BOURGEON CAPITAL MARKET INSIGHTS

“Markets Break When Interest Rates Rise Fast.” ~ Jon Hilsenrath, Senior Writer at the Wall Street Journal

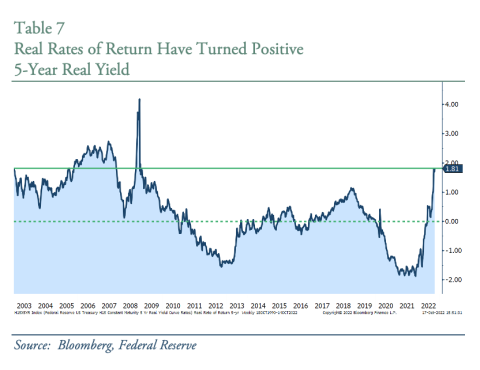

Interest rates are rising rapidly around the world, not just in the United States. In fact, global interest rates are rising at the fastest pace in over 40 years, as central banks attempt to bring down high inflation. The exceptionally fast tightening of financial conditions increases the risk that market disruptions occur in this well-intentioned plan. During the third quarter of 2022, the Federal Reserve made it clear that it does not wish to make the same mistakes of the 1970s where hiking efforts ended too early. So, if the Federal Reserve is not spooked by a potential recession and a stock market down over 20%, what could make it pivot and take its foot off the brake? Historically a policy pivot occurs when “something breaks”, as when the Bank of England recently shifted policy after the turmoil in its bond and currency markets. It remains to be seen if the Federal Reserve finds itself in an uncomfortable enough position to do the same. Or perhaps it could just pause rate hikes for a bit to see the impact? Rapid changes in market conditions often leave participants reacting. Rather than just waiting to react, we have been proactively adjusting your portfolios. We entered 2022 overweight cash and underweight stocks and bonds. In Q2 and Q3 we bought bonds as the real rate of return became positive for the first time in many years. For stock portfolios, we continued to modify our underlying investments and implement tax loss strategies, but our cash holdings remain high. The upcoming earnings season may provide important insights on how to best capitalize on market dislocations. We believe that heightened geopolitical risks and the fight against inflation will create volatile markets, and it is important to stay nimble and flexible in this environment. We also believe that with time, patience and work, the US and world will be in a better place.

The Anti-Pivot Speech that Ended the Second Quarter Bear Market Rally

At the end of the second quarter of 2022, the stock market was down 20%. Thereafter prices for many commodities began to decline. Investors prematurely concluded that the Federal Reserve was getting ready to pivot from its hawkish interest rate stance into a more dovish one, and the stock market rallied 13%. However, Jerome Powell’s August Jackson Hole speech reminded investors that the Fed is not done hiking and will accept some economic pain in their plan to control inflation. After the speech, the stock market gave back the previous gains. At the end of the third quarter, the S&P 500 was down 24% while the Bloomberg Aggregate Bond Market Index was down 15%. Adjustments we made to your portfolios throughout 2022 helped reduce losses and improved your performance relative to the major indices.

Historic Surges in Interest Rates at Home and Abroad…

The speed of interest rate hikes during 2022 has been unprecedented. How does a company or a household prepare? Global short interest rates are up 300bps over the past year, reversing a 40-year trend. In the US, mortgage rates have risen from under 3% to 7%. The home affordability index is down 40% in under a year!

Bonds Did Not Protect Portfolios

One typically expects a bond portfolio to help protect asset values, especially when stocks go down. One of the most frustrating parts of the first half 2022 performance is that both stocks and bonds went down together at the same time. This is only the second time in 40 years they declined in tandem.

… Increase the Probability of Recession and that Something Breaks.

Over the past few weeks, the United Nations, the World Trade Organization, and the OECD have all warned of a global recession, linking a potential recession to “imprudent” monetary policy.

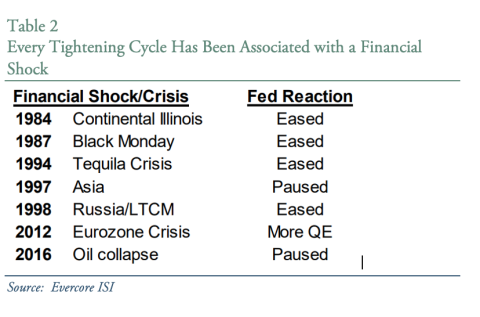

In an October 6th Wall Street Journal article, Jon Hilsenrath highlighted that “Markets Break When Interest Rates Rise Fast”. It is difficult for some financial markets to adjust when decades of process is turned upside down in a matter of months. Hilsenrath highlighted several times in history when a tightening cycle led to a financial shock. Ultimately it was this shock that caused a Fed pivot toward an easing cycle.

So far, we have avoided a big crisis in the US, but the warning signs are increasing. For example, in late September there was a bond and currency crisis in the UK that led the government to reverse recent policy actions and led their central bank to implement emergency liquidity measures.

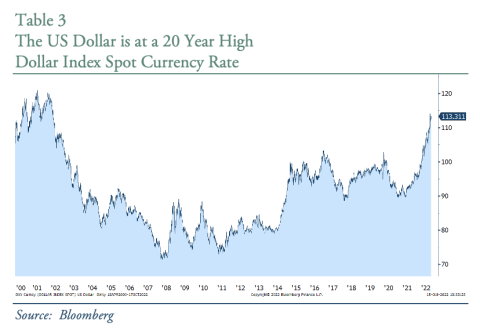

For signs of stress, we are watching corporate bond spreads which have widened, and are now near the highs of historical averages. So far, the yield spreads are still relatively well contained, but demand further scrutiny. We are also monitoring the rapid rise in the US dollar (Table 3), which could negatively impact many parts of the global economy, including emerging markets.

Do We Really Have to Wait for Something to Break Before the Fed Pivots? Perhaps a Pause?

So, what’s a Central Bank to do? Which is worse - inflation or Recession? Actions show that the Central Banks believe inflation is worse, and they are willing to push their economies into recession to bring inflation down to acceptable levels. How will they know when to stop raising rates? This is very difficult as interest rates are a blunt instrument and there is a lag before we see their impact. Does the US have to wait until “something breaks”? Other countries, such as Australia and Poland, have recently announced that they were slowing the pace of their rate hikes. Might the U.S. follow suit?

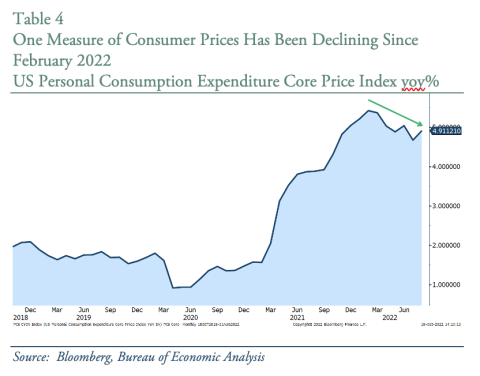

Still, there are some encouraging signs that inflation may be peaking. Lumber, freight, copper, and airline prices are lower. Even apartment rents are off peak levels. The Prices Paid Indices for businesses as calculated by the ISM (Institute for Supply Management) have been generally declining since February. For the consumer, the US Personal Consumption Expenditure Core Index (PCE) has also been on a downward trajectory since February 2022.

The Federal Reserve reminds us that we need to approach this data with caution as inflation is notoriously sticky. For example, the University of Michigan Consumer Inflation Expectations Index began declining a few months ago, but the most recent reading was higher.

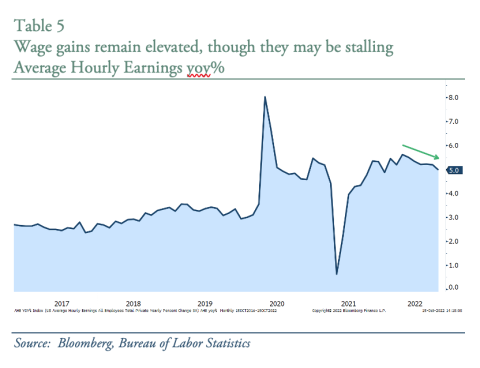

What the Federal Reserve really wants to see is a reduction in wage growth. They are afraid of the dreaded “wage-price spiral”, or when wage increases cause price increases which in turn cause wage increases. If there is one metric to watch as a signal that the Fed may want to pause rate hikes, it is wage growth rates. The problem, however, is that wage growth rates are also a lagging indicator. Waiting for wage growth to hook down increases the probability that the Fed ends up increasing rates too much, creating a recession. There are already some signs that corporate behavior has started to move in the direction of a slowdown in hiring: Google, Microsoft, Goldman Sachs, Walmart, Ford, and even Apple have all announced job cuts or a slowdown in hiring. We believe this weakness has yet to show up in the data in a meaningful way because of the lag effect.

This would imply that the Federal Reserve will likely have to keep fighting inflation for a while longer. But perhaps they are getting close to a period when it could at least pause? We have been consistent in our views that we could see a ‘less hawkish’ Fed in Q4. We still think that’s possible.

Be Greedy When Others Are Fearful?

As both bond and equity markets declined this year, we continued to ask ourselves: Is it time to “be greedy when others are fearful” as Warren Buffet has taught us?

We believe the answer for the bond market is a definite “Yes”. Prior to Fed Chair Powell vowing to “unconditionally” fight inflation, the bond market had already read the tea leaves, swiftly bringing rates much higher. We worked hard in Q2 and Q3 to invest the excess cash into bond portfolios to take advantage of corporate bonds with 3-5% short term yields.

For stock portfolios, the answer remains less clear to us. We know that stock prices have dropped, leading to a sharp reduction in price-to-earnings (PE) multiples. However, we wonder about the “E”, or earnings, part of the PE ratio. If the Federal Reserve wants to combat inflation by lowering economic growth, then it makes sense that corporate earnings growth expectations should decline. If corporate earnings expectations decline, and PE ratios stay the same, then stock prices have further to fall.

We thought we would get a reduction in corporate earnings expectations in the second quarter. This did not happen to the extent we felt necessary. Thus, we continued to be patient with your excess cash. We are watching this upcoming earnings season to see if expectations have been appropriately reset. We have much to hear and learn from company conference calls.

We recognize that timing the exact bottom of any investment cycle is difficult, if not impossible. It is instructive for us to remember that buying after a significant 6-month drawdown has often been profitable in the following year. According to Oxford Economics, after a 20% decline in the S&P 500, although the market may have further to fall in the near-term, the stock market return is usually positive 6-12 months out. In their analysis there have been only two periods of exceptions to this pattern - the global financial crisis in 2008-09 and the early 1970s. See Table 6.

Third Quarter Focus Was Similar to Q2: Rebuild the Bond Portfolio and Research Secular Growth Ideas

Throughout both the second and third quarters, a primary focus was investing excess cash to capture higher interest rates for those with bond portfolios. The equity portfolios still have a high cash position, but we continue to modify the underlying portfolios with a barbell strategy of defense and offense. We are astonished with the speed of this pandemic economic cycle and believe it is important to stay nimble and flexible in this environment.

We continue to research secular growth areas for investment, so that we can act quickly when we believe the risk/reward of an investment opportunity becomes favorable. As we look at the changes over the past 18 months, from Covid to China to Ukraine, we are even more confident of several long-term investment themes. We have previously discussed several of these with you in prior letters, such as alternative energy and climate change, but other themes are coming to the forefront because of recent worldwide economic, political, and competitive changes. Some examples include:

- The seismic opportunities surrounding energy transition should continue. Significant capital will likely be spent on both clean and carbon-based energy (to aid in the clean energy transition). Supporting energy infrastructure has reemerged as a national security focus and clearly shows that the last 5-7 years of severe underinvestment in carbon-based energy will be quite costly. This should help support many carbon-based sectors, including liquified natural gas, pipelines, and oil service companies.

- Food security and availability concerns are rising given logistics issues and droughts.

- Nations are increasing their focus on defense, including both national security and cybersecurity as tensions in the geopolitical environment increase.

- Deglobalization is accelerating, leading to reform of supply chains.

- Commodity shortages may continue, including metals for various alternative energy sources (i.e. batteries, wind mills, and solar).

Third Quarter Stock Portfolio Changes

Defense: In defensive mode, we look at holdings with a two-pronged approach – defensive sectors that perform relatively well during an economic slowdown (healthcare, utilities, and consumer staples) and defense companies that will help support our national security and protect us from bad actors. It is important to note that healthcare is now our second largest investment sector, and your portfolios are overweight healthcare relative to the S&P.

Offense: With several stocks down significantly during the first nine months of 2022, we saw opportunity for long-term holders to begin increasing our investment in beaten down companies, though we recognize that it is very difficult to pick the bottom.

Tax Loss Harvesting: We never like losses, but when they occur, we do review your portfolios to see if it makes sense to reduce your tax burden by harvesting losses. We continued to implement tax loss strategies throughout Q3.

Opportunities to Take Profit: Bear markets (and specifically bear market rallies) can still provide tactical opportunities for sales.

Don’t let that Cash Go to Waste: Rather than let our excess cash sit idle, we have been investing a portion in US Treasuries yielding 3-4%.

Mutual Fund Portfolios

The Bourgeon Mutual Fund portfolios were down in-line with similarly constructed benchmark portfolios in the third quarter. In what has been a relentless and highly correlated down year across asset classes, there have been very few bright spots even among highly diversified portfolios. Our thematic exposure designed to benefit from the energy transition got a boost in the third quarter as policy makers were able to pass the questionably named Inflation Reduction Act. As markets deteriorated into the end of the quarter, we used half the proceeds from the IAU sale earlier in the year to purchase U.S. exposed dividend growth strategies.

Rebuilding Bond Portfolios

While we were concerned that market participants were being too complacent about inflation last year, we never expected interest rates to rise as quickly as they did in 2022. The decline in bond holdings in 2022 is one for the record books. Given our focus on short duration and high cash holdings, your bond portfolios were more protected and were down less than the overall bond market.

During Q2 and Q3 we moved to invest excess cash in your bond portfolios, taking advantage of yield-to-maturity levels for short term investment grade bonds in the 3-5% range. This rate is 3-4x higher than just last year. In fact, the real rate of return in bonds is now positive, and at levels not seen for decades. In Table 7 below, the solid green line represents the current real rate of return on the 5 Year US Treasury. The dotted line shows where the real rate of return is zero.

During 2021, where appropriate, we purchased a private real estate investment to help diversify and improve bond portfolios performance. During 2022 when holdings became long-term, we liquidated half of the position at double digit gains. Depending upon each client’s asset allocation, we will be using this cash to purchase bonds, or to purchase publicly traded REITS, where prices are down 30%+ this year. We like this arbitrage to sell high (private REIT) and buy low (public REIT).

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.