Bourgeon Capital's Market Insights: Fall 2019

“I would emphasize avoiding losing money over avoiding missing opportunities"

-Howard Marks, co-founder of Oaktree Capital Management at a presentation to the Milken Institute Asia Summit on September 19, 2019

During the third quarter of 2019 the S&P 500 rose 2%, but most economic reports worsened, and the global political environment has become more stressed. For the past 18 months, the S&P 500 has barely made any progress, and is subject to the whims of a tweet. One has the feeling that it is only a matter of time before a straw will break the camel’s back. To that end, we appreciate recent comments from Howard Marks, co-founder of Oaktree Capital Management. “I would emphasize avoiding losing money over avoiding missing opportunities.” Throughout the third quarter, we continued to sell or trim stocks where we believed the risk/reward had become less compelling. We used the funds to purchase an allocation to gold. US Treasuries/cash and gold now represent about 15-20% and 5% of the average equity portfolio, respectively. Treasuries provide liquidity to take advantage of opportunities that may arise. Gold provides diversification and an insurance policy against economic weakness and geopolitical pressures.

Most Economic Reports in the US Have Worsened in Q3

Most economic reports that we rely upon to help us forecast future economic growth have weakened further over the past three months. The weakness we first saw in the manufacturing sector has started to spill over into the services sector. The purchasing manager’s index (PMI) for the manufacturing sector is the lowest since 2009, and the PMI for services is the third lowest since 2009. The index of leading economic indicators has continued to fall. More than half of US CFOs believe that the US will be in an economic recession by the third quarter of 2020, according to the Duke University CFO Optimism Index. This is understandable with quarterly profit growth near 0% for the first half of 2019 and consensus for the second half not much better. The US yield curve, a heavily relied upon indicator to forecast a recession, has been inverted for 5 months.

The biggest bright spot for the US is employment. The unemployment rate dropped to 3.5%, a 50-year low! But we see employment as a lagging indicator. According to Dallas Fed chief Rob Kaplan: “If you wait to see weakness in the consumer, you’ve likely waited too long.” Some of the more recent consumer data, such as job openings, are starting to slow, showing that some cracks are emerging.

The credit markets also showed some cracks this quarter – something that warrants close attention. During the middle of September, there was disruption in the Repo markets, leading to a significant spike in rates. The repo market (lending government securities) is traditionally a very boring, but necessary part of the fixed income market and part of the basic plumbing. The Federal Reserve has been able to calm markets – promising $60bn per month of support - by once again increasing its balance sheet. But it is a reminder that one should be watchful when the basic plumbing of credit markets gets clogged.

There is Even More Weakness Overseas

There is an even more pronounced slowdown globally. Amazingly, approximately 30% of the world’s government bond yields are in negative territory. Ultimately by borrowing money from these countries (Germany, France, Switzerland, Japan to name a few) one will lose money if held to maturity. In addition, globally there are 10 countries with inverted yield curves, the highest number since the Global Financial Crisis. In September the OECD (Organisation for Economic Co-operation and Development) reduced its outlook for global growth to 2.9% in 2019 and 3% in 2020. “This would be the weakest annual growth rates since the financial crisis, with downside risks continuing to mount.”

The Global Political Environment has Become More Stressed

The economic toll from the trade war with China is rising. According to estimates from the Federal Reserve Bank of New York, the average American household will pay $831 per year to cover the China tariffs that are already in effect. Others have predicted even greater effects of the tariffs so far, including JPMorgan, which estimates the tariffs’ annual cost at $1,000 per household. There was a meeting with China and the US in mid-October where phase 1 of a mini-deal was agreed upon. While this was in-line with expectations, ultimately we believe that neither side is feeling enough pain to ‘give in’ to a grand bargain at this point. Thus, the uncertainty and disruption from trade tensions will likely remain. We also now have a US presidential impeachment probe. These uncertainties are taking an increasing toll on confidence and investment and weigh on risk sentiment, endangering future growth.

Outside the US and China there are other geopolitical worries. Brexit negotiations continue without any serious headway and the end of October deadline is around the corner. Thus, unless there is yet another delay, Britain could leave the EU without a deal, a worst case scenario. The protests in Hong Kong persist. Finally, the recent attack on Saudi oil facilities reminds us of the increasing tensions in the Mid East. As an aside, a spike in oil prices has led many recessions.

“Have No Fear the Fed is Here" Or “Monetary Policy is Pushing on a String"

The US Federal Reserve did an about-face in 2019 – switching from tightening to easing. They have cut rates twice this year, and announced an end to quantitative tightening. Many economists expect the Fed to cut rates further. But some believe that policymakers may be hard-pressed to justify more so long as growth is solid, labor markets strong, and wages rising. In addition to easing in the US, there is even more overseas. In fact, according to ISI Evercore, over 30 countries have eased monetary policy recently.

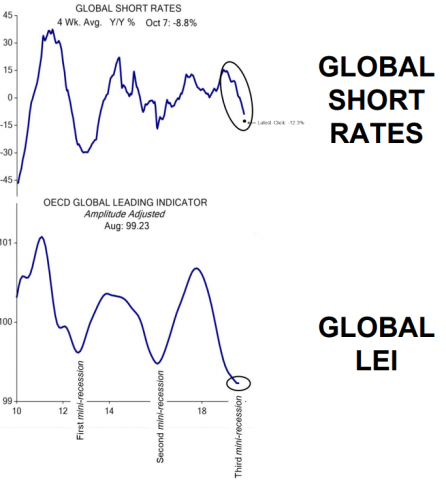

Will this global monetary stimulus be the answer to improve our economic growth? Will the low short rates lead to a turnaround in the leading indicators index? Historically the answer is “it depends”. When easing happens at the start of a recession, it has not been initially effective. When it has occurred in a mid-cycle slowdown it has led to improved growth. We are hopeful that this monetary easing works over time, but are preparing for what happens if it doesn’t. Will fiscal policy be able to assist if monetary policy fails? We are less optimistic here because of the current high debt levels in many major countries.

Table 1

Will the Reduction in Interest Rates Lead to Better Growth?

The value of global short rates vs. the Global Leading Index of Economic Indicators

Source: Evercore ISI

Emphasize Avoiding Losing Money over FOMO

During the third quarter of 2019, we sold stocks to make room for an allocation to gold and silver. With the probability of a recession increasing, we believe that owning gold is a way to protect portfolios. Currently, Treasuries and cash represent about 15-20% of the average all equity portfolio, and gold and silver represents 5%. Given our dual mandate to grow and protect assets, we believe that in the current environment we should emphasize avoiding losing money over FOMO (fear of missing out). We are ever watchful for the opportunity to redeploy the Treasuries back into stocks.

We purchased a 3% allocation in a gold ETF and a 2% allocation in a gold and silver ETF. While we acknowledge that gold is a non-producing asset that does not pay a dividend, we also know that over time it is a non-correlated asset which reduces volatility in a portfolio. With rates everywhere yielding zero or less, the cost of holding a contrarian asset is nil and provides safety. Gold is often called the “currency of fear” for good reason, as it tends to perform well in times of political and economic stress. With slowing growth, higher stock prices, elevated risk of recession, and rising geopolitical pressures, we believe that owning gold is a good insurance policy.

We sold and/or trimmed several holdings to raise cash and to purchase gold.

Mutual Fund Portfolios

During the third quarter of 2019, we continued to increase our cash positions for our all equity mutual portfolios to match the high levels of cash in our traditional investment management portfolios. We sold our innovation ETF and trimmed our exposure to international and emerging markets. With increased volatility and growing uncertainty in the markets, we initiated a position in gold for our mutual fund accounts. The remaining cash is put to work in money market funds.

If One Buys a German Bond Then One is Guaranteed to Lose Money

The bond market is sending many warning signals. On a global basis, there is $15 trillion of negative-yielding debt, double the level a year ago. If one buys a German government bond today and holds it to maturity, then one is guaranteed to lose money. In the US the 10-year Treasury peaked at 3.2% a year ago and has fallen to 1.6% currently. There is speculation that US yield might go negative too. Our yield curve has been inverted for 5 months (the rate of return on a 3-month Treasury is greater than the rate of return of a 10-year government bond). The repo market has settled down following recent disruptions, but underscores that investor confidence in the global financial system plumbing is fragile. We are finding opportunities in corporate bonds and municipal bonds, where spreads over Treasuries have returned to normal levels.

As always, we welcome the opportunity to discuss your portfolio and our current thinking with you at any time. While we have only spoken generically about asset allocation in this letter, we believe that it is a very individual decision. We do our best work for you when we are up-to-date on changes that may be occurring in your lives. We enjoy speaking with you and sharing ideas on a consistent basis; if your situation changes at any time between our regular discussions, please reach out to us and let us know.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

Sincerely,

|

John A. Zaro III CFA®, CIC |

Laura K. Drynan CFA®,CFP®,CIC |

Important Disclosure:

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Bourgeon Capital's Market Insights

|

For more information, please contact us:

777 Post Road

Darien, CT 06820

203.280.1170 | info@bourgeoncapital.com