BOURGEON CAPITAL MARKET INSIGHTS

“This may be the most dangerous time the world has seen in decades.” 10.13.23

-Jamie Dimon, CEO of JPMorgan

Faced with the military conflicts in Ukraine and Israel as well as the burgeoning national debt and the largest peacetime fiscal deficits ever, Jamie Dimon, the CEO of JPMorgan, believes that “this may be the most dangerous time the world has seen in decades.” Our hearts go out to all the innocent victims affected by these horrific wars. While it is difficult to put our emotions aside at this time, we would like to focus on our mission to both protect and grow your investment assets in this environment. We are monitoring the concerns around two major wars, rising interest rates worldwide, slowing economic growth globally including both China and the US, and a surge in the US deficit. Concurrently, we are focusing on the opportunities arising from the introduction of generative artificial intelligence and a worldwide energy transition. The stock market has been very volatile this year. Through June, the S&P 500 was up almost 17%, supported by the performance of 8 “magnificent” technology stocks that were primary beneficiaries of investment in generative artificial intelligence. However, the S&P 500 subsequently declined 3% in the third quarter, bringing the YTD gains in the S&P 500 to 13%. The equal weighted S&P 500 index was up only 2%. We continue to maintain our view that the US economy is likely to enter some type of recession within the upcoming 3-6 months. The cash levels in our equity portfolios remain high at 15% to reflect this concern. Interest rates rose throughout the third quarter, and we now have a great opportunity to further extend the duration of your fixed income portfolios to lock in yields approaching equity-like returns of 5-6%.

The Cure for High Interest Rates is High Interest Rates Meets Federal Policy Acts with Long and Variable Lags

To combat inflation, the federal reserve has raised interest rates at the fastest pace in history, bringing the federal funds rate to over 5%. The intent is to slow economic growth and thereby slow inflation. While we have seen the rate of inflation slow, we have not yet seen economic growth slow. In fact, in Q3 2023 economic growth picked up. This is one reason we have continued to say that interest rates would stay higher for longer.

Over the past quarter, the Federal Reserve raised rates one more time. We believe that we are at or near the peak of the rate hikes. The combination of higher interest rates and lower inflation rates means that “real rates” go up. Real interest rates are now close to 3%, after being under 0% since 2008. This is the highest level of real rates since 2007 and is considered highly restrictive and should lead to a slowing economy.

The Federal Reserve reminds us that their policy works with “long and variable lags”. Even though we have not yet experienced the ever-elusive economic slowdown, it doesn’t mean that it won’t happen. This all takes time. Evercore ISI believes that it takes 12-18 months from the inversion of the yield curve for the US economy to enter a recession. Thus, the US economy could be on the cusp of some type of recession within the upcoming 3-6 months.

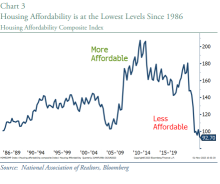

One part of the economy that historically has been highly sensitive to interest rates is housing. So far, housing has not yet experienced a slowdown as higher demand met lower supply. However, with 30-year mortgage rates now close to 8% (Chart 2) and housing affordability at historic lows (Chart 3), we believe that a slowdown should be coming.

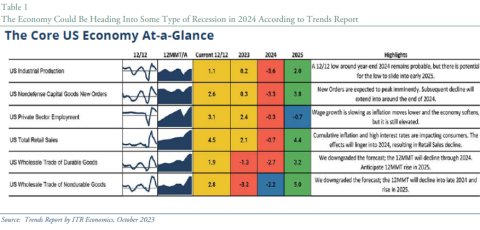

As we look at the overall industrial economy, we also believe that a slowdown is coming. Admittedly the data has been very confusing as it has not followed a “typical” pattern. We are fans of the work of ITR Economics and their Trend Report. According to ITR, since 1948 their forecast accuracy rating is 94.7% at four quarters out. In their September 2023 report they acknowledge

the confusion of the current data. “The rates-of-change of several more leading indicators are rising and providing hope to many, yet the raw data remains mired in decline, which creates a lack of trust in the signals.” As ITR Economics looks forward, they continue to forecast a recession in 2024, especially as credit conditions “are at recession-inducing levels”. See Table 1.

Looking for Opportunities in the Energy Transition

Looking through world events and the economic cycle, we continue to believe that there is opportunity in the energy transition. It will just take time.

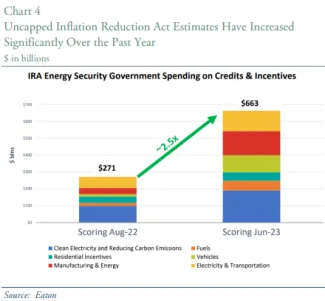

At the moment, there are three major infrastructure spending programs in the United States that focus on clean energy to varying degrees: The Inflation Reduction Act, Infrastructure Investment and Jobs Act, and CHIPS and Science Act. Together, these three programs will provide significant funding in areas of clean energy, electric vehicles, roads, bridges, water infrastructure, chip manufacturing, and increasing domestic high-tech manufacturing. There are several companies in your portfolios that benefit from these programs.

The Inflation Reduction Act, implemented in 2022, commits $369 billion to investing in energy and climate reform (solar panels, wind, electric vehicle tax incentives) to help reach a goal of lowering greenhouse gas emissions by up to 40% from 2005 levels by 2030. The Infrastructure Investment and Jobs Act of 2021 also invests in electric vehicles and clean energy, including charging stations, nuclear, and green hydrogen. The CHIPS and Science Act has helped create 642,000 manufacturing jobs since 2021. CHIPS has the goal to strengthen American manufacturing, supply chains, and national security and invest in research and development, science and technology and the workforce of the future to keep the US the leader in the industries of tomorrow, including nanotechnology, clean energy, quantum computing, and artificial intelligence.

One of the most interesting parts of the rollout of the government capital spending programs is that the better understanding of how the government credit and incentives work has led to a significant increase in the expectation of future capital spending. For example, according to Eaton, infrastructure spending under the Inflation Reduction Act increased from $271 billion in August 2022 to $663 billion in June 2023. See Chart 4.

No matter which side of the argument one takes on energy transition and climate change, we are confident that we are moving forward to a world of more investments in energy – both “clean” and “dirty” energy. First, global regulations to reduce gashouse emissions increase the demand for finding and investing in alternative energy. Second, the recent wars remind us that countries want to increase their energy independence – and this can be done on multiple fronts.

However, in general, both oil and gas and alternative energy stocks have declined this year and we believe this provides us an investment opportunity.

For oil and gas companies there is a conundrum. In the North America and Europe, there are 1 billion “lucky” people who consume 13-14 barrels per capita per day who want to move away from oil and gas toward more costly green energy. In the rest of the world there are 7 billion people who consume 3 barrels per capita per day who do not want to give up the cheap energy that fuels their economic growth. Both sides will continue to need and use hydrocarbons for the economic health of their population, leading to continued demand growth for hydrocarbons for at least another decade or two. If we don’t continue to invest in oil and gas capital spending, we will likely see much higher prices in a so-called “super cycle” which could be detrimental to worldwide growth as well as inflation.

Alternative energy stocks have suffered mightily in the stock market this year. Rising material costs, delays in permitting and government funding, concerns around potential legislation rollback, and rising interest rates for new projects are only a few issues impacting the industry. With earnings and free cash flow lower than expected, the stocks dropped.

We continue to believe strongly that investing in energy in all its forms will be a benefit to our clients, and hence we are overweight the sector. For traditional energy we have holdings in oil and gas companies, oil and gas services companies, and pipelines. In clean energy we own a utility, a green hydrogen company, and two plays on electrification. We anticipate further investments in the clean energy sector going forward. Finally, we are invested in a large copper producer, which is a beneficiary of electrification capital spending in the U.S.

This energy transition will take decades to occur.

Third Quarter 2023 Market Deja Vu

From the perspective of the stock and bond markets, third quarter 2023 was a mini repeat of 2022. Yields rose for the 10-year US Treasury (to 5% at one point). As yields rose, stock multiples compressed, and bond prices declined. Thus, the stock market and the bond market were both down in Q3, similar to 2022. This double whammy of declines was unusual last year, and it was unusual this quarter.

Despite the conflicting economic data, we continue to believe that an economic slowdown is coming and that we are at or close to the peak in interest rates. On average the Federal Reserve lowers interest rates about 8 months after they pause raising rates. If one believes that September was the pause, this means that interest rates could be declining in mid-2024. This means that it is a decent time to protect against an economic slowdown and extend duration.

Third Quarter Portfolio Focus

The focus of our stock investments in the third quarter was centered around buying low and selling high in a tax efficient manner. We took the opportunity to trim several stocks that had made outsized gains this year and added to stocks that had selloffs where we had a favorable risk/reward outlook. In addition, the volatility gave us an opportunity to do some tax loss selling. Given our economic outlook, we kept the cash levels in our equity portfolio around 15%, investing the money in US Treasuries or money market funds yielding around 5% plus.

Mutual Fund Portfolios

Just as the third quarter was a setback for most asset classes across global markets, our Model Portfolios also suffered negative returns for the quarter. Sustaining first half equity performance would have been a challenge under any circumstances, but the simultaneous drawdown in both equities and fixed income throughout the quarter as yields rose was particularly punitive. All strategies are still up on the year and remain defensively positioned with a larger than normal cash position providing decent yield. Looking ahead right now requires a perspective on not just the final quarter of 2023 but an earnest look into the setup and expectations for 2024. Seasonality suggests we could see a modest recovery from the third quarter selloff. 2024, however, is a different ballgame where high interest rates may finally prove restrictive enough to dent growth, jobs and the economy so as to make some type of recession a reality. Getting that timing right, however, is very difficult. Under these circumstances, we will continue to operate and deploy capital consistent with a cautious mindset.

Forget TINA. It’s Now Time For TARA!

The investment community loves its acronyms. For the past several years there was a common saying regarding stocks: TINA, or “There Is No Alternative”. In other words, interest rates were so low, that stocks were the only investment opportunity, as bonds didn’t provide much of a return. But now, with interest rates over 5% it’s time for TARA, or “There is A Reasonable Alternative”. The 5-6% yield to maturity that one can get in high grade corporate bonds now rivals long-term stock returns. Why should take the risk with stocks?

Over the past 3 months, the yield on the 10-year US Treasury has risen to close to 5%. We are taking the opportunity provided by this move to extend the duration of your bond portfolios. Thus, as bonds mature, we will be buying bonds that mature 5-10 years in the future, effectively locking in the yield until the bonds mature.

However, in addition to higher income, one also stands to benefit from capital appreciation in one’s bond holdings. If economic growth slows in 2024, the Federal Reserve may decide to lower interest rates. If they do this, then your bond portfolio could experience capital gains.

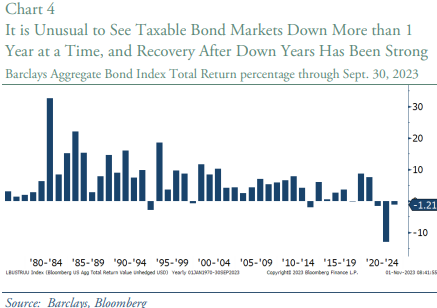

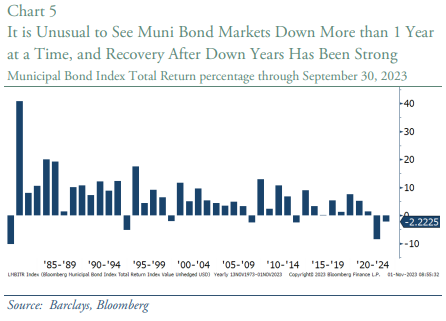

Charts 4 and 5 show the historical annual returns of the US bond markets. Chart 4 shows the Aggregate Bond Index (broad based aggregate taxable bond index). Chart 5 shows the Municipal Bond Index. Note that since the mid-1970s it is unusual to see the bond market down two years in a row.

In the year that followed a bond market decline total bond market returns were usually up double digits as the bonds benefited from both interest income and capital return.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.