BOURGEON CAPITAL MARKET INSIGHTS

“The easy part of being an artist is figuring out the message that everyone else is ready to hear. The hard part is waiting for the proper lull to make the announcement.”

~ Mark Twain

The Federal Reserve announced in September that it will likely begin reducing some of the extraordinary stimulus that it put in place during the initial stages of the COVID-19 pandemic as soon as November. This was after months of waiting and debating, as the economy continued to strengthen and inflate. We have been cautiously waiting for this announcement, concerned that markets might react negatively. But we give credit where it is due. The announcement was well orchestrated, and the stock market suffered only a modest pullback in September and into early October. We believe that the easy part of stock market returns for this cycle is now probably over. There is an old maxim, “Don’t Fight the Fed”. Thus, when the Fed is adding stimulus, stock market valuations go up. The opposite is often true as well, when the Fed is removing stimulus, valuations go down. Companies will have to run harder just to stand still. This adds a new angle to our investment plan. As accelerating growth rates turn into decelerating growth as we move through 2022, we could continue to slowly shift our portfolio out of cyclicals into quality/secular growth, with a tilt towards defensives. We are mindful of the risk that the Fed may begin raising rates more quickly than the market currently anticipates and are uncertain about the timing of our strategy shifts. We will continue to monitor the markets and adjust as the data suggests, while trying to balance the risks with the rewards

Fed Says:

Soon it will be Time to Change Strategy

In September, after many months of handwringing, the Fed talked more firmly about reducing some of its extraordinary stimulus. The September Federal Reserve statement says, “Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals. If progress continues broadly as expected the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

Most analysts expect that the FED will begin moderating their bond purchases starting in November, leading to a cessation of purchases by mid-2022. If economic growth continues to impress, then rate hikes could follow in the second half of 2022.

We anticipate that the economy will reaccelerate into Q4 as the Delta variant fades. Businesses should continue to try to rebuild depleted inventories and ramp-up capital spending. In addition, cross-border activity should also have a meaningful rebound. Thus, while it is not a base case, we are watching for the possibility that the timing of the first Fed rate hike also gets pulled forward – which could serve as a headwind sometime in 2022.

The Easy Part is Over

When rates are declining and stimulus is strong, we usually have an “everything rally”, and asset prices inflate. When the fed tightens, the market typically becomes more volatile, and the performance of stock sectors begins to differentiate. The easy part is over, and active investing could provide a better return.

We are taking into consideration several factors for our investment plan:

The infrastructure package. The government is trying to support two different infrastructure packages, the $1.2 trillion infrastructure package, and the $3.5 trillion Build Back Better social infrastructure package. We anticipate that it may take until the end of 2021 for any proposal to pass, and that the total will likely be less than the $4.7 million of the combined packages.

Taxes to pay for the infrastructure package. There are many suggestions on how to pay for the infrastructure spending. We anticipate there will be some corporate and consumer tax hikes to pay for the infrastructure spending. This could disrupt current tax planning opportunities and create new ones.

Inventories and supply chain disruptions. COVID-19 disrupted supply and demand, and the world is still trying to catch up. Thus, supply chains are stretched, inventories are low, and prices are rising. This impacts future growth and margin expectations for many companies across many industries. We believe it will likely take longer to rebuild inventories than currently anticipated.

China. The Chinese economy is as large as the United States and deserves our attention. Economic growth in China has decelerated sharply in 2021, partly due to COVID-19 after-shocks (perhaps a harbinger of things to come in the US?) and partly due to changes in Chinese government policy. There is a possibility that the policy changes continue to drag down economic growth into 2022, and that risks like Evergrande real estate default concerns continue. In addition, China’s relationship with Taiwan appears to be becoming more adversarial.

Inflation:

What Does Transitory Mean Anyway?

We have been writing about our concern of inflation (and supply chain disruption) for at least a year, and long before it became in vogue. We invested to take advantage of inflation – with an overweight toward cyclical industries starting mid-2020. We are taking our time to slowly reverse this trade as we believe that inflation should eventually cool, either because supply chains improve, or the Fed starts to tighten. However, just like the Fed, we are not ready to define “transitory” just yet.

What About Oil?

Oil prices have risen significantly since the lows of 2020. Your portfolios have benefited from our overweight position in energy (you own both clean and carbon-based energy investments). While we do believe that the prices of many commodities may soften as supply chains ease, we believe that oil and copper may be exceptions. Our reasoning is the significant lack of investment done over the past decade as government and consumer focus shifted to alternative energy.

If the Fed is Preparing to Change Strategy, Perhaps We Should Too?

Fundamentals

Free Cash Flow

Secular Growth

As the historical growth rates of liquidity and fiscal spending begin to drop from their peaks, fundamentals should be more important in driving market valuations and economic growth. For 2022, we anticipate slower economic growth than 2021, but a more self-sustaining environment that is less reliant on government spending and more reliant on consumer and business spending. We also anticipate that interest rates will increase to reflect risk and not ultra-dovish monetary policy.

In such an environment, we believe that a focus on fundamentals and free cash flow will be key. It will likely favor active management over passive management as investors will have to be more discerning about their investment choices. Interest rates should rise, leading to a higher cost of capital. With inflation increasing, steepening of the yield curve occurs. This could negatively impact valuations of long dated assets (long bonds and tech companies with little or no free cash flow). Secular themes should be important in the investment process.

Secular Growth in Electric Vehicles was a Q3 Investment Highlight

Last quarter, we told you we were researching investments focusing on secular themes including artificial intelligence, hydrogen and other alternative energies, electric vehicles, MedTech, and biotech. This quarter we want to talk about how we are investing for the upcoming strong secular growth in electric vehicles (EVs).

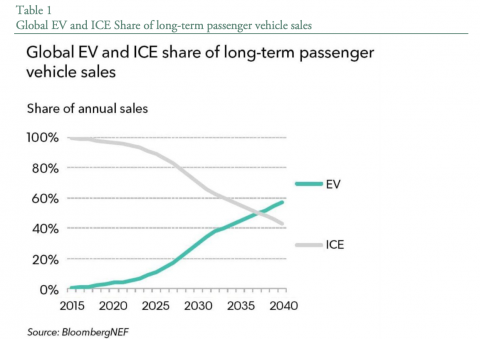

We see the potential for strong secular growth in electric vehicles for the upcoming decade. While electric cars represented 1.7% of North America new passenger vehicle sales in 2020, Bloomberg New Energy Finance expects them to account for 54% of global vehicle sales by 2040 as incumbents ramp up their offerings and policy support accelerates.

During Q3 2021, we chose to capitalize on the growth of electric vehicles through the initial purchase of three companies.

The Transition Will Take Time

The transition from the cyclical upswing to the next phase of lower, but more sustained growth is likely to take some time and will probably be bumpy. While the Fed will soon start tapering its easy monetary policy, we believe it will likely do more. Peak growth rates + tapering have historically led to periods of increased volatility. We will monitor these markets for opportunities to buy into some of the secular themes we discussed above.

During the Third Quarter We Made Some Changes to Take Advantage of Volatile Markets

During Q3, we did more buying than selling (after doing more selling than buying in Q2). We have a relatively small cash position today.

- We added to several cyclical stocks as we saw the Delta pullback as temporary.

- We trimmed and sold some long-term winners on strength.

- We decided to take a larger position in electric vehicle adoption through the purchase of three companies.

Stay the Course for our Mutual Fund Portfolios

We have made no changes to our mutual fund holdings year-to-date. We continue to benefit from the changes we made at the end of 2020. Our increased allocation to our real estate fund and inflation-protected bonds added to relative performance. Meanwhile our addition to our gold holding, and the addition of a dividend growth fund, detracted from relative performance.

With Yields So Low, Bond Investing is More Difficult:

TINA Principle

Investing in our bond portfolio has been difficult with yields so low. During Q1, we invested when yields on the long end spiked. During Q2, we invested when yields on the 2-year spiked. In late Q3, we invested when bond yields spiked on the Fed’s decision to soon reduce bond purchases. But overall, we continue to have a barbell approach to our duration as the yield curve steepens – holding higher than normal cash balances on one side and buying 5–7-year investment grade bonds on the other. In the equity side of client holdings, we are working on increasing the dividend yield of the portfolios. For those with the appropriate risk allocations, we are looking at alternative investments that provide income. As many investors point out, with yields so low, There Is No Alternative (TINA) to overweighting stocks in the portfolio.

We look forward to speaking with you soon and thank you for entrusting us with the management of your money.

This letter should not be relied upon as investment advice. Any mention of particular stocks or companies does not constitute and should not be considered an investment recommendation by Bourgeon Capital Management, LLC. Any forward-looking statement is inherently uncertain. Due to changing market conditions and other factors, the content in this letter may no longer reflect our current opinions. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this letter will be profitable or suitable for your individual portfolio. In addition, past performance is no indication of future results. Please contact us if you have any questions regarding the applicability of any matter discussed in this letter to your individual situation. Please contact us if your financial situation or investment objectives change or if you wish to impose new restrictions or modify existing restrictions on your accounts. Our current firm brochure and brochure supplement is available on the website maintained by the Securities and Exchange Commission or from us upon request. You should be receiving, at least quarterly, statements from your account custodian or custodians showing transactions in your accounts. We urge you to compare your custodial statements with any reports that you receive from us.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.