BOURGEON CAPITAL MARKET INSIGHTS

"The only way to make sense out of change is to plunge into it, move with it, and join the dance.” – Alan Wilson Watts 1915-1973

The second quarter of 2025 delivered one of the most dramatic market reversals in recent history. Following President Trump’s Liberation Day tariff announcement, the S&P 500 fell 19%. Despite the steep fall, the rebound was historic, with the S&P 500 recording the fastest recovery after a major correction. The S&P 500 ended Q2 with a gain of 10.6% (up 6.2% YTD), and its eleventh-best quarterly return in 25 years. The Q2 tariff-induced stock market decline was a policy driven event and easily reversed with tariff delays by Trump. In addition, a stronger market was supported by lower rates, a weaker dollar, and tame inflation. US investors and companies have now caught their breath, with the S&P 500 marking all-time highs by the end of Q2. While 2H25 could offer continued upside for US equities, high valuations, geopolitical turmoil, and the resumption of tariff risks keep us cautious. Our relatively large cash holdings allow us to be nimble, as we try to move and dance with change. We modified our stock holdings during the quarter, adjusting to new themes and implementing tax loss strategies, which all benefited our relative performance. As we look to the upcoming quarter, we believe that recent political wins with the Big Beautiful Bill may embolden Trump to a more aggressive stance on tariffs and on pushing the Federal Reserve to lower interest rates.

Trump Always Chickens Out (for now)

Similar to the 2018 tariff process, Trump’s breaking point was a 20%-ish decline in the stock market. Once that level of decline was reached, he backed off his tariff proposals, postponing them for 90 days to July 1st. Trump has once again postponed the implementation of many tariffs to August 1st. The stock market now generally believes that Trump Always Chickens Out (TACO). Perhaps a big risk now is that he doesn’t.

While we have tentatively settled a few tariff issues and cooled off severe China concerns, hard work remains. The economic fallout from tariffs is just beginning. Companies are still somewhat frozen on what to do, who to hire, where to expand, and spend capex due to unknown tariff policies. Once companies have a more concrete understanding of the new rules, we are confident that many will discover ways to lessen the impact of tariffs on their profits.

A Spoonful of Sugar Helps the Medicine Go Down

Passage of the One Big Beautiful Bill (OB3) helps Trump advance his policy agenda. The bill extends many of the 2019 tax cuts, while providing several other tax and spending cuts. The bill aims to offset weakening consumer confidence and business investment by expanding the primary budget deficit by $2.4 trillion over the next decade, driven largely by tax cuts. The bill's tax cuts are front-loaded while spending cuts are delayed, offering a near-term modest stimulus.

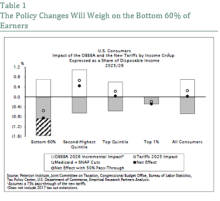

For households, the benefits skew toward higher-income households, limiting the impact on overall demand. See Table 1. On the tax side, OB3 extended the 2019 tax cuts, increased the deduction limit for state and local taxes, and implemented no tax on overtime or tips. The federal estate and gift tax exclusion was increased to $15 million per person ($30 million for married couples) starting in 2025. There were spending cuts in Medicaid and food benefits.

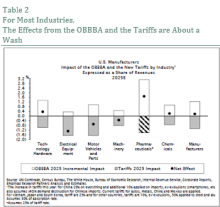

For companies, the positive benefits of the One Big Beautiful Bill Act help offset some of the negative tariff effects for many industries. See Table 2. The bill permanently allows expensing for domestic R&D. Clean energy incentives were reduced.

The high forecasted US debt levels remain a concern. The world is now taking a different look at US credit. U.S.-denominated public debt was over-owned by the world. That is changing at a time when the US will need more funding. This puts upward pressure on interest rates and is a potential issue for the US as the world adjusts to the “New World Order” (i.e. each country on its own).

We believe the probability of a government shutdown over the annual budget is increasing. Even though OB3 was passed under continuing resolution, the annual government budget will go to a vote in September. This requires 60% approval (higher than the 50% under continuing resolution). It will be interesting to see how this gets resolved.

The US Economy is Slowing But Has Recently Surprised to the Upside

While the U.S. economy has recently performed better than expected, the trend is one of slowing growth. The unemployment rate has remained stable. However, the weakness in wage growth is important to watch, and continuing unemployment claims are up 7% year-over-year.

While nothing is “on fire” in the economy, we have weakness in ISM manufacturing data, with new orders even weaker. C-Suite confidence has gone from 84% to 69%, while the Conference Board has dropped from 60 to 34 in Q2 2025 (a recessionary level).

Despite the weakening economy, the Federal Reserve has continued to keep interest rates in the target range of 4.35% to 4.50% as they are concerned about the potential of higher tariff-induced inflation to hit the economy starting this summer. Fed Chairman Powell emphasized that the Fed is well-positioned to wait for more economic data before making further adjustments to monetary policy. We believe that Powell is doing the right thing. He needs to have flexibility on rates to adjust to whatever tariff-induced economic fallout occurs. Whether markets are pricing it in or not, the risks remain very real and potentially far-reaching.

Second Quarter 2025 Portfolio Changes

During the second quarter, we took advantage of stock market volatility to reposition the portfolio. We readjusted our overall sector allocations and did several tax loss trades. We reduced our energy and healthcare allocations while increasing technology. We bought more stock than we sold, reducing our cash position from 18% to 13%.

While we continue to monitor developments closely and remain tilted conservatively, we are also very optimistic on our focus areas, including Artificial Intelligence, power, industrial growth, robotics, defense, and healthcare. We believe that stock market growth should broaden beyond the Magnificent 7 stocks.

Our focus on power, electricity, and transmission will be very key over the next 3-5 years. We have expressed this theme in the portfolio by owning multiple companies across several sectors – utilities, nuclear, basic materials, and industrials. We are expanding our knowledge of fusion to prepare for tomorrow.

The industrial and defense industries continue to receive strong investor support. These changes were initiated by past administrations and accelerated under Trump. This is true for Europe as well, where $3-5 trillion will be spent on defense in the coming few years.

Third Quarter Outlook

We expect markets to take a breather at best over the next two to three months. From a seasonal perspective, and all else being equal, the month of July is usually one of the strongest months in the year for stock performance. August is generally positive. But September is typically a down month for stocks.

We anticipate corporate earnings announcements to come in better than expected in July, with continued caution for how the August tariff announcements may impact profitability. Many strategists have increased their targets for the S&P 500 after the strong Q2 rebound. For example, Goldman Sachs raised its year-end target to 7,100, a 15% increase from the end of Q2.

Model Portfolio Strategies

Our Model Portfolios achieved significant positive performance in the second quarter and are up nicely year-to-date. These portfolios have benefited all year from their exposure to international developed markets, as well as emerging markets. The significant rally in US equities was also captured during the second quarter. Bonds have been a positive contributor to performance so far this year, and they played a particularly constructive and stabilizing role during the first quarter and the turmoil in April.

It is worth noting that: For all the discussion over the past few years of the futility of diversification or the demise of the 60/40 portfolio, an investor has been well served this year in expressing each of these traditional investment philosophies from both a performance and volatility perspective. Poking holes in both philosophies has been a reasonable discussion in which to engage, as US equities have largely been the predominant driver of superior returns in recent years. However, periods such as we are experiencing in 2025 are great reminders that it is also reasonable to stay committed to the core concept of diversification across both asset classes and geographies. Achieving quality risk-adjusted returns over long cycles, coupled with an appreciation for “smoothing the experience” from a volatility and stress inducing perspective, are the hallmark of such diversification, though it may come with periods of underperformance to any individual asset class.

We made some adjustments in the Model Portfolios during the second quarter. We sold our positions in several thematic ETF’s, including biotechnology, smart grid technology and oil services. Though not directly correlated, much of these proceeds were used to initiate a position in a Real Assets strategy. This holding is intended to broadly capture exposure to commodities, natural resources, precious metals, and real estate. We also increased our weighting in an existing European equity focused mutual fund.

Alternatives in Bourgeon Portfolio

As we continue to explore investment opportunities, we have begun selectively allocating to private markets, where appropriate, and after thorough due diligence.

Over the last five years, significant changes in the alternatives landscape have made it more accessible to individual investors, lowering traditional barriers and opening new growth potential. We believe that private markets (equity, infrastructure, credit, real estate, secondaries) present a compelling opportunity to diversify your portfolio further.

As always, we remain committed to guiding you through these opportunities. If you’d like to discuss how alternatives could fit into your investment strategy, please don’t hesitate to contact us.

Filling The Bond Ladder

Following the tariff announcements in early April, bond yields rose significantly, creating dislocations that ultimately pushed Trump to call for a 90-day tariff delay. After the delay, the bond market remained mostly steady. Our strategy has been to continue to keep our bond portfolios fully invested. We like 4%-5%-ish annual returns on our investment-grade 5-7 year bond ladder. We have been upping quality in our recent bond purchases, staying with defensive sectors and increasing international holdings.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.