast.

The volatility around bond yields continued into Q1 2019. In November 2018 the 10-year yield peaked at just over 3.2%. Only four months later the 10-year yield is at 2.4%, a decline of 80 bps. Meanwhile, corporate spreads have widened. They bottomed in 2018 at only 120 bps, and now are closer to 160 bps. After primarily buying Treasuries for clients throughout most of 2018, the increased spreads are welcome for buy and hold bond investors, and we have started buying investment grade corporate bonds again. We will monitor the yield curve to see where we can get the best yield. For our municipal portfolios, the muni market yield curve has not inverted and we are using that to our advantage.

Over the past several years we have increased the financial planning capabilities at Bourgeon. We currently utilize goal-based financial planning discussions and software as well as personal financial websites to assist our clients in navigating their unique financial journey. If you haven’t already taken us up on the offer of these services, please do so. We find them to be incredibly helpful, insightful, and fun. “Those who plan often fare better than those who don’t.”

As always, we welcome the opportunity to discuss your portfolio and our current thinking with you at any time. While we have only spoken generically about asset allocation in this letter, we believe that it is a very individual decision. We do our best work for you when we are up-to-date on changes that may be occurring in your lives. We enjoy speaking with you and sharing ideas on a consistent basis; if your situation changes at any time between our regular discussions, please reach out to us and let us know.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

Sincerely,

|

John A. Zaro III CFA®, CIC |

Laura K. Drynan CFA®,CFP®,CIC |

Important Disclosure:

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market InsightsWinter 2018 Fall 2018 Summer 2018 Spring 2018 |

For more information, please contact us:

777 Post Road

Darien, CT 06820

203.280.1170 | info@bourgeoncapital.com