BOURGEON CAPITAL MARKET INSIGHTS

“AI will transform our approach to what we know, how we know, and even what is knowable.” - Kissinger, Schmidt, Huttenlocher, 2021

What an older generation believes is transformative often becomes common place for the generations that follow. John’s recent experience in San Francisco with his 3.5-year-old grandson reminded us that the future is here and exciting. It was an amazing day, with two very exciting adventures: a ride in a driverless taxi (Waymo) and a visit to the Exploratorium at Pier 15. John was blown away by the ease of the Waymo trip, while his grandson felt it was normal. At the Exploratorium, John was inspired to see children aged 3-15 (our future) so comfortable with science and technology. The next generation is very much ahead of us and together we are excited for the future.

The markets have been strong this year. Through the third quarter of 2024, the S&P 500 was up 22%, and the Dow Jones Industrial Average was up 14%. The overall bond market (US Aggregate Bond Index) was up 4.5%. The markets have been supported by the Fed’s reduction in interest rates, declining inflation, better than expected employment levels, and strong corporate earnings. Concerns about the political and geopolitical environment remain. The upcoming earnings season will be full of questions about the outlook for corporate growth which in turn will lead to discussions of how much the FED may need to cut rates from here and how the yield curve may move. We continue to look for opportunities to shift the stock portfolio – buying on weakness and trimming on strength – all mindful of our investment themes and our risk/reward outlook.

Learning from the Next Generation: Our Personal Experiences Help Shape Out Outlook

John recently spent a day in San Francisco with his 3.5-year-old grandson, Sebby. It was an amazing day with two very exciting adventures.

First, they took a Waymo driverless taxi ride. This was not Sebby’s first ride, having ridden several times with his mother. Sebby wanted to show John that robots drive the car. Obviously, Waymo uses Artificial Intelligence (AI) through the sensors on the car and autonomous driving technology that Google has been perfecting for over a decade. In addition to the super smooth ride, John was impressed by the safety features. Waymo came over the radio live to make sure the “under 50-pound child” was properly secure! Most importantly, the Waymo vehicle makes extremely safe decisions (very noticeable if you pay attention) that some drivers might not make. Waymo doesn’t take risks, doesn’t daydream and is not aggressive. While Sebby thought it was “normal” for a robot to be driving, John was blown away by the total experience, which showed us first-hand how far this technology has come.

Second, John and Sebby spent three hours at the Exploratorium at Pier 15 in San Francisco. It was made possible by the generous donations of many of the largest and most cutting-edge technology companies as well as some individuals who have been leaders in technology and science. It was terrifically laid out, with over 600 interactive technology and science exhibits. In one case, there were at least twelve wide-eyed children watching as a scientist took a cow eyeball out of its socket. They were mesmerized. It was inspiring to see these children, aged 3-15, so comfortable and engaged in things that as a child we could have only dreamed of. The best news is that these children are our future!

Our Investment Themes Remain Well Supported

After some mid-quarter weakness, the investment markets ended the quarter resilient and strong. We continue to carefully invest in our long-term themes such as electrification of the grid and data centers, artificial intelligence, energy transition, reshoring, reindustrialization, healthcare, and infrastructure.

Electrification of the Grid and Data Centers

The energy demand of AI has led to an explosion of data center construction. Electricity demand is now growing by as much as 5% per year after growing at 0% for the last 15 years. We believe that growth will continue for some time as electricity demand at data centers is growing 25-30% annually for the next 5+ years. We have been discussing this theme for over a year, but the acceleration has recently been explosive.

Several companies we invest in benefit from the growth in data centers.

Artificial Intelligence

AI is impacting the world. The AI theme is rapidly changing and evolving. Like all new eras, some of the impact is good and some is not quite so good. John recently read a great book called “The Age of AI” written by Henry Kissinger, Eric Schmidt, CEO of Google and AI thought leader, and Daniel Huttenlocher, MIT professor in AI. Interestingly, Kissinger spent the last 5-10 years of his life researching and writing about AI. His second co-authored book is coming out shortly after his recent passing. Kissinger felt that AI was one of the most important issues of our time in relation to security, morality, politics, and warfare, to name a few. One of his biggest take-aways from the book was that AI is moving from the most expensive period, or “training”, and entering the era of “inferencing”. The main difference between AI training and AI inference is that “training” teaches an AI model how to perform a task, while “inference” is when the model uses that knowledge to make predictions. During this transition, which has just begun, there will be interesting, difficult, and emotional issues to deal with, beyond job loss. It will be harder for humans when AI makes decisions without emotions, explanations, and discussions.

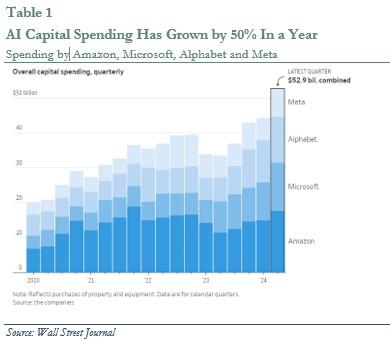

From an investment perspective, several of the AI leaders, otherwise known as the “Magnificent 7”, have struggled over the last few months (although that has changed somewhat lately). Some of the difficulty is driven by the government pressure on the industry (think Google). Another difficulty is understanding what the return on investment from AI could be. The amount of capital spending required by the AI industry is enormous. Table 1 shows quarterly capital spending on AI from only 4 companies – Amazon, Microsoft, Alphabet, and META. During the latest quarter those companies spent $60 billion, compared with about $35 billion a year ago. This is an increase of 50%. Alphabet has said that they believe there is a greater risk on underinvestment in AI.

But investors are asking more often “What will be the return on that investment (ROI)?” Goldman Sachs has attempted to answer that question. According to their analysis, an estimated annual capital spend on AI of $65-100B through 2026/7 may only produce annual revenues of $35B. At some point, companies will have to produce a positive return. We believe that “If we build it they will come” is not a great answer with capital spending levels so high.

Several companies we invest in benefit from the growth in AI.

Energy Transition

We believe that the energy transition will take time. Nothing this monumental changes quickly. We are on our way, and we think there is no turning back. It’s easy for China to mandate a switch away from diesel to electric trucks, but it’s not that easy in other non-authoritarian regimes. The one billion people who live in the developed world can move slowly toward green energy. But the 7 billion who live in the developing world are struggling to move themselves into the modern world. They may find it more difficult to allocate spending to green energy. The developed world is not able to force change on the developing world unless we give them trillions in capital. This means that oil, natural gas and nuclear will still be needed for many years to come. Hydrogen and Fusion are new technologies that will come in future decades.

Several companies we invest in benefit from growing energy demand (both green and dirty energy).

The Largest Economies in the World are Stimulating Their Economies. This is Supportive of Soft-Landing Scenario

In the United States, inflation has been declining, but unemployment has been creeping up. Real rates are high, which creates a headwind for growth. Given that the risks to employment were increasing, the Federal Reserve cut the Federal Funds Rate by 50 bps (0.5%) from 5.5% to 5.0%. This is the first rate cut since 2019, and it is likely not the last. How much the Federal Reserve cut rates from here will be dependent upon the path of inflation and employment. Currently the financial markets expect the Fed to reduce rates by an additional 50 basis points from here. A reduction in rates is ultimately positive for economic growth expectations, so it is reasonable that the financial markets have reacted favorably.

Outside of the US, economic growth has been challenging over the past year, especially in China. After a few years of weakness, China has moved to more aggressive economic stimulus. We anticipate more concrete motions and proposals over the next few weeks. China is an economic powerhouse, and stimulus has a large impact on world growth, especially within the commodity space.

Given that the two largest economies in the world have recently provided economic stimulus, it is very hard to see the economy slowing down much from here. These actions are supportive of a soft-landing scenario.

The Political and Geopolitical Environment Remains "Messy" and Economic Grey Rhinos Remain

We are monitoring several political and geopolitical concerns.

Let’s start with the United States presidential election, which creates uncertainty for markets. As we write this report, the race is very close between Harris and Trump. Less than three months ago, many were very concerned about Biden and his ability to carry on. Now Harris has reenergized the Democratic party. That in turn has put the Congressional elections back into play, which has ramifications. Harris has raised more than $1 billion for her political campaign. According to the New York Times, “No Presidential Candidate is believed to have ever raised so much money so fast after entering a race.” We believe that the Presidential election will be surprisingly close, and that we will have a split Congress. A primary focus of markets will be how Congress will handle the sunset of current tax provisions in 2025.

Sadly, the Middle East war continues to rage on tragically with the latest movement into Lebanon and the continued attacks in Gaza. After Iran’s recent attack on Israel, the world is awaiting Israel’s response. No one is certain whether that attack/response will be on nuclear sites, or on oil terminals and ports (which could lead to a regime change by stifling oil revenues or just a large embargo on energy). Whatever happens, we believe that the ramifications in the Middle East will be far and wide. There are many unknowns.

Finally, we believe that one of the biggest “Grey Rhinos” is the Federal deficit. (We use “Grey Rhino” as a metaphor for the threats that we can see and acknowledge yet do nothing about.) In fiscal 2024, the deficit is estimated to be $1.8 trillion, potentially growing to 106% of GDP by 2027. We believe that this is unsustainable. Our deficits require huge financing for the long term. Many US experts from Jamie Dimon, CEO of JPMorgan, to Larry Fink, CEO of BlackRock, have warned that this is a long-term issue for the United States. Rick Rieder, bond strategist at BlackRock, thinks the deficits may lead to a shortage of fixed income in the markets. It is vital that our treasury auctions go smoothly as they provide liquidity to the world. If a US debt auction failed, it would be very hard to restore confidence quickly. This would be a serious black swan event.

Third Quarter 2024 Investment Management Changes

During the third quarter, we made several changes to your stock portfolios.

We took new positions in two companies that should benefit from the energy transition and data center growth:

- One is a company that is instrumental in the energy transition. Their products are used throughout the liquid gas supply chain in production, storage, distribution and end-use of atmospheric, hydrocarbon, and industrial gases. The stock pulled back in Q3 as they lowered their 2024 outlook when some of their end customers pushed some projects out in the future. We found the pullback provided a compelling risk/reward with the stock trading at a 2025 price-to-earnings multiple of only 10x, significantly below the company’s historical level, and the S&P 500.

- We purchased an initial position in the largest nuclear power owner in the country. With the growth in AI and data centers, the need for more electricity continues to become evident. After our purchase, the company announced a deal with Microsoft to reopen the Three Mile Island nuclear facility. We expect this will be the first of many such announcements as the demand for electricity and power grows.

We took a new position in a semiconductor company. Semiconductor companies had strong momentum through the middle of 2024. Then most collapsed. This stock, specifically, was down 40-50% from peak levels. We saw that as an opportunity to take advantage of a powerful risk/reward setup for 2025.

We did some swaps within industries.

- We sold one healthcare focused holding and substituted with another. Our investment in the former did not meet our expectations. We decided to swap into the latter, the high-quality best of breed leader.

- We trimmed two energy related names and increased an existing holding in the same space.

We took profit from stocks after a strong 2024 YTD performance.

- We took profit from one of our bank holdings. Banks, as a sector, performed very well in 2024. However, interest rates may continue declining. This could negatively impact net interest margins. We felt it was prudent to trim our bank holdings.

- We sold a fintech position after a strong 2024 performance.

- Throughout 2024 we have been trimming our position in a major construction company. We felt that the higher interest rates would be a hindrance to future growth. During the third quarter of 2024 we sold the remaining holdings.

We began some tax loss harvesting. We never like to have losses in the portfolio. But for taxable accounts, we can book the loss to help offset capital gains. It’s our way of making lemonade from lemons.

Third Quarter Model Portfolios

Our model portfolios fully participated in the resounding strength across asset classes in the third quarter. Each strategy saw very nice absolute returns that brought them to their highest levels for the year by quarter end. The broadly diversified nature of these portfolios allowed them to benefit from some of the outsized moves seen in various sectors, including the particularly impressive strength in REIT’s and Emerging Markets.

We have been mindful to rebalance the models on occasion to ensure we as are exposed as we want after accounting for position drift. As such, we have been more fully invested of late, including full weights in fixed income and in some of the smaller sub-sectors that have enjoyed recent outperformance relative to the S&P 500. These include REIT’s, Emerging Markets, Small and Mid-Cap US equities, as well as our biotech and infrastructure plays. The third quarter saw us move on from a clean energy position that has been better expressed through infrastructure, and we initiated a position in the undervalued oil services sector.

Some of these subtle adjustments have helped and are nice, but we will be mindful to ensure these models are representative of what they are meant to be: broad based exposure across geographies, market capitalization, fixed income duration and thematic investments, without deviating too far in any one direction.

Bond Portfolios Providing a Real Return

After a few years of 0% interest rates, we are enjoying bond portfolios that provide mid-single digit returns. With inflation declining, bonds are providing real rates of return. During 2024, bond returns have been somewhat dependent upon actual Federal Reserve rate cuts and the bond market expectations of any future cuts. The variability of market expectations has been dramatic. While we have tried to be fully invested in bond portfolios over the past 18 months, this variability has also afforded us the opportunity to “speed up” or “slow down” the reinvestment of bonds that have been maturing. Our decisions have primarily been to your advantage. We continue to reinvest maturing bonds in the 5–7-year range, extending duration.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.